EUR, JPY flows: EUR fiirmer, JPY struggles

Better German orders and stronger global equities help EUR. JPY upside limited by still weak wage and spending data

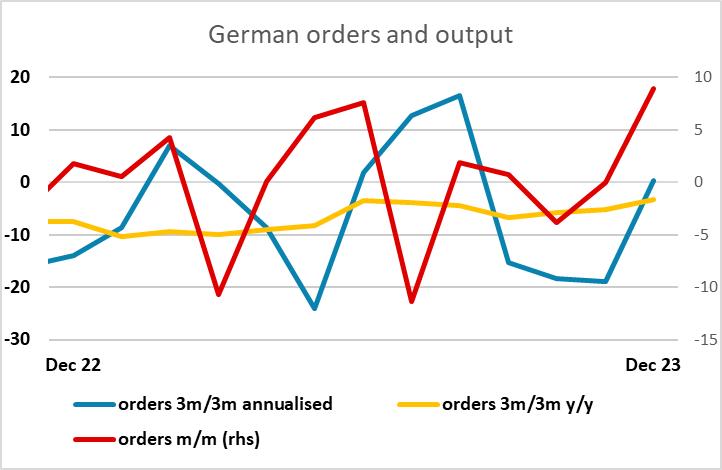

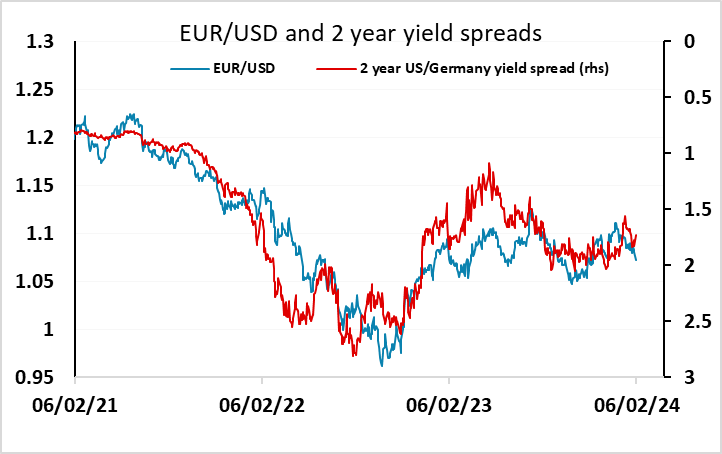

The EUR has benefited from the better risk tone overnight, and has seen an initial positive reaction to the stronger than expected German manufacturing orders data this morning. The 8.9% m/m rise in December is big surprise, but the series is very volatile. Nevertheless, it suggests that the underlying trend, which had seemed to be deteriorating, is no worse than flat. The rise in EUR yields in the last few days on the back of the rise in USD yields looked inconsistent with the EUR data, but these numbers will help sustain the rise and for now the EUR should have bottomed out, with some prospect of a recovery to 1.08. Given the better regional equity performance, it is no surprise that the JPY has softened on the crosses, with USD/JPY not much changed.

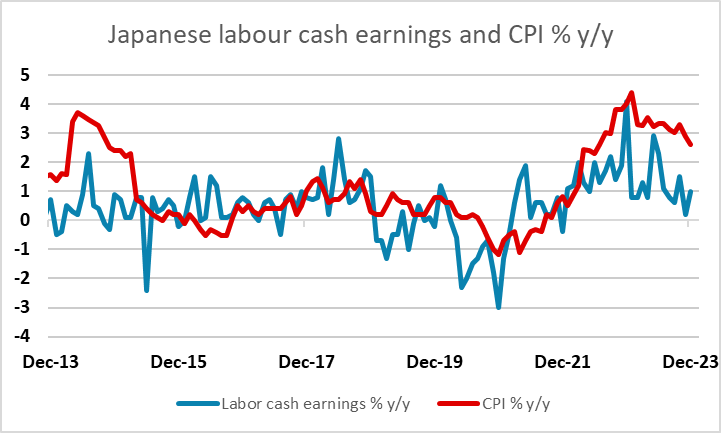

The December Japanese labor cash earnings data released overnight, along with the household spending numbers, were both stronger than November and weaker than consensus. So there was little in the data to encourage those looking for a spring BoJ tightening, although this is still on the cards if the spring wage round produces significant wage increases as PM Kishida has urged companies to enact.

The JPY continues to look weak relative to yield spreads, but the better equity market tone is likely to keep it under pressure on the crosses for today.