FOMC eases by 25bps, dots and economic forecasts more hawkish

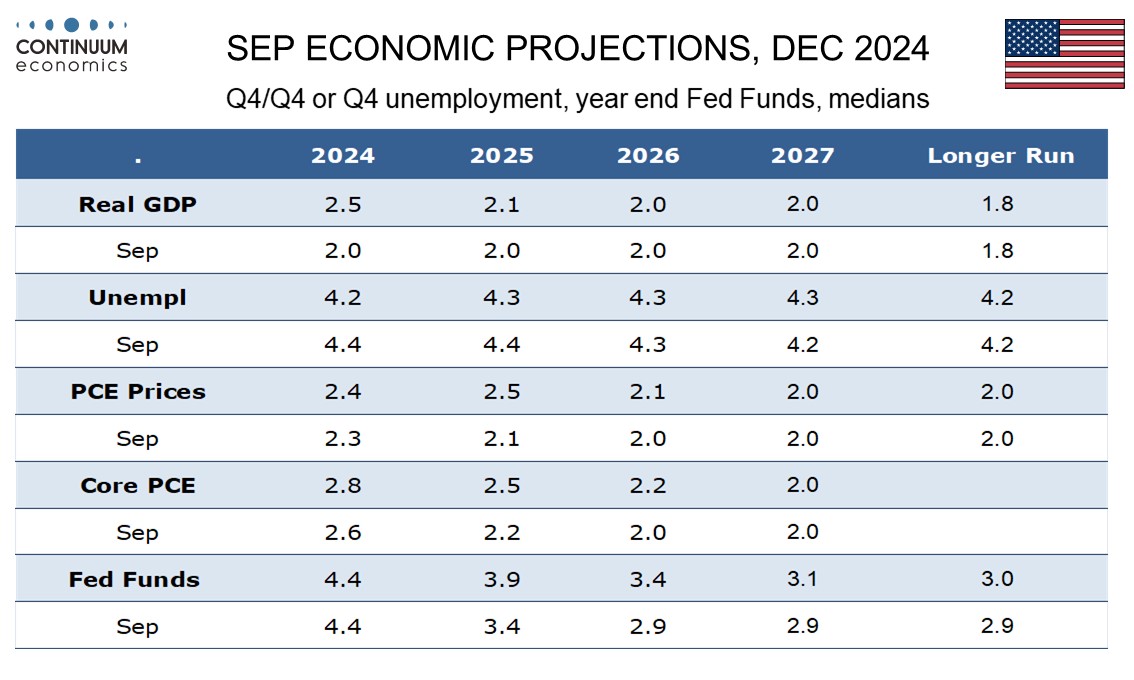

The FOMC has eased by 25bps as expected but the dots look hawkish with only 50bps of easing seen in 2025 rather than 100bps, and there was one dissenting vote, Cleveland Fed President Hammack preferring to keep rates unchanged. Core PCE price forecasts have also been revised significantly higher, 2025 to 2.5% from 2.2%, with the target not seen being reached until 2027 rather than 2026.

GDP is now seen rising by 2.5% in 2024 rather than 2.0% but revisions to GDP going forward are marginal, while unemployment is seen at 4.2% at the end of 2024 rather than 4.4%, with modest revisions going forward. Core PCE prices have however been revised up by 0.2% for both 2024 and 2026, to 2.8% and 2.2% respectively.

The end 2026 median Fed Funds view has also been revised up by 50bps, to 3.4%, meaning 50bps of easing are seen in that year, while the end 2027 view has been revised up by 25bps to 3.1%, meaning 25bps of easing are seen in 2027. The long-term neutral rate has been revised up to 3.0% from 2.9%.

While the dots and forecasts are more hawkish, the statement has minimal changes, though the phase “the extent and timing of” has been added to consideration of additional adjustments to the target range, indicating uncertainty over the extent and timing of further moves.