Rate Hold Masks Deeper Questions on BI’s Policy Independence

Bank Indonesia held rates in November as expected, prioritising rupiah and inflation stability over premature easing. While a December cut remains likely—especially if the Fed turns dovish—BI has made clear it will move only under the right conditions.

Bank Indonesia kept its benchmark interest rate unchanged at 4.75% during its January Board of Governors meeting, marking the fourth consecutive hold amid mounting exchange rate pressures and growing market concerns over central bank independence. The decision came as the Indonesian rupiah (IDR) weakened by over 1.5% since late December, prompting a prioritisation of currency stability over further easing even as signs of a domestic growth slowdown persist.

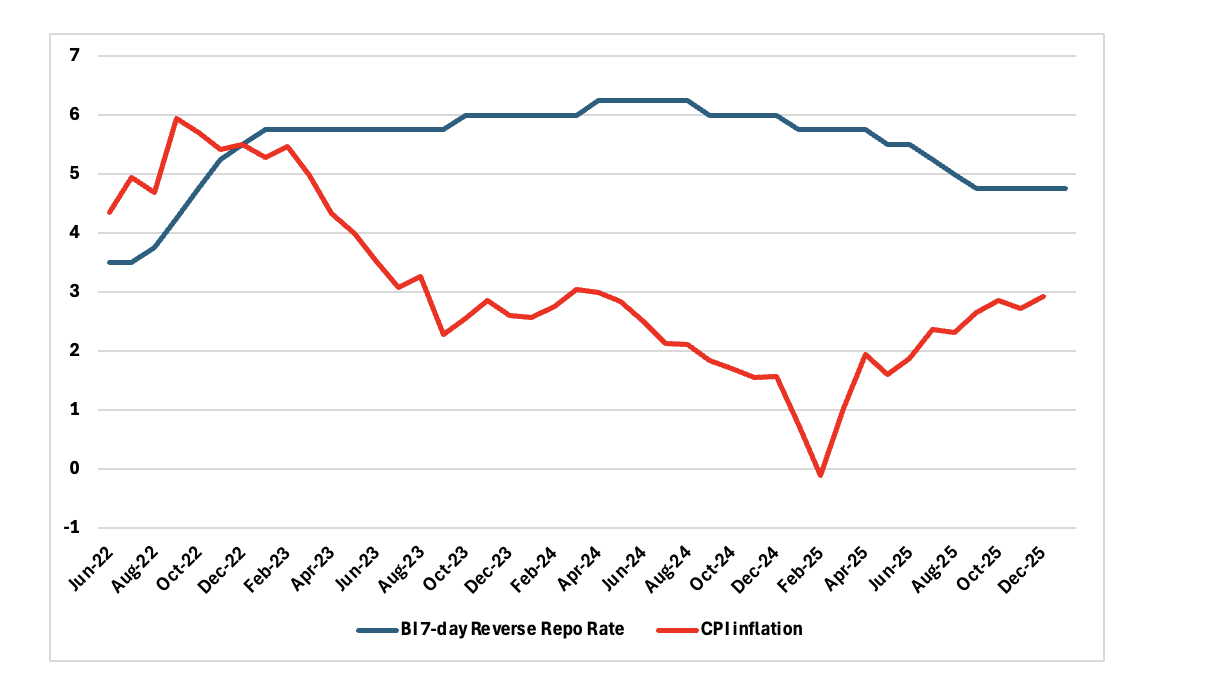

Governor Perry Warjiyo reiterated the central bank’s commitment to anchoring inflation expectations and stabilising the rupiah. He underscored that the hold was consistent with inflation targets and "fundamentals of the rupiah", pushing back against calls for deeper monetary stimulus. While Indonesia’s headline and core inflation remain subdued with overall CPI well within the 2.5% ±1% target band, BI is acutely aware that imported inflation and speculative pressure on the currency could quickly erode price stability. The recent IDR depreciation, attributed to a mix of global uncertainty, elevated FX demand from state-owned enterprises, and investor anxiety over domestic fiscal slippage, shaped the cautious tone of the decision.

Figure 1: Bank Indonesia Policy Rate and Headline Inflation (%)

Complicating the picture is rising scrutiny over Bank Indonesia’s autonomy, particularly after the nomination of President Prabowo's nephew to Bank Indonesia's board. The move has stoked concerns of fiscal dominance where monetary policy becomes subordinated to government growth and spending ambitions, especially as Jakarta targets 8% GDP growth by 2029. Markets reacted swiftly. The 10-year government bond yield spiked to 6.33%, reflecting investor unease over institutional independence and the credibility of monetary policy as a firewall against deficit monetisation. While BI’s decision to hold rates signalled a defence of its policy mandate, the optics of political proximity have added risk premia to Indonesian assets.

Governor Warjiyo acknowledged signs of slower economic momentum, but defended BI’s cautious stance, citing macroprudential easing tools and priority sector lending incentives already in play. He highlighted that Bank Indonesia has already cut rates by 150 basis points since September 2024, and that the current policy setting remains supportive of growth. Forward guidance remained dovish, with Warjiyo noting that additional easing remains on the table if inflation stays within target and external pressures ease.

In our view, the January decision reflects a deliberate pause, not a reversal of easing bias. But it also highlights the structural dilemma Bank Indonesia faces: navigating currency fragility, political proximity, and credibility all at once. The bank’s strong communication on inflation and currency management has, for now, helped anchor expectations. However, the perception of encroaching political influence, particularly amid widening deficits and ambitious growth targets, poses a latent threat to BI’s independence and market trust.