FX Weekly Strategy: August 25th-29th

Powell comments put the USD on the back foot

JPY still has the most potential for long term gains…

…but gains on the crosses are unlikely until risk premia rise

USD/CAD now looks likely to meet selling above 1.39.

Strategy for the week ahead

In a relatively quiet week for data the market may focus on the aftermath of Powell’s Jackson Hole speech. Powell effectively gave a green light to a September rate cut in saying that “a policy adjustment may be warranted, with rates still restrictive”. This led the market to shift the probability of a September cut to 90% from 70% before the speech, and triggered a general USD decline. His comments about the labor market also suggested that the Fed could potentially have to act quickly at some point in the near future to respond to weakness. He said “while the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly”.

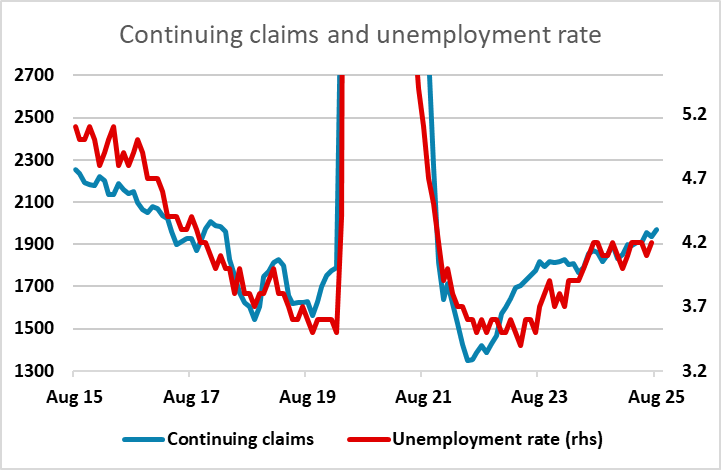

The speech makes it hard to see the market taking a more hawkish view anytime soon. While the latest PMI data were strong, and suggested we may see good growth in Q3, Powell’s comments suggests an underlying fragility. The jobless claims data, particularly the continuing claims data, are suggesting some risks of rising unemployment, and given slowing labor supply growth this suggests significant slowdown in employment. All in all, it is a picture that supports the market pricing of aggressive Fed easing of 125bps by the end of 2026.

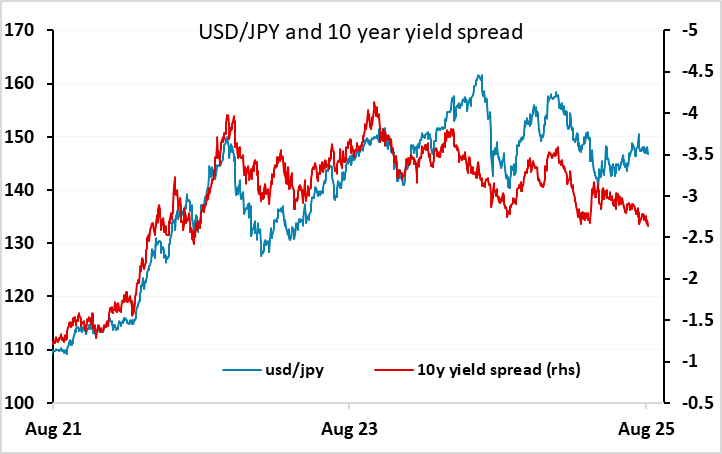

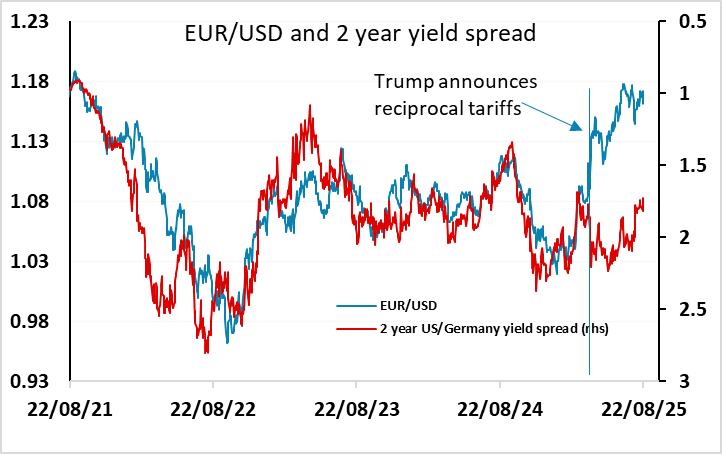

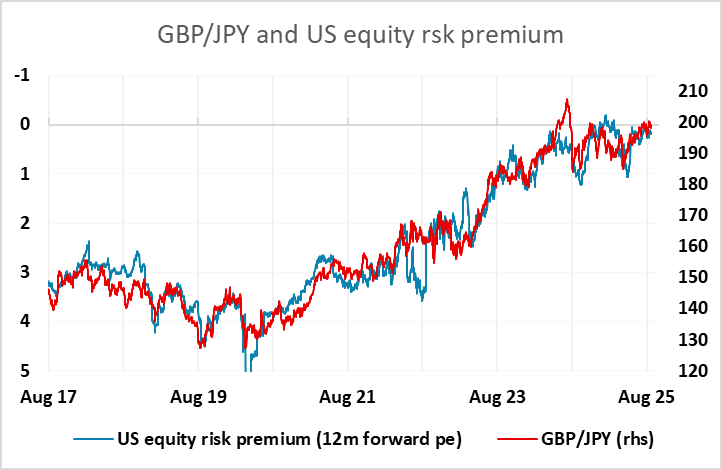

From an FX perspective, the USD correlation with yield spreads has generally weakened this year ever since the announcement of reciprocal tariffs back in April. The EUR has outperformed its previous relationship with spreads against the USD, while the JPY has underperformed this relationship. The correlation that has continued to hold and provides a guide to the FX market has been the correlation of JPY crosses with equity risk premia. This suggests that JPY weakness is due to the strength of the equity market, or more specifically the low level of equity risk premia. Powell’s speech increases the uncertainty as to whether such low levels can be sustained. Historically, low levels have correlated with a strong economy and low unemployment, so any increase in unemployment would likely lead to higher risk premia and a higher JPY. However, the equity market continues to look very resilient in the short term, and until we see some negative news it seems likely that the JPY will continue to struggle on the crosses. But after Powell’s comments it is hard to see anything other than USD weakness against the JPY going forward, and as long as equity markets remain resilient, this is also likely to mean USD weakness across the board.

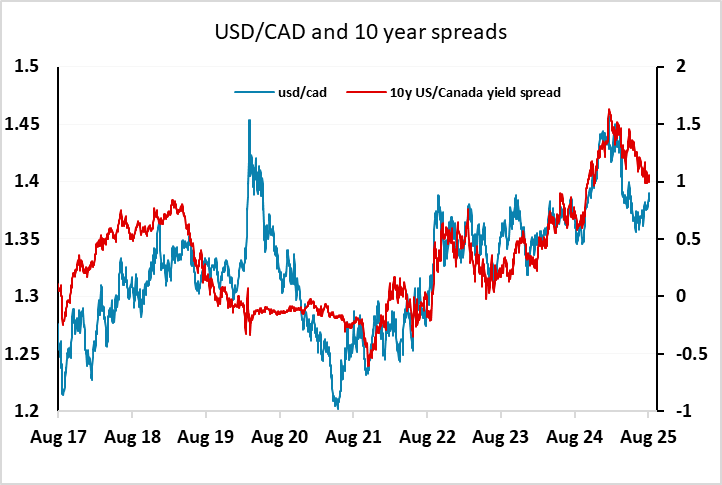

Canadian GDP is one of the only significant releases this week, but we see little upside for USD/CAD after the Powell speech. While the Canadian economy is weak, there is little prospect of further significant rate cuts, and 1.40 looks like an effective ceiling for USD/CAD, Any push up above 1.39 is likely to meet selling.

Data and events for the week ahead

USA

On Monday, we expect July new home sales to fall by 1.9% to 615k. On Tuesday we expect July durable goods orders to fall by 4.5% but with a marginal 0.1% increase ex transport. June house price data from FHFA and S and P case Shiller are also due, with August consumer confidence following. August Michigan CSI data has already been reported as weaker. Fed’s Barkin will speak on Tuesday.

After a quiet Wednesday, weekly initial claims are due on Thursday, when we expect Q2 GDP to be revised up to 3.2% from 3.0%. July pending home sales follow, and Fed’s Waller is due to speak.

On Friday we expect July PCE prices to match the CPI with a 0.2% rise overall and a 0,3% rise in the core rate. We expect gains of 0.5% in both personal income and spending. We expect July’s advance goods trade deficit to rise to $99.8bn from $84.9bn a recovery in imports. Final August Michigan CSI data follows.

Canada

Canada’s key release will be Q2 GDP on Friday, where we expect a 1.0% annualized decline due to a plunge in exports despite looking for a 0.1% increase in June. Q2’s current account is due on Thursday.

UK

The holiday-shortened week has little of interest data wise save for CBI trades survey data) where calendar distortions may again be the order of the day. Before then, BoE Governor Bailey speaks on a panel at the Jackson Hole conference (Sat) and may discuss the symposium’s subject matter this year, namely labor markets.

Eurozone

As a precursor to the following week’s EZ HICP, French Spanish and German CPI/HICP numbers for August arrive on Friday. After, the lower-than-expected July HICP numbers with a 0.2 ppt drop to 1.8% y/y, a 10-mth low, further adverse energy base effects will likely to feature even more strongly in the German numbers, enough to take the headline back toward, if not actually to, 2.0% - food prices pose upside risks. EZ Money and credit data (Thu) have been volatile of late but with a better trend most recently.

But there is more survey data; Monday sees what may be mixed German IFO update and then comes European Commission consumer and business numbers (Thu), notable as they have been offering a more downbeat picture than the PMIs. Otherwise, both from the ECB, is its consumer expectations survey due Friday.

Rest of Western Europe

There are key events in Sweden, with Tuesday’s Minutes to the recent Riksbank Board meeting. A Key update arrives (Thu) with the Economic Tendency Survey while preliminary Q2 GDP data should largely corroborate the weak message from monthly data. Similarly, in Switzerland, preliminary Q2 GDP data should largely corroborate the weak message from flash data. Finally, in Norway, the labor market numbers may be scrutinized more than usual given signs of a jobless rate rise emerging

Japan

Tokyo CPI for August will be released on early Friday. It is expected headline figure will continue to moderate but underlying inflation, shown by ex fresh food and energy will be staying above 3%. However, without clarification on the U.S.-Japan trade front, it is unlikely we will be hearing strong commitment from the BoJ. On the same day, we also have retail trade and unemployment rate but unlikely to affect JPY much. Else, we have tier two data throughout the week.

Australia

The RBA meeting minutes will be released on Tuesday but unlikely to provide more cues as the RBA points towards data dependency. The monthly CPI on Wednesday will be more important and could potentially see another figure below 2%. If the pace to south accelerates, we could hear more from the RBA.

NZ

Retail sales on Monday and business activity & outlook on Thursday are both tier two data.

Highlights from the last week