EUR, JPY, GBP, NOK flows: Mildly more risk positive tone

Asia trading sees modest gains in the riskier currencies with safe havens edging lower

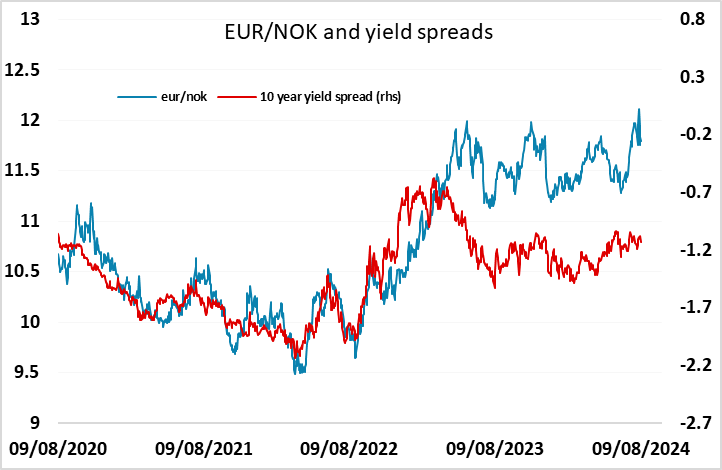

A quiet start to the week with little on the calendar and a fairly neutral opening session in Asia, although there is a risk positive bias in FX following the equity rally in the US session on Friday. USD/JPY, EUR/CHF and AUD/USD were all higher in Asia, and in a quieter market the tendency is likely to be for the risk positive tone to extend into Europe. There are some nerves around possible escalation of the Middle East conflict, but at this stage there isn’t much impact on global equities or global risk in general. EUR/USD remains stuck just above 1.09, and looks unlikely to move, but EUR/GBP has dipped below 0.8550 in line with the generally more risk positive tone. We still see the NOK as having the most potential for gains of the European currencies, with a break below the 11.7250 low from August 1 having potential to trigger a shaper downmove.