UK GDP Review: Mixed Messages with Little to Sway the BoE

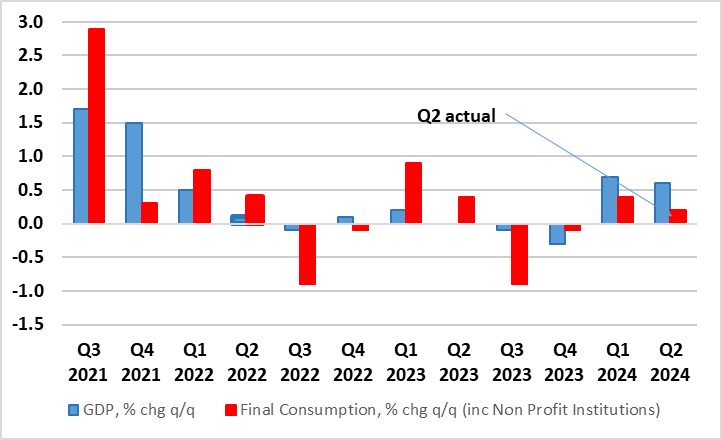

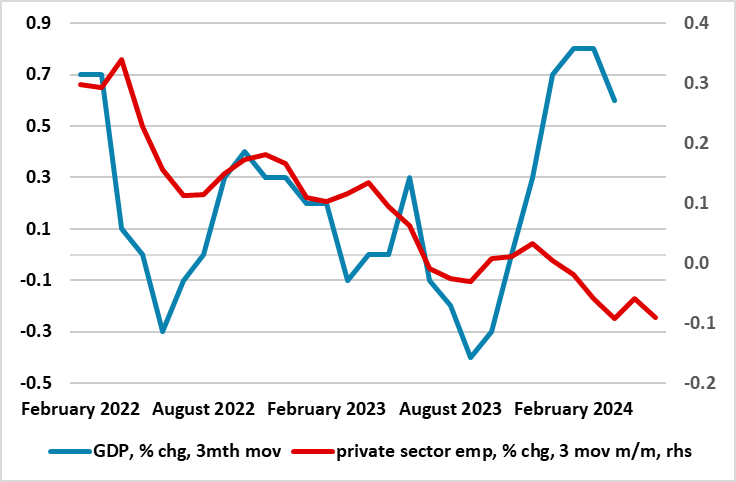

After the mild recession in H2 last year, the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive but in only one of the three months of the last quarter. Indeed, amid weaker retail sales, property transactions and car production data, GDP failed to grow in June. But this still left Q2 GDP numbers (released alongside the monthly data) showing a 0.6% q/q rise after the 0.7% gain in Q1 (albeit half that in per capita terms). That Q1 ‘strength’ was partly due to a further fall in imports, but that was not be the case in the Q2 breakdown, albeit with consumer spending softening (Figure 1, with growth instead boosted by an import-fuelled jump in stock-building. Regardless, the June lack of growth will create a soft base effect for Q3 growth which we see advancing just 0.1%, a quarter of the BoE estimate. This weaker immediate outlook is something that chimes more with labor market data (Figure 2) and where HMRC payrolls offer a much softer backdrop and possible outlook.

Figure 1: Clearer Recovery But Weaker Consumer?

Source: ONS

Regardless, the data is too historic to have any major impact on BoE thinking, although policy hawks may take note that the private consumption deflator actually fell below the 2% BoE CPI target. Even so, coming in a notch lower than the BoE expected, GDP is estimated to have grown by 0.6% q/q in the three months to June 2024 compared with the three months to March 2024. Services output was the main contributor with growth of 0.8%, partially offset by production and construction output, both falling by 0.1% in the same period. Monthly real gross domestic product (GDP) is estimated to have shown no growth in June 2024, following unrevised growth of 0.4% in May 2024 and a flat April reading.

As for Q2, on the supply side, as suggested above, the economy was boosted mainly by services with manufacturing contracting (in spite of a clear June bounce), this divergence being something very much evident across W Europe. Consumer spending growth halved to 0,2% while business investment slipped slightly, with domestic demand instead boost by government spending – hardly likely to persist. Unlike the Q1 GDP jump, imports actually detracted from GDP, but this import build spilled over into an inventory rise which having added 2 ppt in Q2 alone, also may not persist. Even so, the Q2 jump actually saw little growth in the quarter, instead boosted by base effects from Q1

Regardless, these national account data have prompted BoE thinking to be much more positive for the last quarter and make it now suggest growth of around 1.25% for the whole year, more than double the previous estimate, albeit we think a little too optimistic. Our reticence reflects that this apparent resilience, if not strength, in the GDP data contrasts increasingly with employment weakness and is partly a result of public sector gains. But the strength in GDP is chiming with PMI survey data and this resonates with the BoE, even though those PMI data (covering the private sector) also conflict with what (possibly more) authoritative private sector payroll suggest.

Figure 2: GDP 'Strength' Conflicts with Payroll Weakness

Source: ONS, CE, HMRC