UK GDP Preview (Feb 15): Recession to be Confirmed?

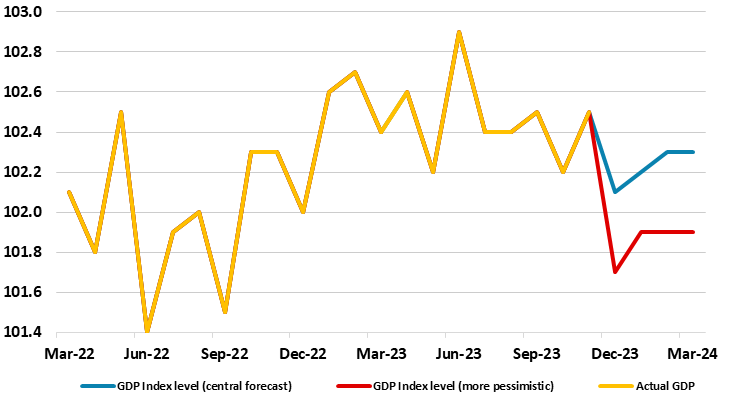

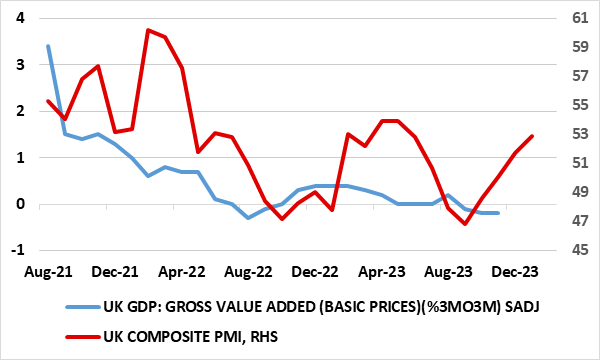

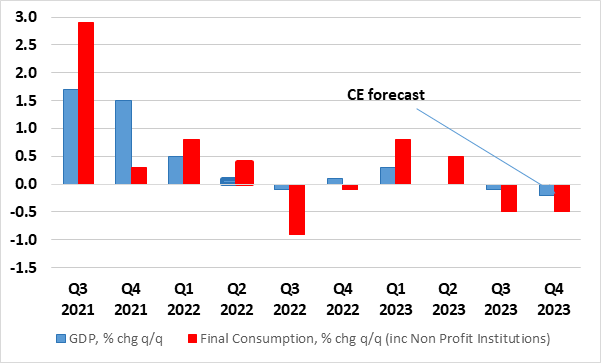

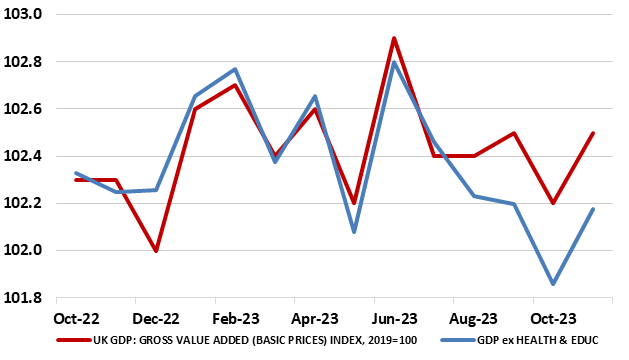

Coming in higher than expected, and probably boosted by less poor weather and a correction back in imports, GDP rose by 0.3% m/m in the November data, a result that meant that the surprise drop of the previous month was exactly reversed. We think this will have been a short-lived reprieve, with a 0.4% m/m drop in December and with downside risks, not least on account of the plunge in retail sales and abnormal weather, which suggest downside risks (Figure 1). Admittedly some upside risks are posed by some survey data, but where the likes of PMI numbers have been very poor guides to GDP swings (Figure 2). As for those swings, we see the December result resulting in a 0.2% q/q Q4 drop, both below the BoE’s flat projection and meaning that, after the Q3 decline, the economy may be in formal recession, with a further drop in consumer spending alongside (Figure 3). As Figure 4 shows as well, were it not for the recoveries in both health and education from the pandemic, the overall GDP picture of late would be even worse.

Figure 1: UK GDP Still Volatile but With Downside Risks…

Source: ONS, CE

Downside Risks Still Clear?

In terms of recent momentum, GDP is estimated to have fallen by 0.2% in the three months to November 2023, while monthly GDP is estimated to have grown by 0.3% m/m in November alone3, following an unrevised fall of 0.3% in October 2023. Services output grew by 0.4% in November 2023 and was the main contributor to the monthly growth in GDP; this follows a fall of 0.1% in October 2023 (revised up from a 0.2% fall in our previous publication). Admittedly, weather patterns have helped accentuate swings in monthly GDP numbers of late and may have done so again given how warm and wet December proved to be, potentially hitting and hurting consumption, utility output and construction collectively.

Perhaps, the essential trend remains flat but where domestic demand weakness is still being masked by softness in imports. But elsewhere the allegedly less-weak housing market is having an increasing impact via the fall in transactions.

Figure 2: PMI Composite Survey - A Poor Guide to GDP Swings?

Source: Markit, ONS

As for the economic outlook, our relatively gloomy scenario may seem to be in conflict with survey data that have seemingly shown some degree of resilience in the last few quarters. Indeed, PMI data have perked up late but these numbers have been very poor indicators of actual GDP swings in recent years (Figure 2), especially the composite measure which excludes construction, government and retailing, perhaps the three sectors most affected by policy both monetary and fiscal. Even so, there are supportive factors: not least the marked drop in wholesale energy prices which will filter through in another bout next quarter and where the fiscal situation is going to be little more supportive than previously envisaged. But businesses are losing much of the energy support cushion through 2024. However, the main concern is clearly the impact of the sizeable tightening in monetary policy that is already causing tighter financial conditions that will increasingly bite the economy through the credit channel, this very much highlighted by unprecedented declines occurring in both the level of bank credit and bank deposits. This fragile outlook is very much led by the consumer, the most exposed to likely outright damage from the housing market. In perspective, this will involve consumer spending falling modestly in 2023 and slipping a little further in 2024.

Recession Signalled?

The 0.4% m/m drop would mean that in the absence of revisions, Q4 GDP would fall by 0.2% q/q, this therefore would be a second successive fall (Figure 3) and an outcome weaker than the flat picture painted by the BoE. This is likely to encompass a further clear q/q fall in consumer spending, especially after the slump in retail sales through last quarter. Over and beyond the monetary policy repercussions, (actually more driven by inflation dynamics), the question is will such a result add to the government’s already shaky and divided position.

Figure 3: A Second Successive Fall in Both GDP and Consumer Spending?

Source: CE, ONS

As for details, it is notable the strong contribution provided by both recovering education and health services from their nadir in the pandemic without which GDP would have been appreciably weak that current headline suggest (Figure 4). These are hardly cyclical developments and are unlikely to persist at the recent pace of growth, adding to weak growth outlook we envisage.

Figure 4: GDP Weaker Without Boost from Health and Education

Source: ONS