USD, JPY, CHF, NOK flows: Mild risk recovery on ISM

A better than expected ISM services index has helped to stabilise equities and risk sentiment in general, but FX markets still show extreme valuations

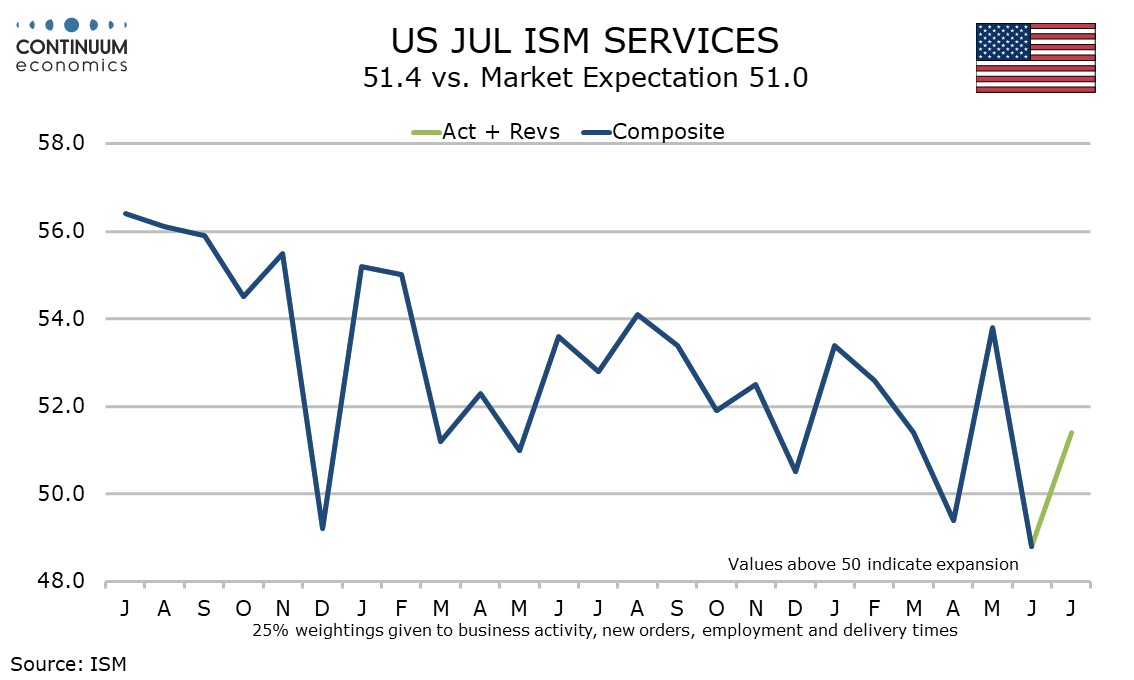

The much stronger than expected non-manufacturing ISM data has triggered a general risk recovery, with S&P futures back up to European opening levels, and the JPY and CHF both falling back from their highs, while the riskier currencies are staging a recovery, with the EUR and CAD the best performers. Certainly, the strength in the ISM data is a reminder that most of the US data hasn’t been notably weak, and the weaker than expected employment report last week was not weak enough to suggest we are on the brink of recession. The risk sell off we have had may therefore have been excessive, so that some recovery is justified.

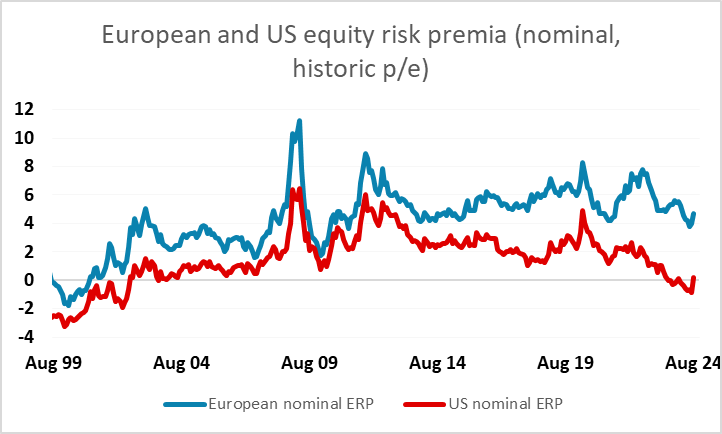

However, the reaction looks to have been due to extreme valuation more than extreme data. Mildly weaker data has consequently triggered a sharp move, and while we may see some correction if we see stronger data, current equity market levels look more sensible than the levels we saw at the highs a few weeks ago. The US market remains extremely highly valued, both in terms of current p/e levels and relative to current yields, and it is hard to justify a substantial recovery given the current degree of uncertainty on the economy and politics, both domestically and globally.

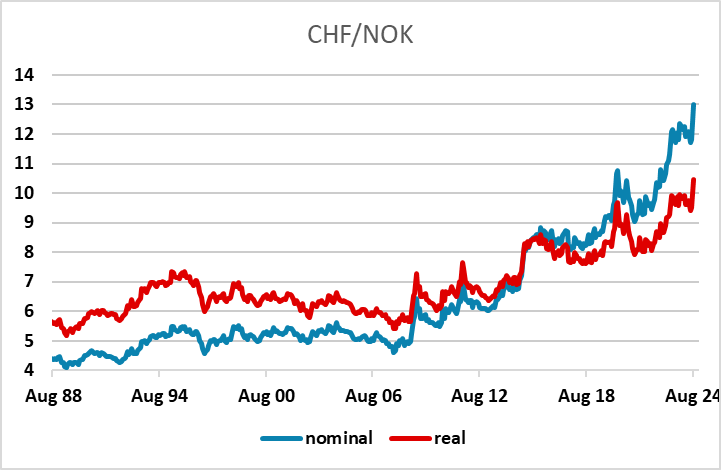

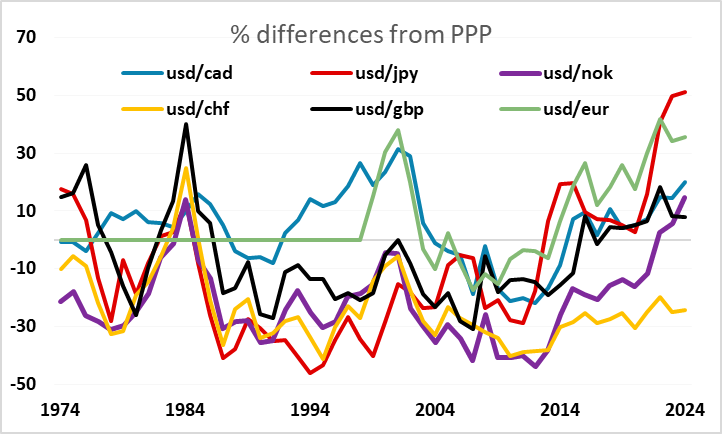

In the FX market, the valuations are even more extreme, with the JPY still extraordinarily weak, even after the 20 figure decline in USD/JPY from the highs in the last month. There are also a lot of other extreme valuations. The CHF remains exceptionally strong, while the NOK has fallen to new all time lows against the EUR, GBP and CHF (excluding the pandemic spike), a decline that looks hard to justify on fundamentals. This may lead to more significant FX volatility in the coming weeks and months, even if equity markets stabilise.