Canada June CPI - Subdued but probably not quite enough for a July easing

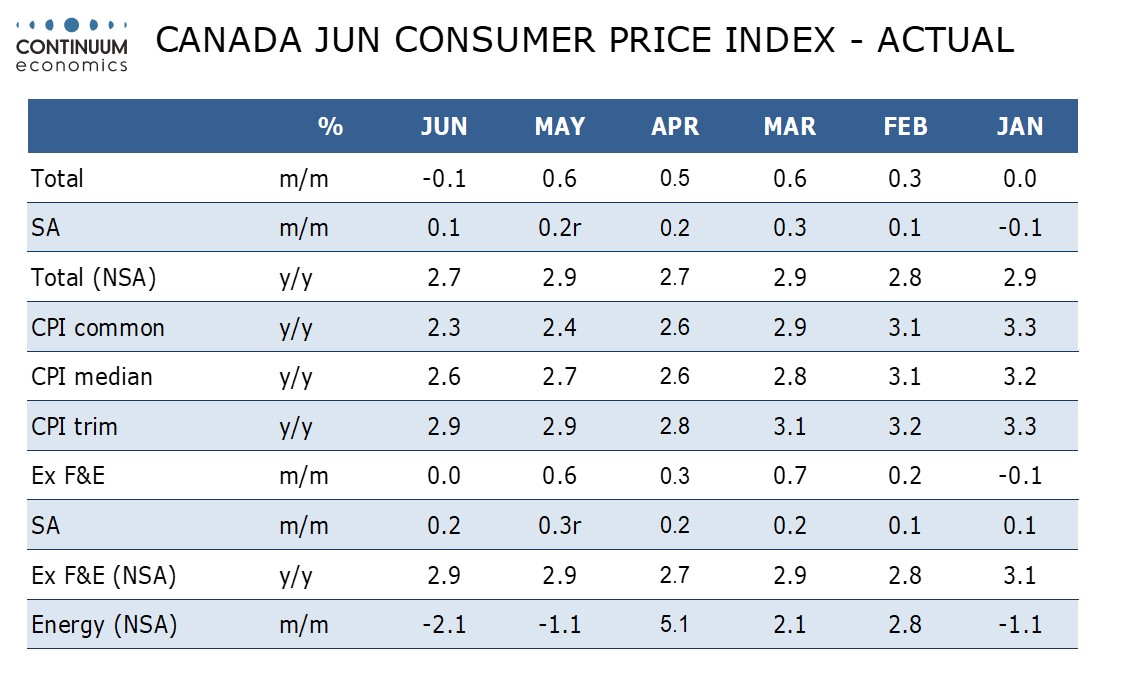

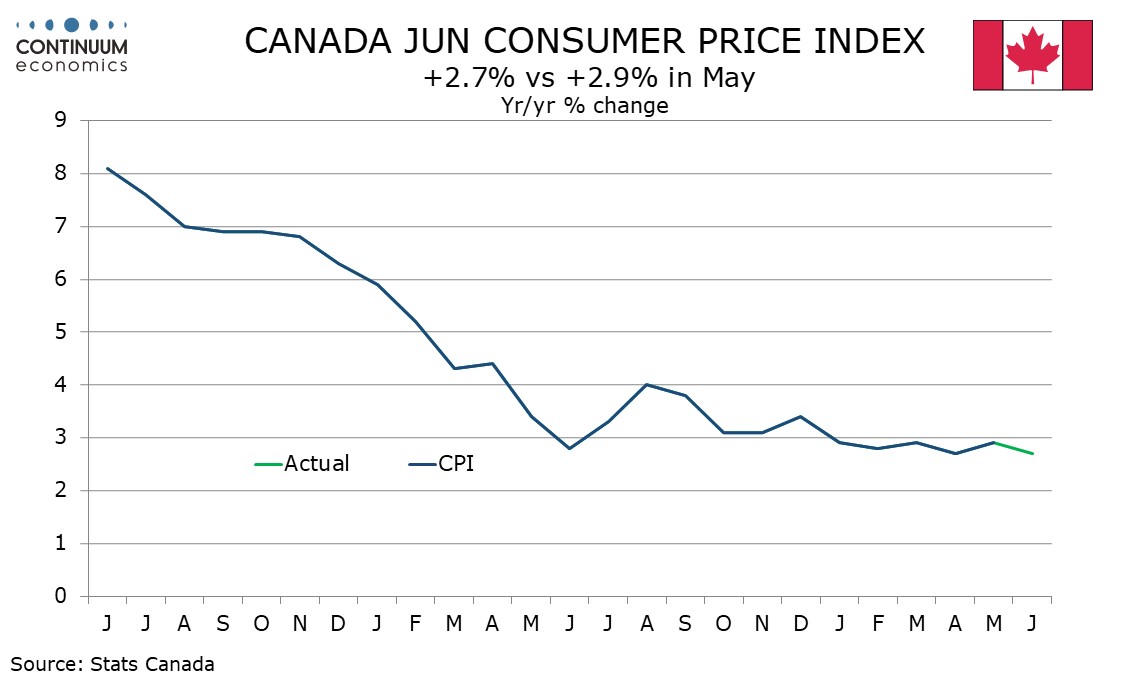

June’s Canadian CPI at 2.7% yr/yr from 2.9% has reversed an upside surprise seen in May and details suggest a generally subdued underlying picture. The data might not be quite soft enough for the Bank of Canada to deliver a second straight easing when it meets on July 24, though the decision will be a close call.

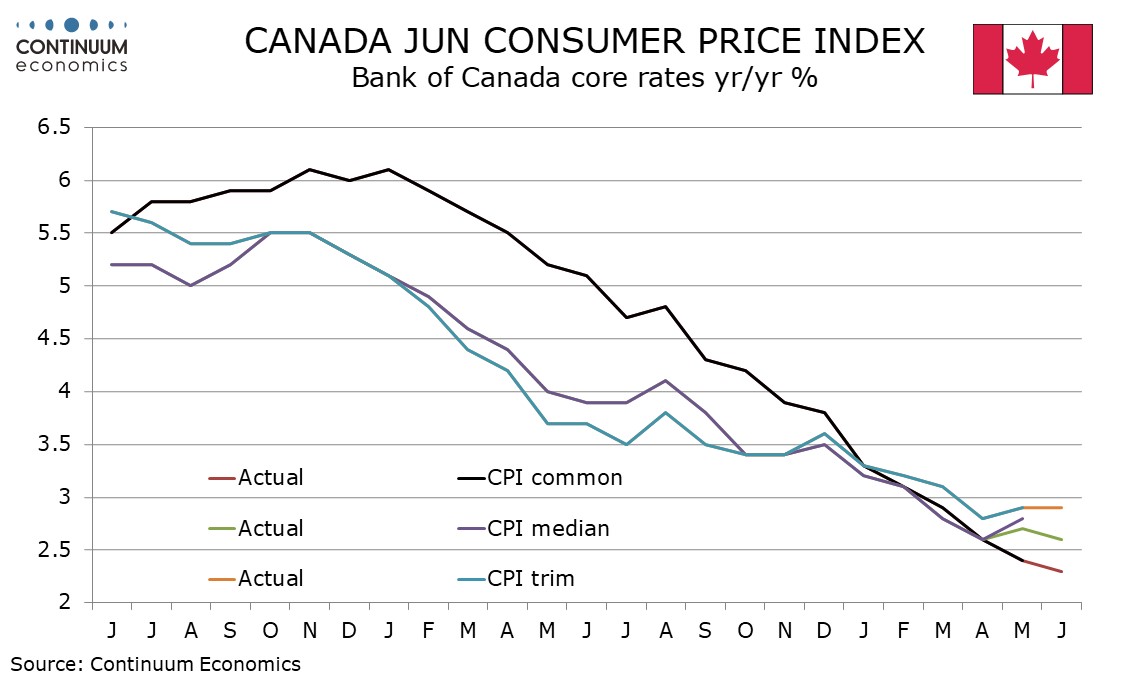

The BoC’s core measures saw dips in CPI-common to 2.3% from 2.4% and CPI-median to 2.6% from 2.7%, the firmer extending a May dip and the latter reversing May increase. However CPI-trim was unchanged at 2.9%, sustaining a rise from 2.8% in April.

The average of the three core rates of 2.6% is only marginally softer than the 2.67% seen in April and May and the core rate which has made the most progress (CPI-common) is the one of the three that the BoC gives least attention to. After significant progress in Q1, progress on inflation slowed in Q2.

On the month CPI was unchanged before seasonal adjustments with a 0.1% increase ex food and energy. Seasonally adjusted CPI rose by 0.1% overall and 0.2% ex food and energy, the latter following a 0.3% May increase that was revised from 0.4%. After a 0.2% rise in April Q2’s gains are moderate, but stronger than in Q1 where the seasonally adjusted ex food and energy rate saw gains of 0.1% in January and February before a 0.2% rise in March.