USD flows: USD weaker on soft PPI

Softer than expected PPI suggests USD downside risks, especially against the riskier currencies

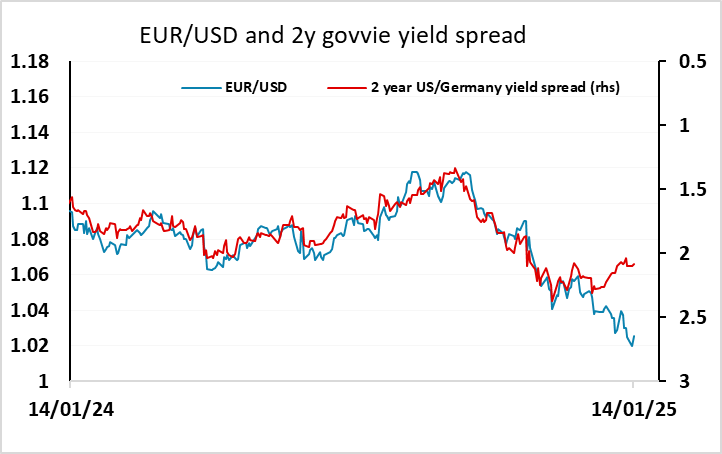

US PPI has come in weaker than expected, with core flat on the month and headline up 0.2%, both well below market consensus. PPI isn’t the biggest market moving release, but this will tend to put the USD on the back foot ahead of the CPI data tomorrow. Our underlying view is that it will be hard for the market to reduce Fed easing expectations much further without some much more hawkish Fed commentary or clear evidence of rising inflationary pressures, and today’s data suggests that won’t be forthcoming near term. Despite already moving to price in only one rate cut this year, 2 year yield spreads have moved against the USD against the EUR in the last few weeks, so from here we favour further gains in EUR/USD towards 1.03. The yield spread picture is less clear with USD/JPY, but AUD/USD should be a strong performer if US inflation data is soft, supported both by yield spread and equity market impact.