UK Labor Market: Further Signs of Clearly Softer Wage Pressure

As we have underscored repeatedly, the BoE has come to regard the official average earnings data with some suspicion; after all, they have implied wage growth being well above other official and survey sources. But even though they were higher than consensus thinking, the latest data are showing signs of a material slowing in such pay growth probably reflecting clear signs of a looser labor market, most notably evident in a further and significant drop in vacancies in the latest data. As such they now chime more with HMRC (the UK tax authority) sources data, which have for some been showing much weaker relative growth in mean and median pay growth. Indeed, the ONS data are being kept high relatively by base effects, but where adjusted data for more recent swings are much lower (Figure 1) with actually the level of pay having not risen in the last 3-6 months. Indeed, the latter leaves the ONS data on track to undershoot BoE thinking for private sector regular earnings for the current quarter. Otherwise, while the data still seemingly imply apparent resilience in terms of jobs growth, there is still a clear slowing (Figure 2) and which masks a stalling in terms of private sector employment. Regardless, concerns about the validity of the data are still marked!

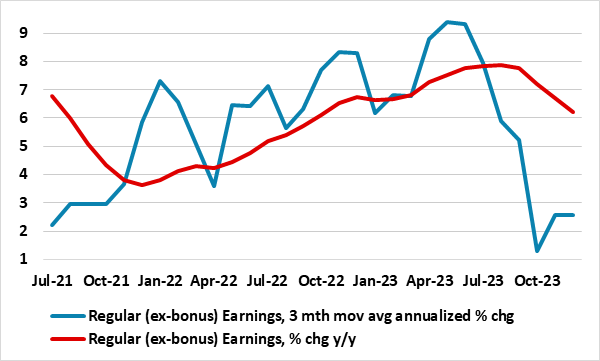

Figure 1: Stark Contrast - Adjusted m/m Earnings vs y/y Data

Source: ONS, HMRC

Data Still Suspect

UK labor market data have been updated with new benchmarks (ie reweighed to reflect new information on the UK population). But there are still doubts about that accuracy given low response rates in the manner in which the data is compiled. The ONS aim to have transformed labour force survey (TLFS) — that would resolve such problems— but these will not be available until at least September. And the Office for Statistics Regulation (OSR), an arm of the UK Statistics Authority, remains wary whether interim data (despite recent changes) can be anything but being useful as they do not fully meet standards on quality

Mixed Details

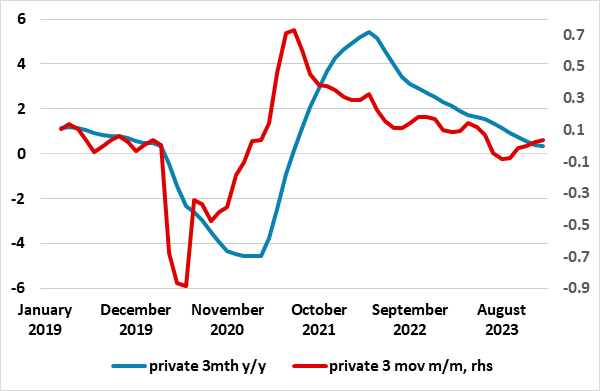

Payrolled employees in the UK rose by 31,000 (0.1% m/m) in December 2023 and rose by 401,000 y/y. While the number of payrolled employees continues to increase, the rate of annual growth is decreasing. Moreover, the January 2024 estimate should be treated as a provisional estimate and is likely to be revised when more data are received next month, albeit is largely chiming with LFS employment numbers. More notably, the payroll data suggest that private sector jobs growth has stalled (Figure 2).

Otherwise, the UK unemployment rate (3.8%) for those aged 16 years and over decreased in the latest quarter, returning to the rate a year ago. In contrast, the UK claimant count for January 2024 increased by 14,100 on the month and by 61,200 on the year to 1.579 million, all highlighting the confusing picture about the possible tightness in the labor market. Indeed, the UK economic inactivity rate (21.9%) for those aged 16 to 64 years was largely unchanged in the latest quarter but is above estimates a year ago (October to December 2022), driven by long-term sick at historically high levels. In November 2023 to January 2024, the estimated number of vacancies in the UK fell by 26,000 on the quarter to 932,000. Vacancies fell on the quarter for the 19th consecutive period but are still above pre-coronavirus (COVID19) pandemic levels. The current sequence of quarterly falls in our vacancy estimates is the longest ever recorded, but has slowed in the latest period, with the smallest fall in the number of vacancies since May to July.

Figure 2: Resilient Labor Market Masks Stalling in Private Sector Jobs

Source: ONS, HMRC, all seasonally adjusted

Pay Levels Moving Sideways?

Perhaps most notably, and as we highlight again, officially computed seasonally adjusted m/m presented ONS earnings offer a very much more benign cost picture than y/y number. The headline ONS data are being kept high relatively by base effects, but where the adjusted data for more recent swings are much lower (Figure 1) actually showing that the level of pay having not risen in the last 3-6 months. Indeed, the latter leaves the ONS data on track to undershoot BoE thinking for private sector regular earnings for the current quarter (at 5.7%). Surely, this is likely to temper what is clearly at the core of the BoE’s worries about inflation persistence.