EUR, USD, JPY flows: EUR softens on Lagarde press conference

EUR lower as yields slips on ECB press conference, EUR/JPY leading the way

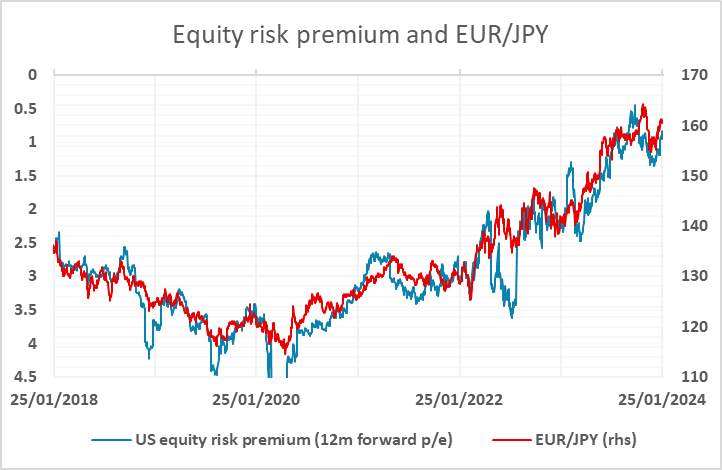

Lagarde’s tone at the press conference so far confirms the statement, and she is unwilling to get into a discussion about rate cut timing, saying the ECB were data dependent and that it was premature to discuss rate cuts. EUR/USD has moved a little lower as yields have slipped lower, perhaps helped by the further mention of declining inflation, with EUR/JPY showing the largest move as the JPY has also benefited from lower yields in the US following the US data. EUR/JPY continues to look vulnerable at current levels if the market maintains expectations of an ECB cut in April, especially since weak Eurozone growth remains on the cards based on the recent PMI and IFO survey data. However, some rise in US equity risk premia may be necessary to support a rise in the JPY on the crosses.

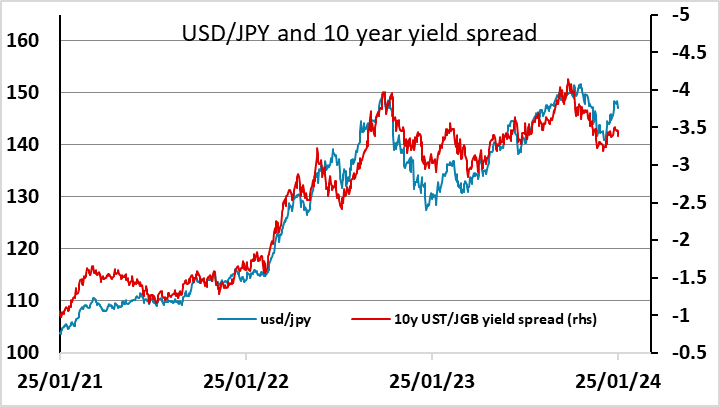

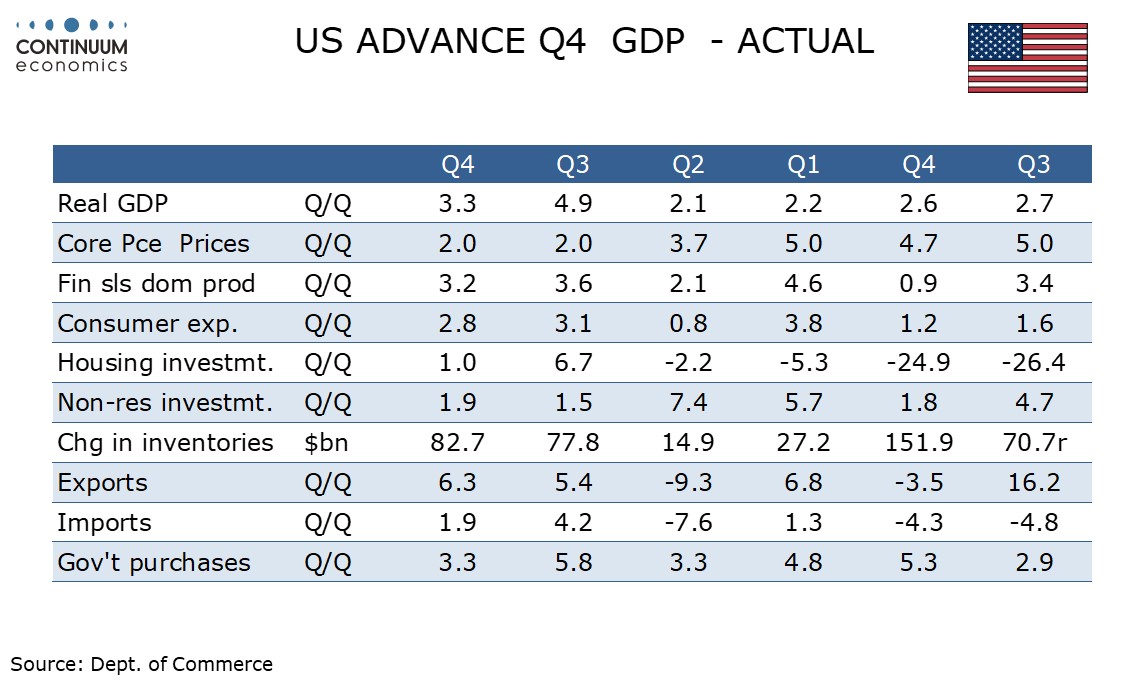

The decline in US yields looks strange to us, as the US GDP data was stronger than expected, and despite the lower GDP deflator, the core PCE deflator (which is the Fed’s reference inflation rate) was in line with expectations at 2%. However, USD/JPY was already sitting well above levels that look consistent with current yield spreads, so we would not oppose the USD/JPY decline.