ECB Preview (Jan 30): A Staging Post in Easing Cycle

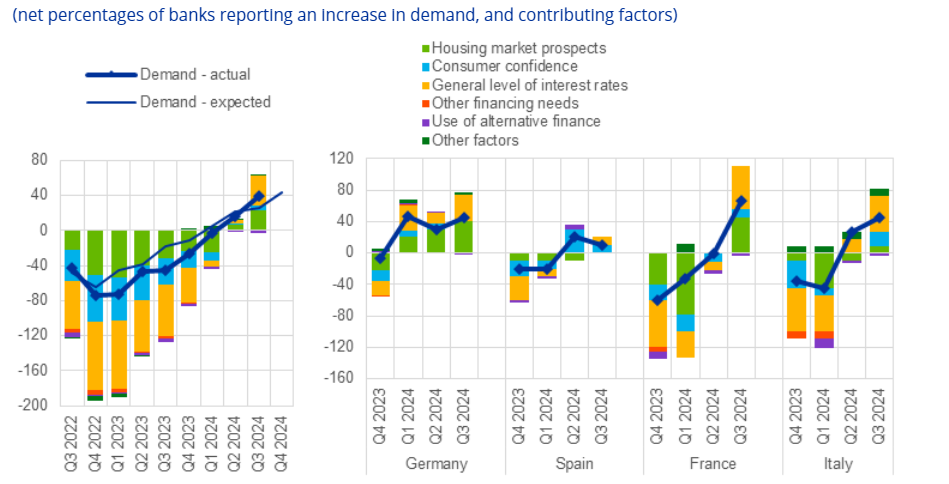

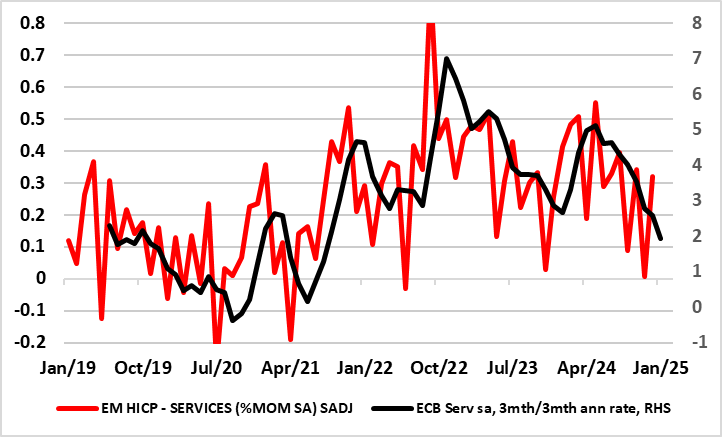

It is unlikely that the ECB verdict at this month’s Council meeting will be anything like as resounding as that seen in December. A fifth 25 bp discount rate cut is virtually assured, to 2.75%, but may not see any demand to at least consider a larger move as was the case last month. Admittedly, the door will be left open for further cuts but hints may be made that amid less-soft survey data, possibly including better bank lending signs (Figure 1), the discount rate is approaching a terminal if not a neutral outcome. It is clearly the case that the ECB is discussing what constitutes a neutral rate, but this is occurring more covertly rather than within the confines of the Council meetings. Regardless, we still think that the economy will undershoot ECB thinking and inflation (even for services – Figure 2) will continue to soften. All of which implies around four 25 bp cuts in H1 this year, with an ensuing around-neutral 2% policy rate. But it is possible that amid a continued sub-par growth outlook into 2026, then further easing may be on the cards into 2026.

Figure 1: Household Loan Demand Reflecting Better Interest Outlook?

Source: ECB Bank Lending Survey

(Some) Better Survey Signs?

As the account of the December 11-12 Council meeting noted, a minority of the Council wanted a 50 bp move. Such demands may be repeated this time around but better survey data may both diminish such arguments and certainly persuade the Council majority to adhere to a 25 bp move. PMI data are less weak and the ECB may get better messages from its important bank lending survey (Jan 22), over and beyond those seen in the last such data. Indeed, three months ago, while still suggesting banks remain cautious about lending, the bank lending survey suggested a clear improvement in the demand for loans very much reflecting an increasing perception that interest rates have started to fall and have further to go (Figure 1). On the consumer side, with households having built hefty savings afresh of late in reaction to higher interest rates, more signs of easing to come may start to unlock those savings and provide a much needed boost to demand – just as policy easing is supposed to do. In fact, this is already supported by actual monetary data suggesting that households have started to reduce their holdings of bank deposits

But the dominant theme will still be around growth worries. Indeed, preserving growth does seem to have become the ECB policy priority, not least against a backdrop of still stagnation risks and much reduced cost pressures that could even suggest a contraction in GDP last quarter. Indeed, the ECB may remain open about this, suggesting still that “risks to economic growth remain tilted to the downside as firms are holding back investment spending in the face of weak demand and a highly uncertain outlook.

Services Inflation Succumbing?

The December meeting was important for the (as we expected) change in forward guidance in which the ECB accepted that on-target inflation is likely to be durable enough so that it no longer has to pursue policy restriction. In this regard, the first glimpse of 2027 economic projections offered last month support this as they point to a second successive year of around-target inflation even on a core basis and also on the basis of markets assuming rates fall to around 2% in 2026. Indeed, it was noted that the on-target 2027 HICP inflation forecast would actually have seen a clear undershoot but for what may be pessimistic assumption on how emissions trading costs may fare. Indeed, we think that softer inflation signs are already evident in what appear to be still-resilient y/y core and services inflation, but where seasonally adjusted m/m numbers are telling a vastly different story. Indeed, as Figure 2 shows services inflation on this latter basis is already consistent with the 2% ECB target and where a clear slowing in services output growth may accentuate such a slowing. Moreover, underlying inflation is softening due to both softer profits and wage pressures, something very much highlighted by quarterly GDP income data and also implying that the process has further to run.

Figure 2: Softer Services Inflation – An Alternative Perspective

Source, Eurostat, CE

Gauging Neutrality

Admittedly, the ECB as a whole seems reluctant at this juncture to move totally away from being data-dependent, but however much they may not want to discuss the matter openly, the Council must be considering what constitutes ‘neutral’. Admittedly, what constitutes neutral varies over time and according to alternative assessments and certainly does not apply solely to a particular policy Rates, instead depending on how the whole yield curve is shaped. Notably, according to some ECB hawks, this 25 bp move last month would constitute policy being at least at the upper end of a range of neutral estimates. This contrasts with the more dovish ECB thinking as highlighted by BoF Governor Villeroy who has pointed to a neutral estimate between 2% and 2.5%. And somewhere in the middle there is also thinking that there may have been a bit of an upward movement in this underlying real interest rate but, albeit probably most of it being cyclical, possibly a result of a recent rise in government deficits reducing the saving/investment balance.

But, if so, this may reverse. Indeed, we suggest it is possible that amid a continued sub-par growth outlook into 2026, and where a shift in the savings balance caused by a continued drift higher in precautionary savings alongside uncertainty deterring investment, may ultimately persuade the ECB to revise down its neutral policy assessment. Then this may create scope, if not rationale, for further easing into 2026. In particular, talk, let alone the reality of tariff or non-tariff measures, would be negative for investment and could accentuate precautionary savings motives. In terms of domestic demand, this would be disinflationary and suggest a fall in the neutral policy rate.