FX Daily Strategy: N America, August 21st

EUR slightly firmer after better PMI

USD could be vulnerable to gains in continuing claims

USD may also weaken as US PMIs likely to fall

USD/JPY remains the main candidate for a big move

EUR slightly firmer after better PMI

USD could be vulnerable to gains in continuing claims

USD may also weaken as US PMIs likely to fall

USD/JPY remains the main candidate for a big move

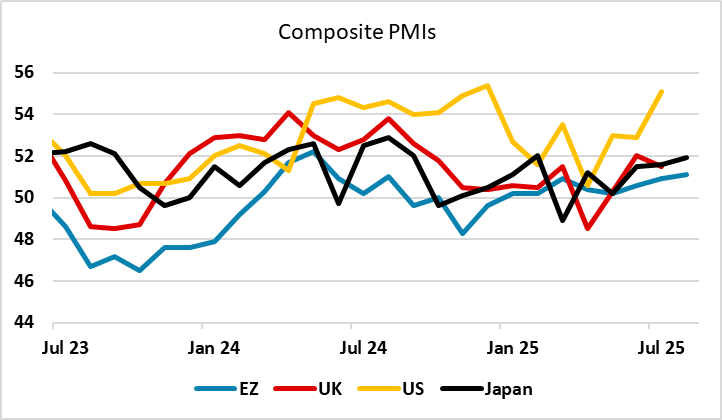

Eurozone PMIs coming in on the strong side of consensus, with little or no mention in the text of any impact from tariffs or of the EU/US trade deal. This may still be to come, but for now the data suggest weak but steady growth. The EUR has firmed up modestly in response to the data, and could yet benefit further if, as we expect, the US data weakens more than expected this afternoon. But from a big picture perspective the numbers don’t significantly change the underlying picture, and a 1.1590-1.1730 range in EUR/USD continues to look hard to break unless Powell’s speech at Jackson Hole challenges current market thinking on Fed policy.

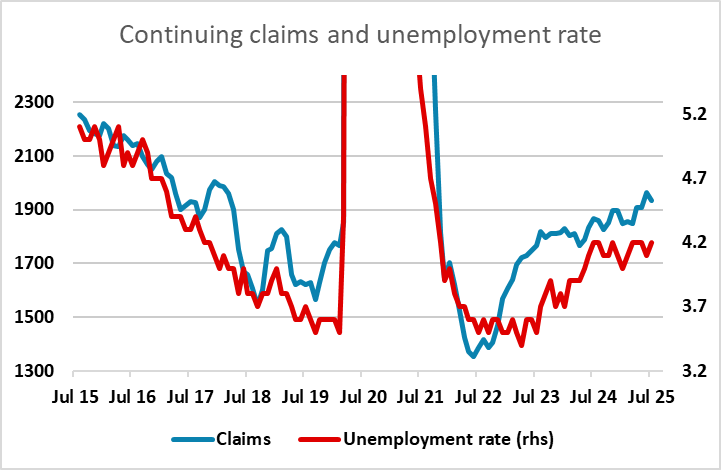

The jobless claims numbers will attract more attention than usual because they relate to the employment report survey week. The initial claims data hasn’t shown any persistent significant increase thus far, while continuing claims have risen steadily for the last few years. The continuing claims data does suggests upside risks to the unemployment rate, with the lack of increase in initial claims potentially reflecting low hiring rather than increasing layoffs. The fact that the unemployment rate has been steady for the last year even though employment growth has been slowing has been one factor limiting the pressure for the Fed to ease. But a further rise in continuing claims might be a signal that this is about to change, so the USD could be sensitive to any continuing claims strength, even if initial claims remain subdued.

There will also be interest in the US PMIs given the surprising strength in July. We expect August S and P PMIs to show slippage in manufacturing to 49.5 from 49.8, and services to 53.0 from July’s surprisingly strong 55.7. The market is looking for a slightly smaller decline, so there may be some USD disappointment in the data.

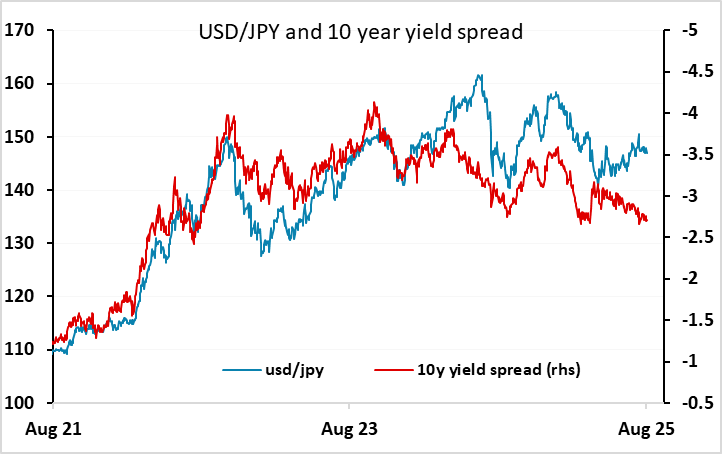

On Wednesday the USD fell back in part because of the Trump call for Fed governor Lisa Cook to resign due to accusations of mortgage fraud. While Cook is a moderate, and has recently expressed concern about the weakening employment picture so would seem likely to vote on the dovish side in September, any Trump interference in the Fed is seen as USD negative. Moves were fairly modest, but with equities also slipping lower, the USD showed weakness against the safer havens, with USD/JPY seeing the biggest move. USD/JPY remains the main candidate for a large move among the majors, as yield spreads suggests it is too high, valuation remains extreme, and any equity market weakness will help the JPY both against the USD and on the crosses.