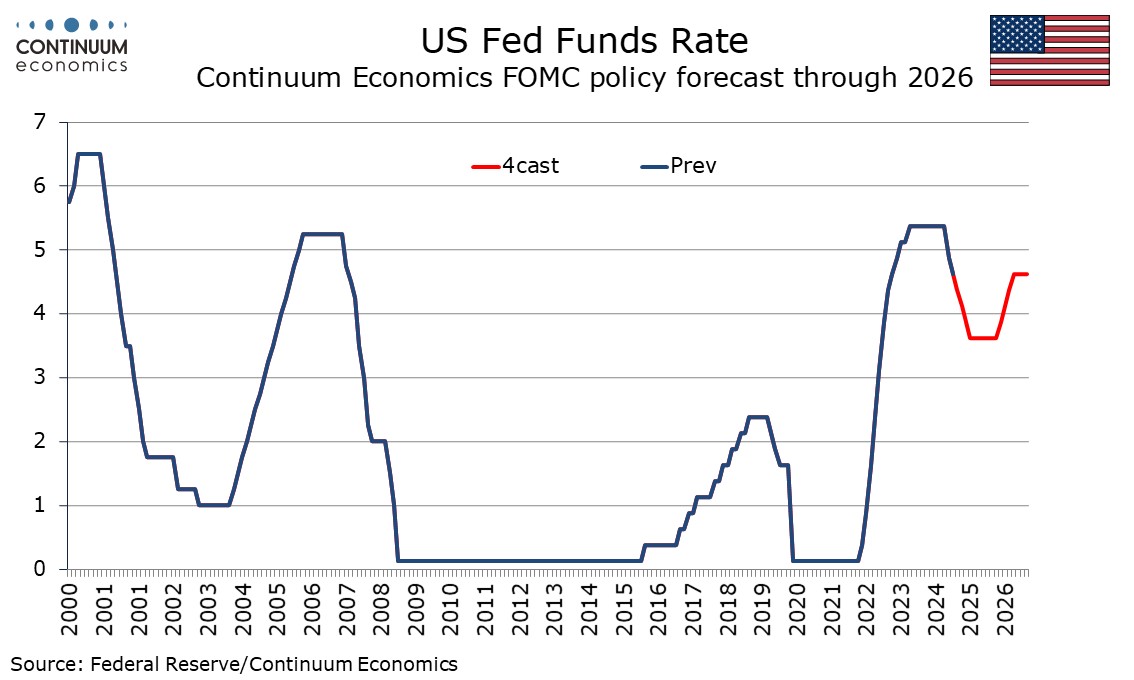

FOMC Eases by 25bps. We Now Expect 100bps More by Mid-2025 Before Renewed Tightening in 2026

The FOMC eased rates by 25bps as expected with a statement that avoided making any further dovish signals beyond what were given on September 18. In his press conference Chairman Jerome Powell left his options open for December when the decision will be data-dependent. On balance we still lean towards a December ease, though we expect less easing in 2025 than previously given likely fiscal support. For 2026 tightening may resume if tariffs lift inflation.

On September 18 the FOMC stated that job gains have slowed. Today it stated that since earlier in the year labor market conditions have generally eased. On September 18 the FOMC stated inflation has made further progress toward the 2% objective. Today they dropped the word further. The FOMC dropped a phase that it has gained greater confidence that inflation is moving sustainably toward 2%, though still judges risks to be roughly in balance. On September 18, before stating it had decided to ease by 50bps, it made a reference to progress on inflation and the balance of risks. Today it simply stated the 25bps move was in support of its goals.

In his press conference Powell noted data since September 18 leaving a feeling that downside economic risks had been diminished. Most recent data has been on the firm side of expectations, a weak payroll for October an exception but almost certainly depressed by hurricanes as well as a strike at Boeing. We expect that November’s payroll will rebound, but not so dramatically that it erases a sense that payroll trend has slowed. Inflation data will probably not provide any major scares before the December meeting. That leaves us leaning towards another 25bps move in December, though the decision will depend on incoming data.

Powell stated that in the near term the election will have no impact on policy as the timing and substance of any policy changes are unknown. However it is likely that Trump, even if not fully meeting his promises, will seek to cut taxes beyond simply extending the 2017 tax cuts, and that will provide support for the economy. That is likely to be done fairly quickly. Aggressive tax cuts will add to the budget deficit, probably sufficiently to cause some concern in the bond markets, and Trump’s most obvious method to raise revenues will be tariffs. He has few serious ideas on cutting spending. If tariffs are raised substantially, inflation is likely to receive a lift, and that is likely to be apparent in the data by 2026.

We continue to expect rates to end 2024 at 4.25% to 4.5%, 25bps lower than currently. Previously we had expected rates to fall to 3.0-3.25% by end 2025. A more expansionary fiscal policy has us now predicting only 75bps of easing in 2025, taking rates to 3.5-3.75%, with two 25bps moves in Q1 and one in Q2. As inflation rises, we expect tightening to resume in 2026, taking rates to 4.5-4.75% by Q3, after which we expect rates to stabilize with the economy likely to be then losing momentum after a strong 2025.