China: 2026 Modest Rather Aggressive Policy Support

• On January 15, PBOC cut the 1yr structural lending rate from 1.5% to 1.25% in a targeted move to benefit some borrowers from banks. Monetary policy will likely remain targeted rather than broad and we see only one 10bps cut in the 7 day reverse repo rate in 2026, as policymakers are concerned that more broad rate cuts could hurt bank margins and lending!

• Meanwhile, the very end of 2025 saw initial Yuan357bln of fiscal easing announced for 2026 for strategic and security projects plus households trade in programs. This will be followed in March by the main fiscal measures, but we see overall fiscal stimulus for 2026 being similar to the Yuan2.5trn in 2025. Though the 15th five year plans has raised hopes of more aggressive stimulus, recent announcements leave that impression that the authorities actions will remain modest. Concerns that debt/GDP levels are already very high are restraining fiscal policy action.

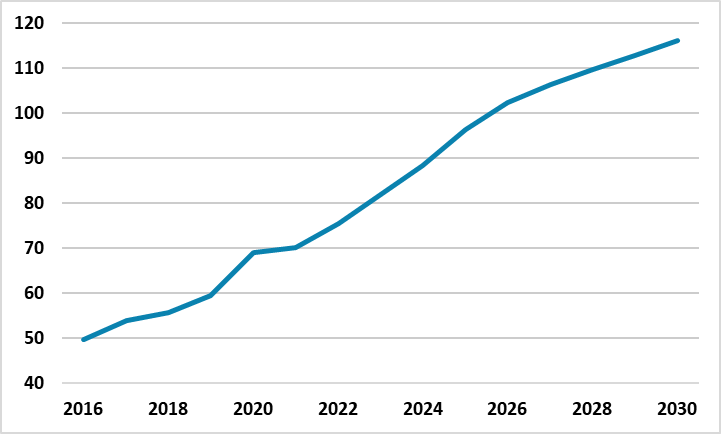

Figure 1: China General Government Debt/GDP (%) Source: IMF Oct 25 Fiscal Monitor

Source: IMF Oct 25 Fiscal Monitor

Today PBOC move follows China’s announced Yuan357.5bln of 2026 fiscal measures over the holiday period, which suggests that policy support will remain modest and similar to 2025. Key points include.

• On monetary policy the December CEWC statement noted that official policy rate and RRR cuts will be used flexibly and efficiently. On January 15, PBOC cut the 1yr structural lending rate from 1.5% to 1.25% in a targeted move to benefit some sector borrowers from banks. To further support credit, the PBOC will provide an additional 500 billion yuan for lending toward small businesses and the agricultural sector by merging and expanding existing facilities. Monetary policy will likely remain targeted rather than broad and we see only one 10bps cut in the 7 day reverse repo rate in 2026, as policymakers are concerned that more broad rate cuts could hurt bank margins and lending!

• Yuan62.5bln for consumer trade in programs. The December 30 announcement of Yuan62.5bln initially for trade in programs shows that hopes of major consumer stimulus are unlikely to be fulfilled. Though cars traded in for EV’s can now attract a 12% subsidy, the range of household appliances supported by trade in programs has been restricted from 12 to 6. Extra money for subsidies will likely be announced in March, but is unlikely to exceed the Yuan300bln in 2025 and could end up being less! Some fiscal transfers to households could also be announced, but these are likely to be modest and full short of optimism raised by end 2025 official emphasis on households! Meanwhile, though structural safety nets (health, unemployment and pension) will likely be improved further, it remains unlikely that radical improvement will be seen that would free up excess precautionary savings to be spent by China households. 2026 consumption will likely be modest, with consumer confidence and income expectations remaining depressed and wealth adversely hit by the housing slump. For more see our China Outlook (here).

• Yuan295bln investment. Dec 31 also saw an announcement of Yuan295bln for 1000 projects for national strategic and security. This will be supplemented in March with the main infrastructure stimulus from China authorities. However, the 2026 fiscal stimulus will likely be similar to the 2025 Yuan2.5trn, which supported the economy but did not really boost growth to the 2025 5% target – a net export windfall and high tech manufacturing/ investment were the key drivers.

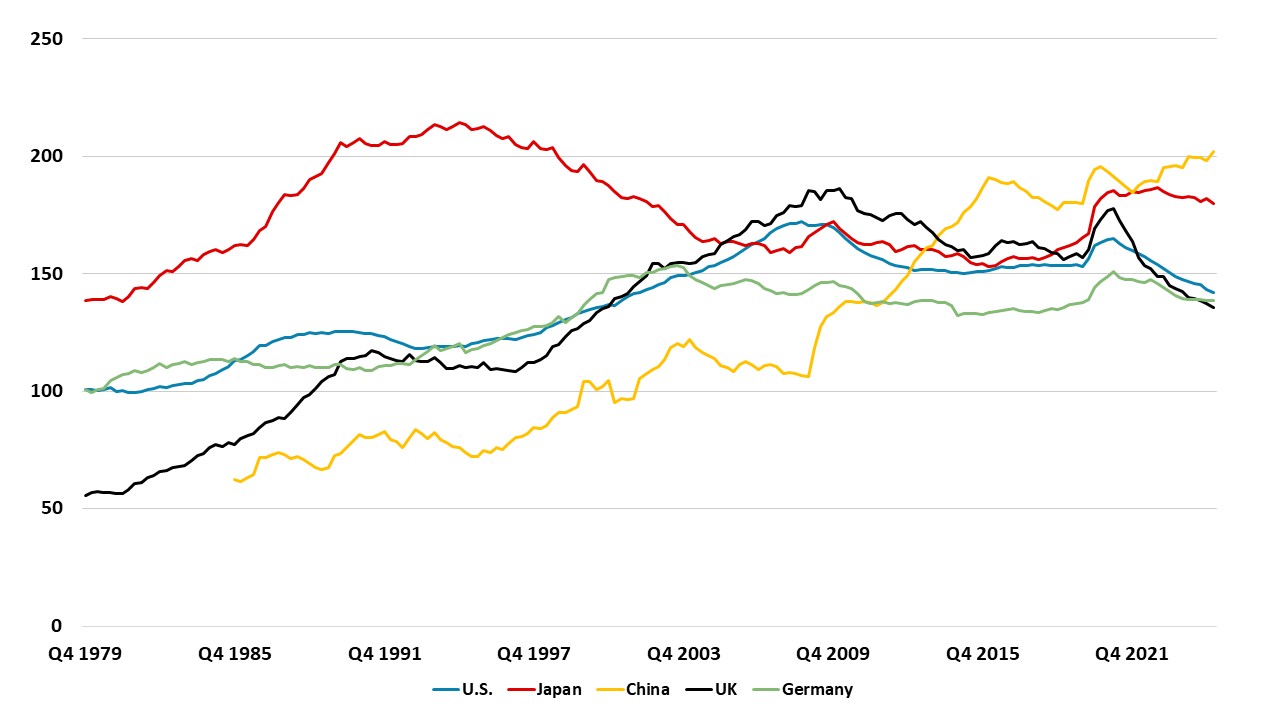

• Modest fiscal space and high debt. China’s authorities remain concerned that fiscal space is modest rather than large. Actions over the last few years suggests that the authorities actions are restrained by the IMF trajectory for general government debt/GDP (Figure 1) rather than the lower narrower central government debt trajectory. The general government deficit/GDP is projected to remain excessive at 8% of GDP 2026-30 and with nominal GDP of 4-5%, this means a surge on government debt/GDP. The IMF measures include 2/3 of LGFV debt and some other extra government expenditure. Additionally, China’s authorities remain concerned about the rising trajectory of household and company debt/GDP (Figure 2), which has surpassed major DM economies. The major official concern is that excessive debt causes Japan style balance sheet recession, with the economy insensitive to ultra-easy monetary policy. If government debt continues to rise sharply, then overall debt levels could threaten a Japan switch to debt paydowns across the economy. It could be argued that certain households and businesses are already in balance sheet recession, which accounts for the sluggish lending by banks to the private sector and households seeing more repayments than new loans.

Figure 2: Total Household/Corporate Debt (% of GDP)

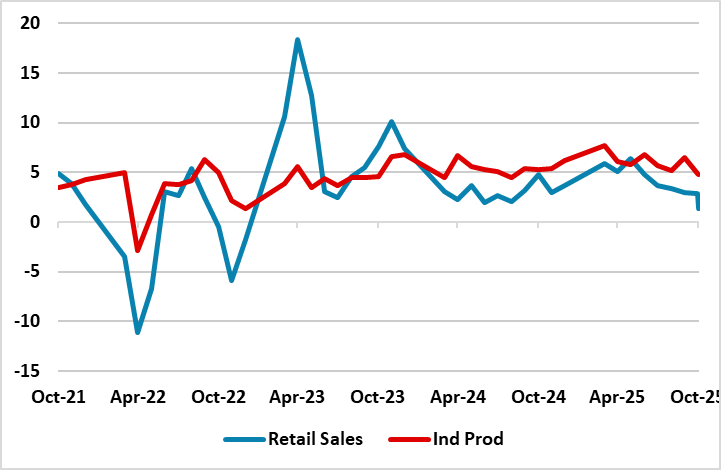

• GDP Growth Quality Over Quantity. The statement from the December central economic work conference (CEWC) suggest that more stimulation will be announced to boost growth in March 2026 and was consistent with the 15th five year plan ambitions to boost the economy. This has prompted more hopes that China’s authorities would be more aggressive in boosting the economy in 2026 than 2025. However, over the Christmas period, President Xi noted that the economy should not be judged on GDP numbers alone, which places the emphasis on quality of growth still. This is the 2025 policy of favouring high tech and AI investment and production over rebooting the residential property sector. This means an excess of production over domestic demand (Figure 3) and disinflation pressures. Overall, we see around Yuan2.5trn on extra government fiscal stimulus. This will likely fall well short of the more aggressive suggestions from the IMF from the December article IV. We thus forecast 4.4% 2026 GDP growth.

• Expectations are that the authorities will likely still set a 5% real GDP target for 2026 in the March announcement. It could well be that the reported GDP numbers are higher than the actual reality. Though China’s authorities are placing more emphasis on quality growth, the illusion of 5% growth is useful for social and political cohesion. China could still stick with a 5% growth target in 2026.

Figure 3: Industrial production and Retail Sales (Yr/Yr %) Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics