FOMC Preview for June 18: No change in rates or dots, only marginal changes to statement and forecasts

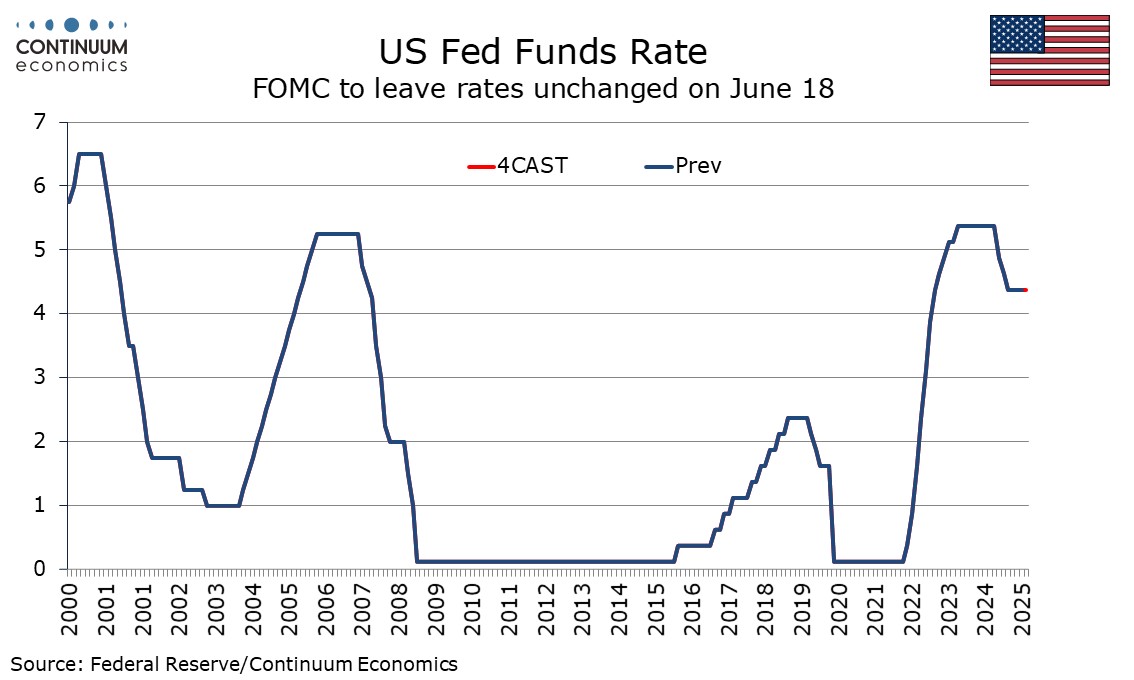

The June 18 FOMC meeting looks highly likely to leave rates unchanged at 4.25-4.5%. We expect only marginal changes to May’s statement and the Fed’s median forecasts from March, with no change at all in the median dots on rates. Chairman Powell at the press conference may welcome recent signals on inflation, but given uncertainty over tariffs, will state more information is needed before easing.

Core PCE prices produced soft 0.1% gains in March and April, and CPI data suggests a similar outcome for May. However, these followed strong gains of 0.3% in January and 0.5% in February. The Fed is likely to be pleasantly surprised by the lack of pass-through from tariffs so far, though this can be explained by a large Q1 inventory build up and uncertainty over the future tariff picture. With decisions on reciprocal tariffs due from both Trump and the courts in July, the case for waiting in June is strong. Resilient employment data for May suggests the economy is not at the cusp of recession. May’s meeting, and particularly minutes, saw the Fed downplay the significance of a marginal negative in Q1 GDP, that was due largely to a surge in imports which April trade data suggests is being reversed in Q2.

The statement is likely to continue stating that economic activity continues to expand at a solid pace. May’s statement also stated that inflation remained somewhat elevated. The Fed will need to consider fine tuning this, with May data likely to look similar to April’s when overall PCE prices at 2.1% were only marginally above the 2.0% target with the core rate at 2.5% at its lowest since March 2021. Still, any dovish adjustment would probably need to be accompanied by a warning that the impact of tariffs remains uncertain, and the Fed may decide to leave the statement as it was. Powell at his press conference will recognize the recent softer price data, and could suggest that easing could be seen if this persists, or if labor market resilience fades. This could be seen as a dovish spin.

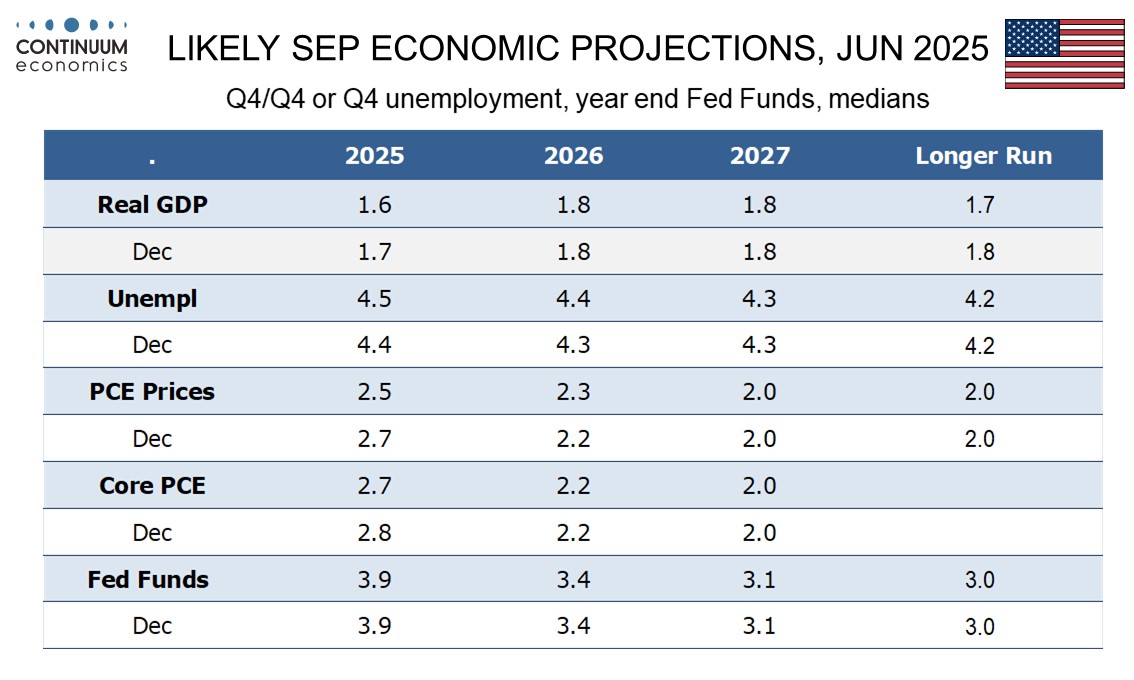

Markets are however unlikely to get any dovish signals in the dots, which we expect to be unchanged from March. These looked for two 25bps easings in both 2025 and 2026, and one more in 2027 putting the end 2027 rate at 3.0%-3.25%, only marginally above the long run neutral rate of 3.0%. All of these dots had an upward skew, particularly 2025 when eight respondents were above the median and only two below. Encouragement over recent inflation data is unlikely to achieve anything more than leaving the skew on the dots somewhat more balanced. We also do not expect much change in the economic forecasts. Inflation may be nudged down marginally for 2025 given recent data, as could GDP given the soft Q1 and a slightly more aggressive tariff picture than was expected in March, but the 2026 and 2027 views will see few if any changes. March saw core PCE prices at 2.2% in 2026 and back to the 2.0% target in 2027. Reduced immigration could also see the longer run GDP view trimmed.