U.S. November Retail Sales - Mixed detail but trend still strong

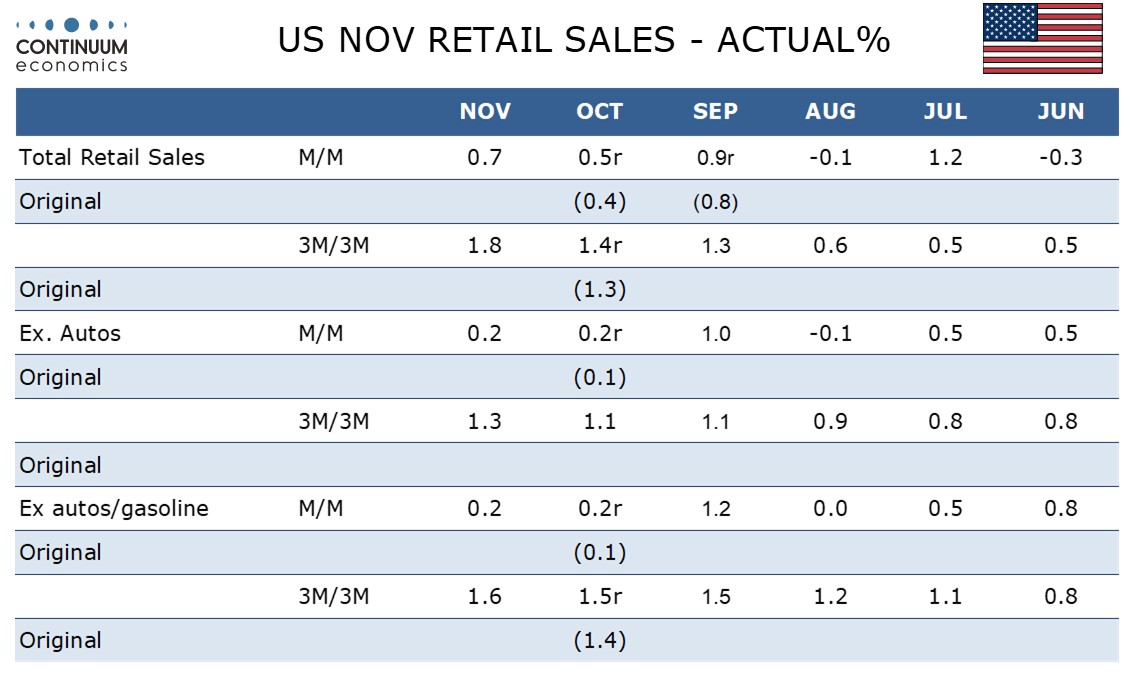

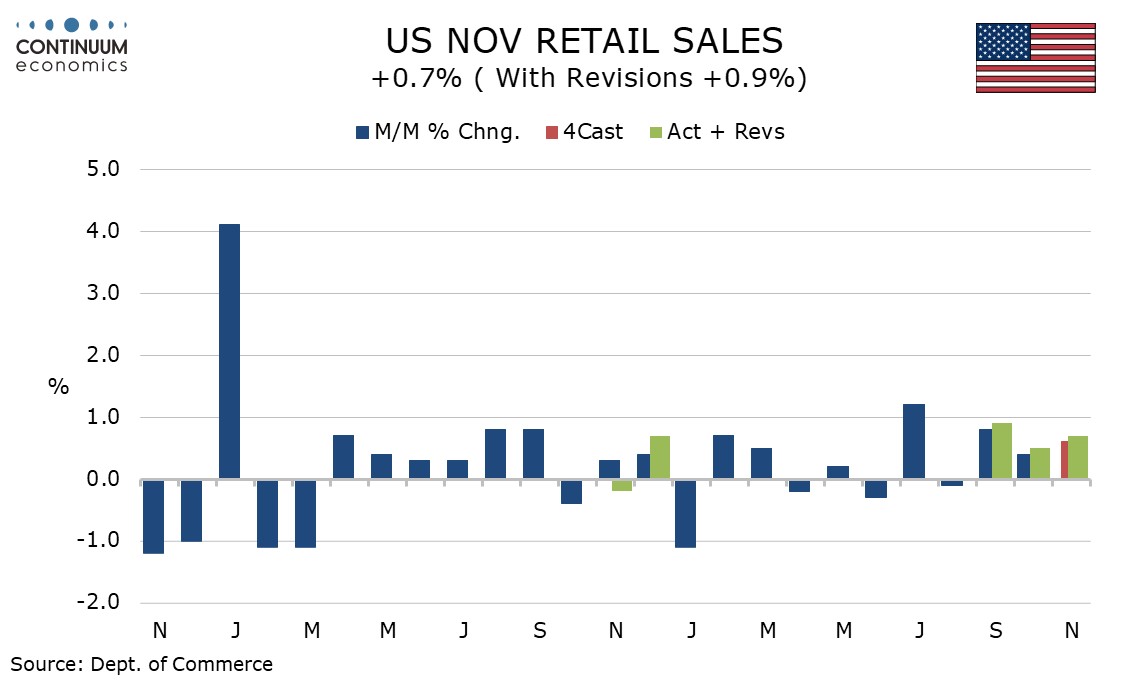

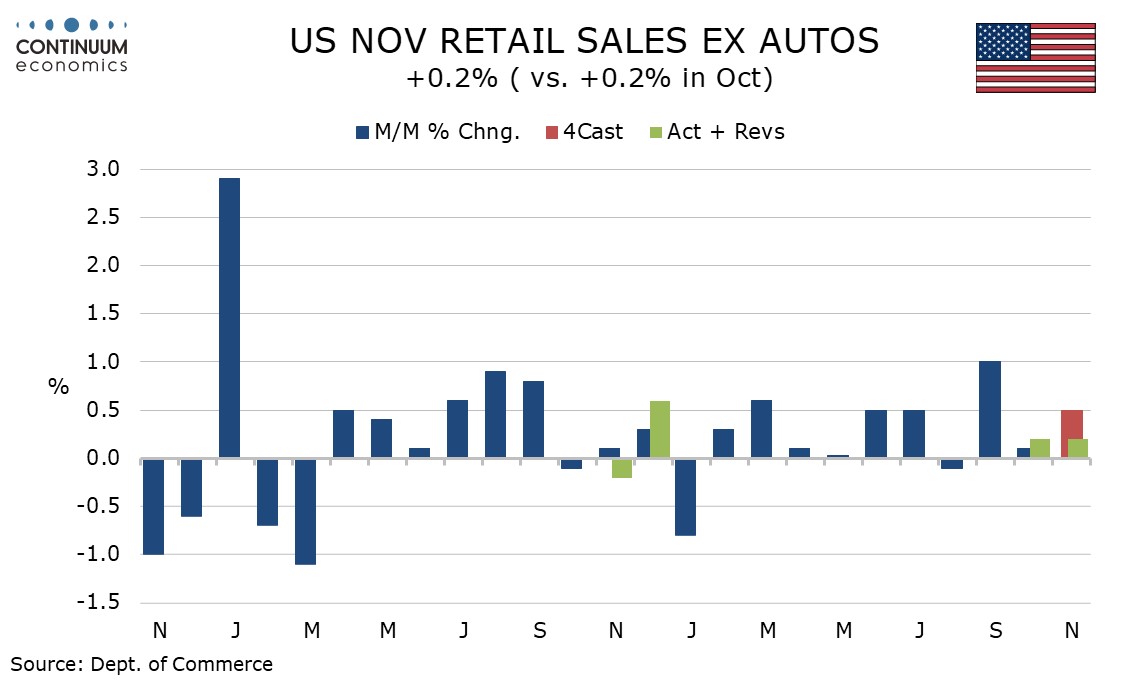

November retail sales with a 0.7% increase are stronger than expected overall but the 0.2% gains in the core rates both ex autos and ex autos and gasoline are weaker than expected, though an as expected 0.4% rise in the control group suggests a healthy contribution to GDP. Revisions are marginally positive, +0.2% overall and +0.1% in both core rates.

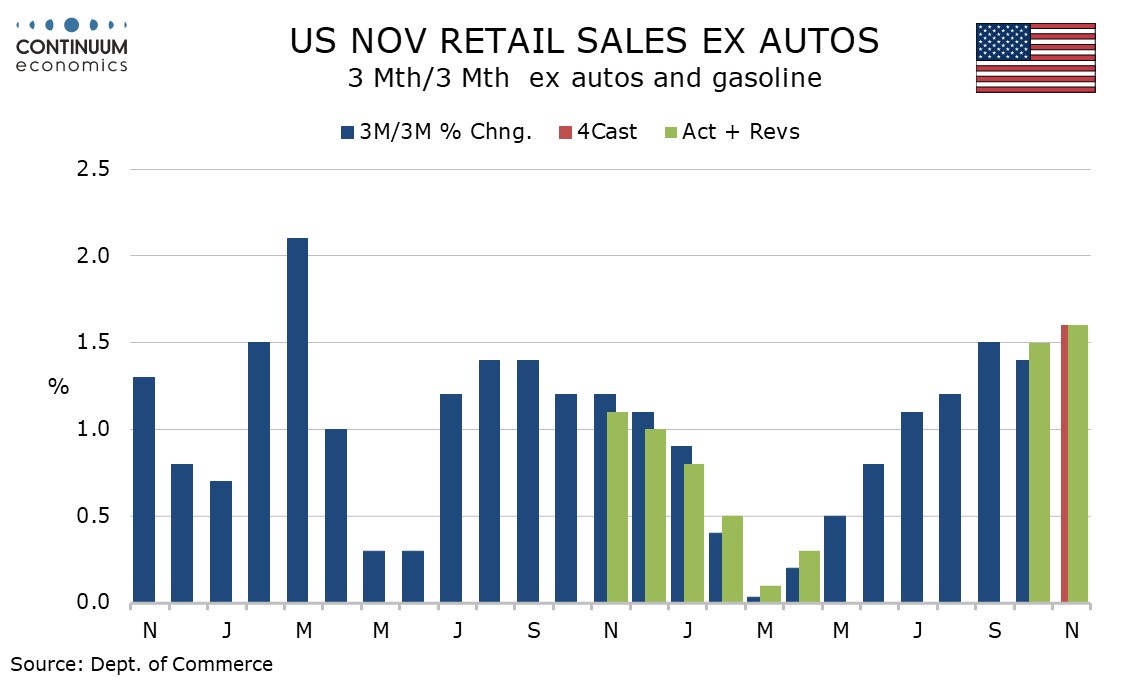

The data still leaves a positive consumer picture with 3 month/3 month rates of 1.8% overall, 1.3% ex autos and 1.6% ex autos and gasoline (not annualized) all the strongest for at least 12 months.

Details show a third straight gain in autos which have been increasingly strong, this consistent with gains in industry auto sales data and probably supported by falling interest rates.

Electronics, building materials and furniture all saw moderate gains, but the details for non-durables were generally soft, though a 0.4% decline in food services looks corrective from recent strength. Increased spending on durables may reflect sensitivity to interest rates.

Non-store retailers were another area of strength, rising by 1.8% and trend here is outperforming.