UK GDP Preview (Dec 13): Friday the 13th Weakness?

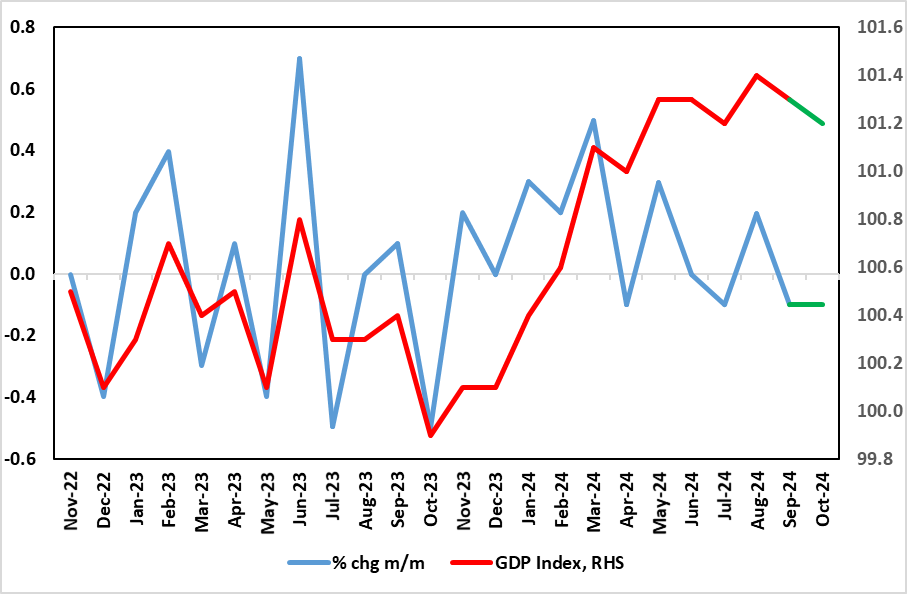

There are increasing questions about the UK’s economy’s apparent solidity, if not strength, as seen in sizeable q/q gains in the first two quarters of the year of 0.7% and 0.5% respectively. However, GDP growth has been positive in only two of the last six months of data and worth a cumulative 0.3%, and where even that much more modest momentum looks to have ebbed given that September GDP fell 0.1% m/m, soft enough to have limited Q3 GDP growth to a 0.1% q/q rise, half the pace the BoE recently pared back its estimate too but in line with our thinking. Moreover, we think the weakness has continued with a further 0.1% m/m drop envisaged for the October update (Figure 1), this chiming with already released weak(er) survey data, payroll numbers and retail sales data for the month. The question is whether any such weakness suggests that the support from services to the economy seen of late, thereby offsetting manufacturing weakness, may be faltering.

Figure 1: Momentum Faltering Further?

Source: ONS

To suggest that the unexpected GDP drop in September was a result of pre-Budget apprehension is wide of the mark; after all, GDP stopped growing between March and when the new government too office in July. As for the latest details, m/m real GDP is estimated to have fallen by 0.1% in September, largely because of declines in manufacturing output and information and communication services, after unrevised growth of 0.2% in August. Notably, services output showed no growth, following an unrevised increase of 0.1% in August 2024, and grew by 0.1% in the three months to September 2024. Even construction, where surveys are the most upbeat, output grew only by 0.1%

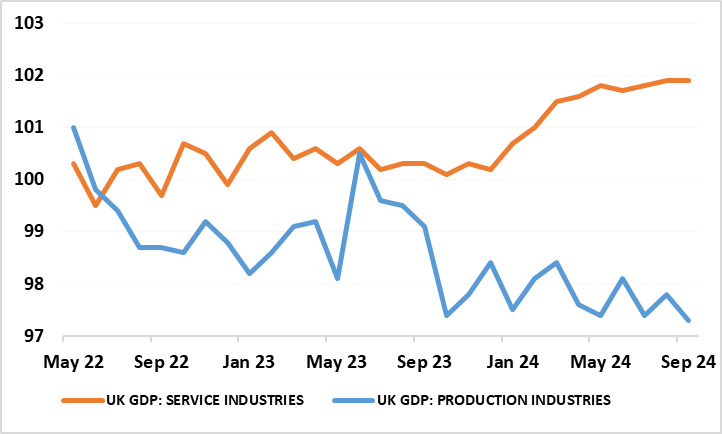

Regardless, the monthly real economy data may be becoming an increasingly important factor in shaping BoE policy ahead, especially if more weakness occurs. In this regard, as for October, we think that mild weather curbed utility production. There will be a clear boost from real estate given a sizeable jump in house sale, but with something of an imponderable being the public sector which had been clearly boosting activity in H1, but may now be flattening out, if not reversing, at least outside of health. Retail sales were down clearly and broader weakness has been flagged both by a further m/m drop in payrolls during the month and by business surveys. They suggest deeper weakness in manufacturing (something echoed by industry data on vehicle production), but a slowing in services, this being important given the manner in which services have propped up the whole economy of late (Figure 2).

Figure 2: Are Services Ebbing?

Source: ONS

Regardless, the lack of growth in late Q3 has created a soft base effect for Q4 growth which we now see being flat in q/q terms, thereby 0.2 ppt below the BoE estimate and maybe even weaker without an assumed recovery in the Nov/Dec GDP numbers. This backdrop may cause some consternation at this month’s MPC meeting, with a verdict due on Dec 19, albeit with it likely that clear majority still votes for stable policy. Regardless, and as suggested above, this weaker immediate GDP backdrop is something that chimes more with labor market and public borrowing data and where HMRC payrolls paint a much softer backdrop and possible outlook that also had conflicted very much with PMI survey numbers, at least until recently. However, while the BoE may still look to a clear recovery into 2025, any further signs that Budget apprehension and what may now be damaged business and consumer confidence from actual fiscal measures may warrant a reassessment, especially given what looks to be a weak economic picture in neighbouring Eurozone.