Japan Outlook: Ready for Another Step

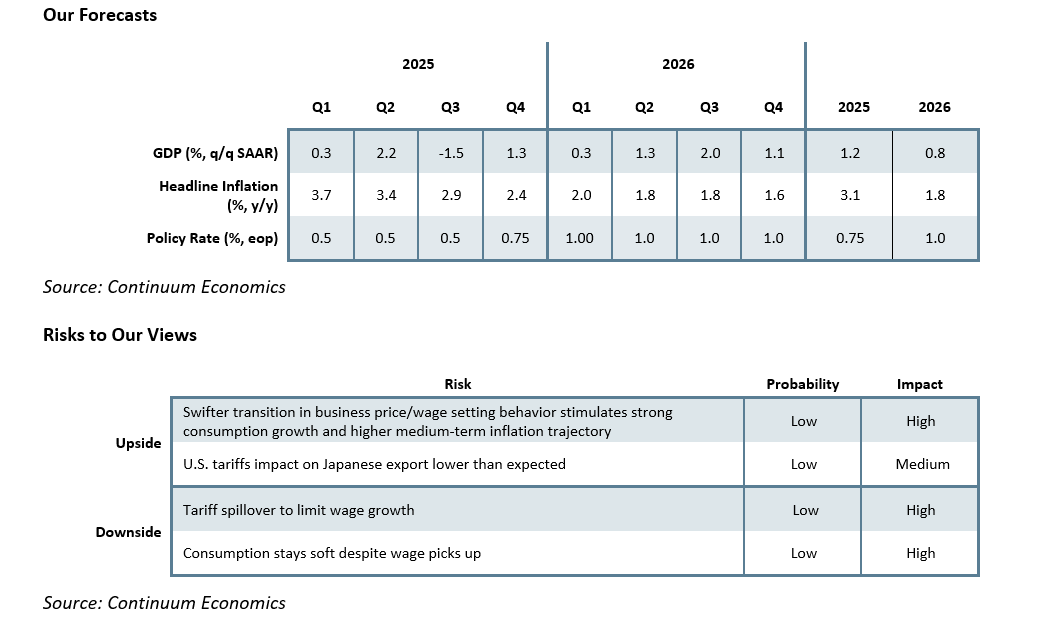

• The recovery in private consumption surprised to the upside is Q2 2025 because wage growth regained traction after clarity on the U.S.-Japan trade front. The gradual transition of business price/wage setting behavior will continue to support consumption in 2025/26. Trade balance in 2025 has shown signs of pre-tariff stockpiling and should return to average for 2025/26 and causes a modest slowdown in 2026. We forecast +1.2% GDP in 2025 and +0.8% in 2026.

• The BoJ remains cautious in their normalization steps, both as they judge the underlying outlook and as political uncertainty surfaced after PM Ishiba’s resignation and will only be unveiled in the October 4 LDP leadership election. However, we believe the BoJ is ready for their next step to hike by 25bps in the October meeting for medium term inflation forecast is now align with their 2% inflation target, followed by a further 25bps in 2026 to a 1% policy rate.

Forecast changes: We revised 2025 GDP higher to +1.2% from +0.9% and sees 2026 GDP at 0.8% as wage growth supports consumption. 2025 CPI forecast is unchanged at +3% before moderating to 1.8% in 2026.

Macroeconomic and Policy Dynamics

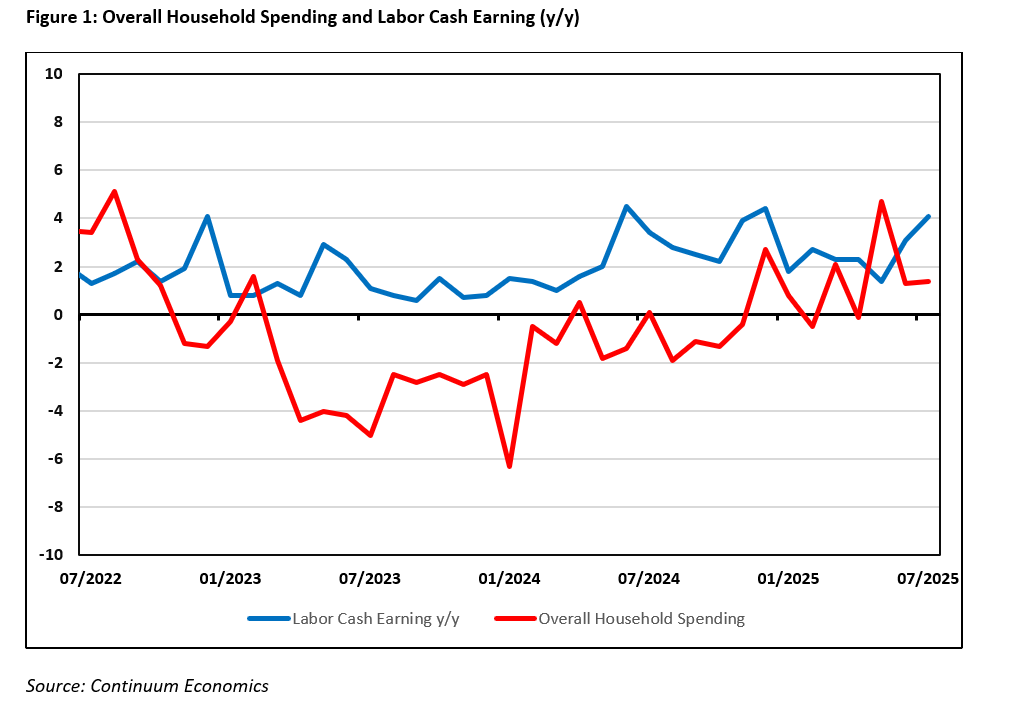

The trajectory of consumption points upwards into 2026as wage growth regains traction after the framework of U.S.-Japan trade agreement has been set. Household spending has also shown signs of healthy growth in the past three months despite higher prices suggesting consumers are not holding back as much. The dynamics between higher price and steady consumption growth would be critical in terms of reaching the sustainable 2% inflation goal. However, choppy real wage will likely hinder the momentum in consumption recovery.

Our forecast for 2025 GDP is revised higher to +1.2% to reflect the stronger rebound in private consumption and labor cash earnings. Economic growth is going to be normalized from more balanced wage/inflation dynamics and less exports after the 2025 export surge to the U.S. , thus 2026 GDP’s forecast is +0.8%. Private consumption is expected to grow at a modest pace, driven by improving real wages. Headline labor cash earning has regained traction (+4.1% y/y in July) after the U.S.-Japan trade agreement capped any tariffs at 15% (Figure 1), providing the clarity business need to assess the impact. The stronger wage outlook supports the recovery of consumption, exacerbated by the moderation in headline inflation. Transitory factors, especially historic rice prices (poor harvest and residents stockpiling), have led us to a slight revision of 2025 headline inflation to +3.1% with 2026 inflation unchanged at +1.8%.

While the effect of government budget cut has begun to show, the political uncertainty after LDP losing the majority in both houses and PM Ishiba’ resignation could see fiscal consolidation derailed. The LDP leadership election will be conducted on Oct 4. The top two candidates are Agriculture Minister Shinjiro Koizumi and former Internal Affairs Minister Sanae Takaichi. Koizumi is more popular among younger generations and tilted towards reform while Takaichi seems to be favoring more fiscal stimulus. The opposition party has been calling for reduction in consumption tax, which was initially rejected by the current ruling party LDP, may now be reconsidered as the LDP need the support of opposition to keep the ball rolling. The compromise from the Japanese government may lead to another budget slippage in the next fiscal year and worsen the overall fiscal health of Japan if tax is lowered at the same time. On the margin, a consumption tax cut could provide some temporary support to consumption.

The strong export in H1 2025 are unlikely to be repeated as it is mostly stockpiling before the U.S. tariffs took place. Auto and chip export to the U.S. has fallen by more than double digits after the U.S. tariff activates. While Japanese export remain attractive in terms of quality and value, the 15% overall tariff will have a negative impact towards the overall trade balance in 2026/27 before Japan tries to redirect the supply to Europe and Asia. We also forecast 125 on USDJPY by end 2025, given Fed easing and the BoJ’s tilt towards more tightening and this could further reduce the attractiveness of Japanese exports.

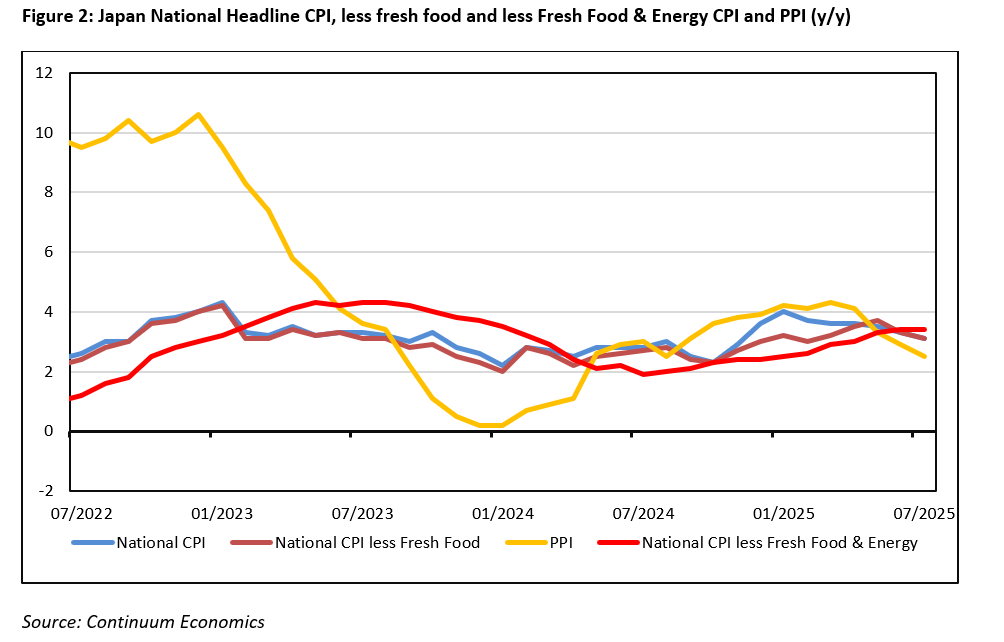

The latest rhetoric from the BoJ suggest they are now seeing the 2% sustainable inflation target close to being reached in their medium-term outlook. The main reason is attributed towards the changing price/wage and consumption behavior. While the change in such behavior remains gradual, it stayed on the right track despite choppy real wage and with the consumer becoming less sensitive to price hikes. Yet, the pace and magnitude is likely to be more modest than BoJ forecast and its contribution to inflation would also be humble.

The National y/y CPI has remained high in the past months on food price and a weak JPY. Despite headline CPI steadily moderating from 4% in Jan 2025 to 3.1% in July 2025, ex fresh food & energy CPI is instead steadily rising to 3.4% in July 2025, the highest level since Jan 2024. It indicates the underlying inflationary pressure is more stubborn than the headline figure. Moreover, householding spending is seeing an expansive quarter (above 1%) and suggest more sustainable inflationary pressure going forward. Thus, we have revised 2025 headline CPI higher to be 3.1% y/y and 2026 is at 1.8%, with inflation mostly driven by the change in price/wage setting behavior.

Policy Outlook

The BoJ has kept their hawkish rhetoric by suggesting more tightening if economic forecast align with a 2% sustained inflation trajectory. With the U.S.-Japan trade deal concern in the past, the only obstacle left for the BoJ is political and fiscal uncertainty. Our central forecast sees the BoJ to hike by 25bps in the October 2025 meeting after the LDP leadership election and a subsequent 25bps in Q1 2026, to bring the policy rate to 1%. For the BoJ to move further from 1%, we will need to see a further adaption of higher price/wage from both Japanese consumers and SMEs owners and we feel that this will be slower than the BOJ needs to hike beyond 1% in 2026 – though we can see further normalization towards a 1.5% neutral rate in 2027.

Meanwhile, the BoJ is well aware of the bond market’s yield curve dynamics and planned to further reduce their pace of extra purchase by JPY200 billion after April 2026, which will increase the pace of QT. The BoJ will mostly allow yields to gradually go up along the curve yet verbal and actual intervention cannot be ruled out if we see a jump in yields. However, monthly BOJ bond purchases are set to scale down to Yen2.1trn by Q1 2027 and means heavy QT with maturing bonds, which we see pushing 10yr to 2% in 2026. This could cause the BOJ to slow the QT ramp up still further in the June 2026 review and also be cautious about BOJ policy rate hikes in H2 2026.

Additionally, the BoJ announced their plans to sell their ETF and J-REITs holding. The BoJ holds more than 75 trillion JPY in ETF, around 7% of Japanese equities. Such indirect QT should not have a significant impact towards the outlook as the current magnitude and pace of selling indicates a timeframe that spreads across a century. The BoJ believe buybacks from Japanese firms and foreign inflow will be more than enough to absorb the offer and kept the doors open to further changes if they think there is market disruption.