FX Daily Strategy: APAC, August 22nd

EUR slightly firmer after better PMI

USD could be vulnerable to gains in continuing claims

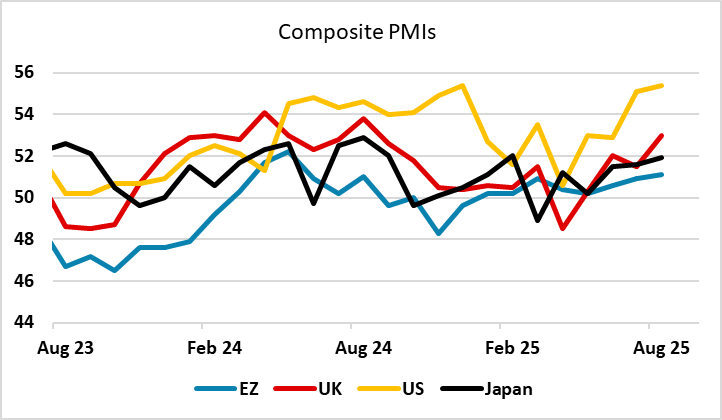

USD may also weaken as US PMIs likely to fall

USD/JPY remains the main candidate for a big move

Powell the market focus on Friday

Risks to the USD upside given strong data

Market pricing of aggressive Fed easing also suggests little USD downside risk

Friday was supposed to see the release of UK retail sales for July, but this has been delayed so ll we are left with is Canadian retail sales which rarely has an impact, partly because it is for June. While there is guidance on the likely July outcome, the data is insufficiently current to trigger market action.

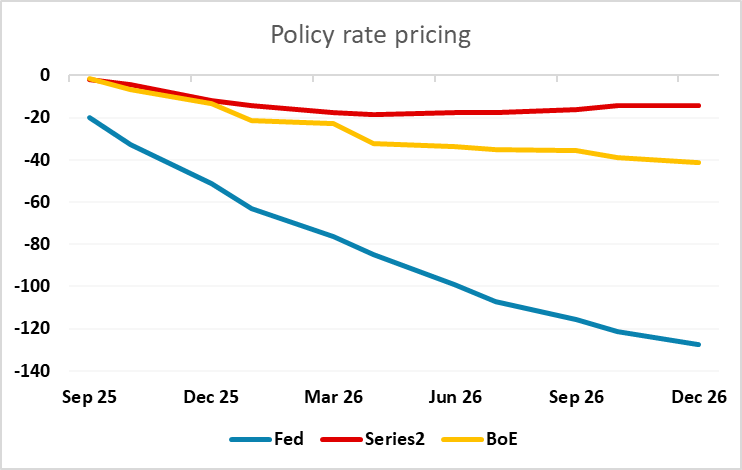

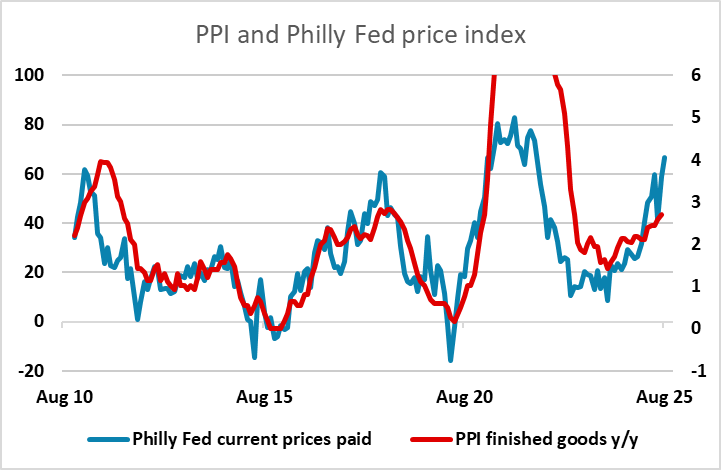

The market will therefore likely focus on the Jackson Hole speech from Powell set for 15:00 BST. As it stands the market is 80% priced for a 25bp Fed cut in September, and there are five 25bp cuts priced by the end of 2026. The latest data doesn’t suggests that Powell is going to encourage a more dovish view than this. Thursday’s PMI data was strong, and the price data from the Philly Fed survey also suggested upward pressure on prices. The latest PPI data also showed a spike, and although this was probably not tariff related as it was concentrated in services, there may be tariff related price rises to come.

So even though Powell may well indicate that a September cut is likely (given market pricing if he doesn’t oppose the idea the market will assume he is OK with it) it looks hard for him to guide towards the 125bp easing by the end of 2026 that the market is pricing in. While it is of course possible, the risks have to be towards less easing being priced in, as there is simply too much uncertainty about the economic picture for him to suggest such a substantial easing is clearly indicated over the next year and a half. Things would change significantly if there was clear-cut evidence of weakening in the US labor market, but despite a few months of weaker employment growth, this is not clear at this point. We would therefore see risks to the USD upside, both because the market is pricing in a lot of easing and because the latest data has been on the strong side.