USD flows: USD firm post-CPI, BoJ holding fire

USD holding onto post-CPI gains. BoJ to keep powder dry as long as JPY weakness is only seen against the USD

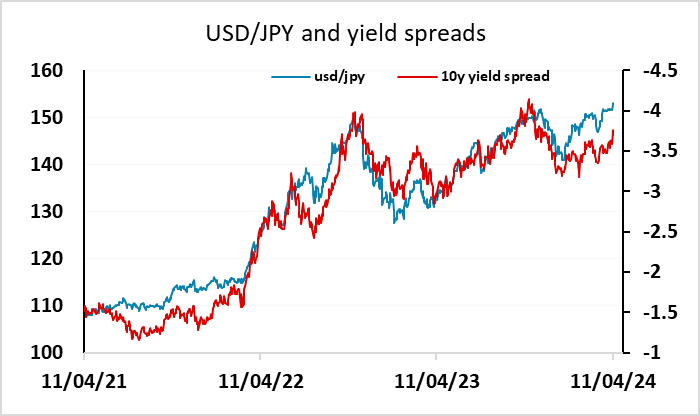

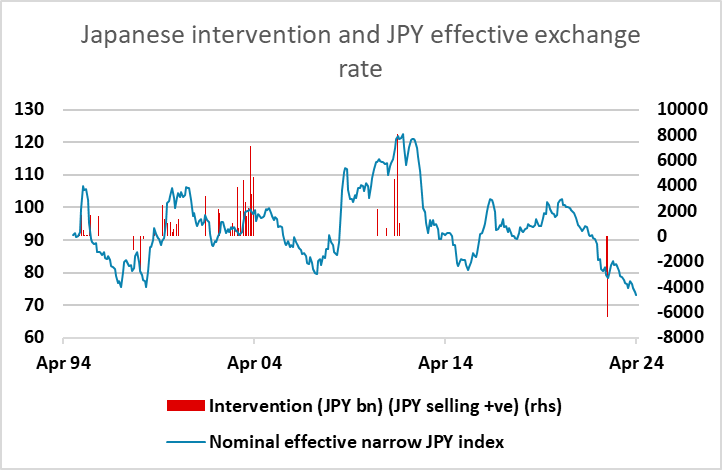

USD strength following yesterday’s stronger than expected CPI reached its peak in the North American session. There has been some mild corrective pressure in Asia, but the USD is still slightly higher against most currencies than at the European close yesterday. There has been no evidence of intervention from the Japanese authorities. Suzuki came up with an escalation of rhetoric by indicating close communication with Kanda, who executes intervention, to try and curb the JPY's weakness. However, he followed up with a remark that FX levels are basically determined by markets, and suggested a weak JPY has its pros and cons. We would not expect the Japanese authorities to respond as long as this move is USD strength as opposed to JPY weakness. The JPY is generally slightly firmer on the crosses since the US CPI data, and as long as this continues we would expect the BoJ to stay out of the market. They are not in the business of attempting to prevent USD strength, but they are likely to be active if this turns into JPY weakness.

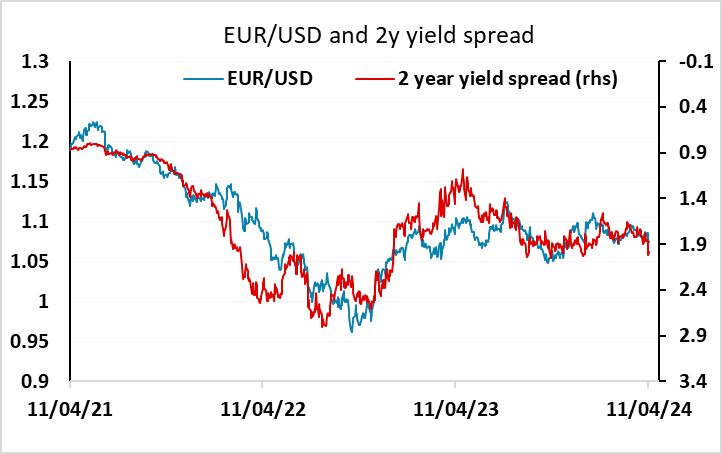

The ECB meeting will be the main focus today. The market has pulled EUR front end yields lower after the US CPI data, so that a June rate cut has gone from being fully priced to only being around 80% priced in. This has reduced the widening of yield spreads in the USD’s favour, and helped limit the EUR/USD decline, but a clear signal from the ECB that a June cut is planned could be expected to push EUR front end yields back down and EUR/USD with it. The 1.0695 level has been the low for the year, but looks likely to come under pressure, as even with the current level of EUR yields, spreads suggest EUR/USD downside risks.