Preview: Due February 12 - U.S. January CPI - Core rate to pick up on the month but slow yr/yr

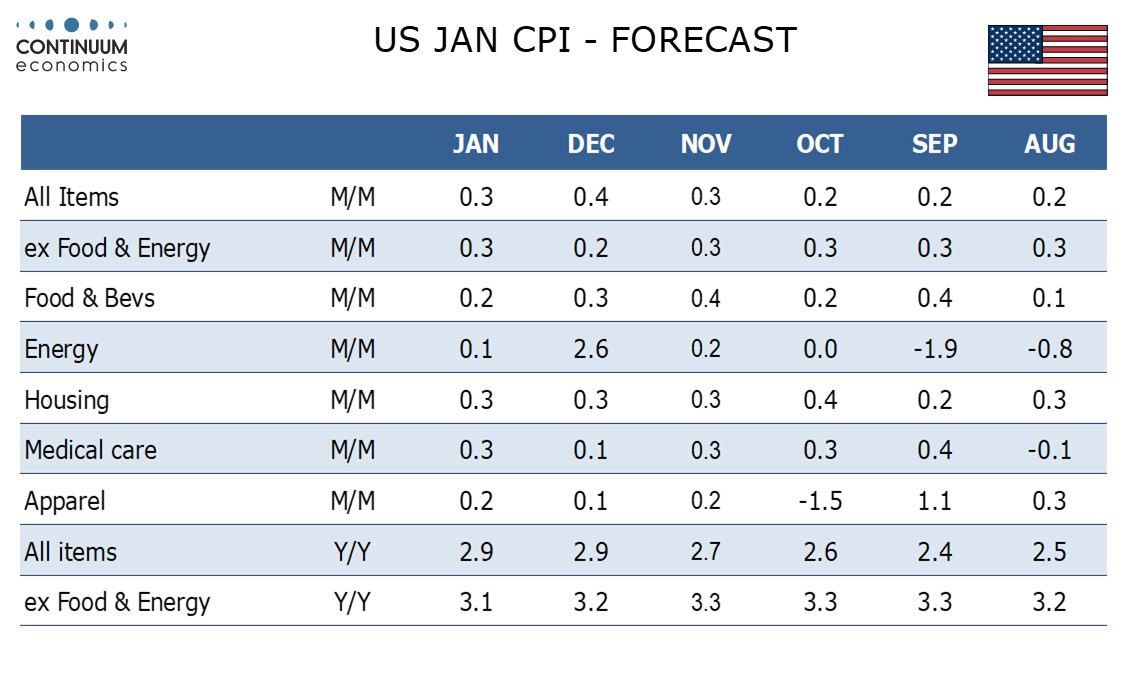

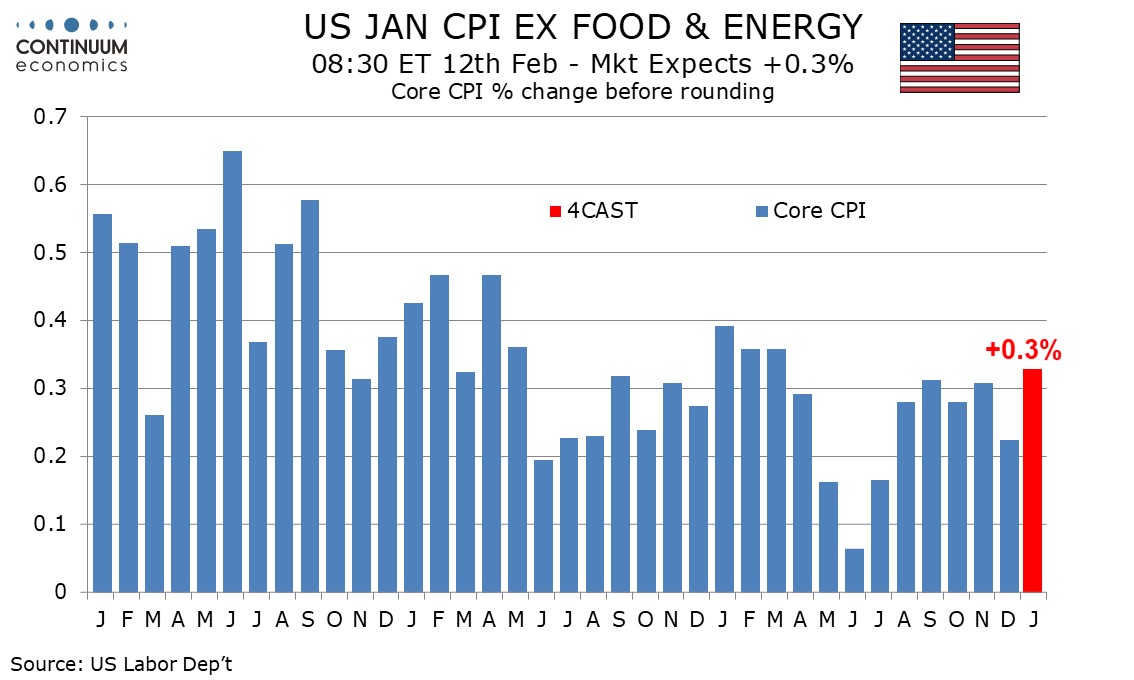

We expect January’s CPI to increase by 0.3% both overall and ex food and energy, with the overall figure close to 0.3% even before rounding, but the core rate rising by 0.33%, which would be the strongest monthly gain since the three months of Q1 2024 each showed monthly core rates of 0.4% (each a little below 0.4% before rounding).

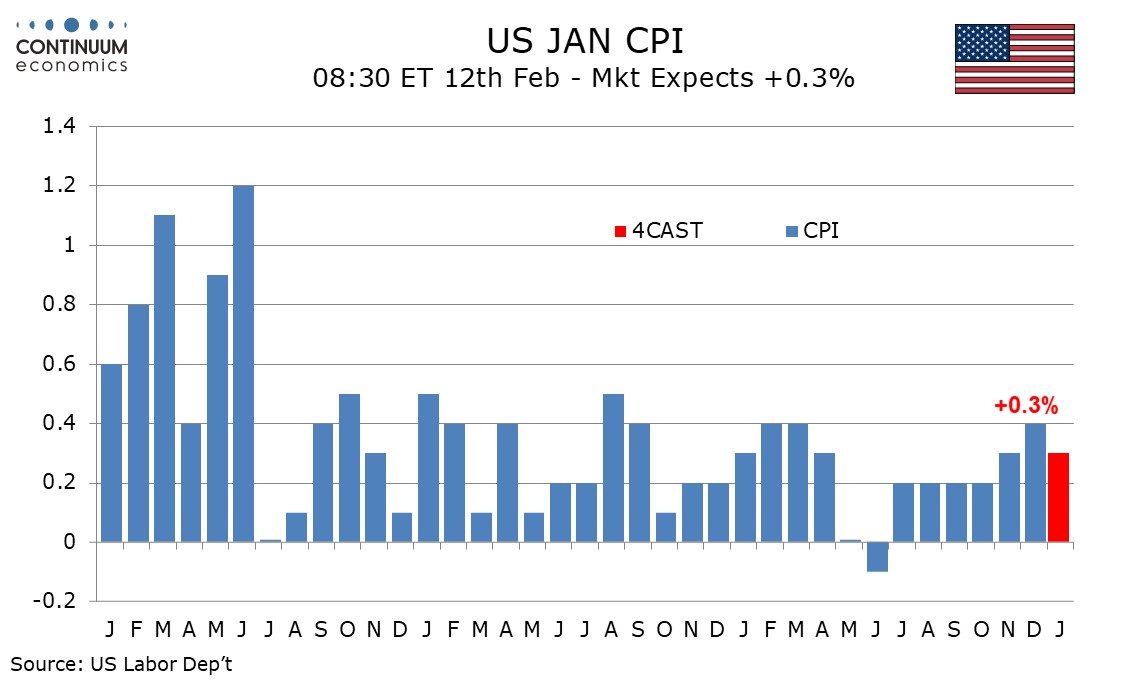

There appears to be some residual seasonality in the CPI even after seasonal adjustment, with both 2023 and 2024 having stated the year strongly before showing some below trend months in mid-year, with June being the softest month in each year.

We however doubt that January 2025 will be a s strong as January 2024, and with January 2024 having been slightly below 0.4% before rounding we expect January 2025 to be rounded down to 0.3%. Updated seasonal adjustments due with the release could smooth some of the residual seasonality. January 2024 saw owners’ equivalent rent particularly strong at 0.6% and with that sector having lost momentum we doubt January 2025 will be so strong, though it may be above trend. Autos are however an upside risk for January 2025.

We expect gasoline to be unchanged and energy up only 0.1%, and a 0.2% rise in food, leaving overall CPI close to 0.3% even before rounding. The yr/yr core rate is likely to slip as January 2024 strength drops out, to 3.1% from 3.2%, putting the pace at its lowest since April 2021. We however expect yr/yr overall CPI to be unchanged at 2.9%.