Imports Surge, Growth Slows: Indonesia’s Q3 GDP Falls Short of 5% Mark

Bottom line: Indonesia’s Q3 GDP growth slipped to 4.95% yr/yr in Q3, missing the 5% target as soaring imports weighed on the headline figure. Private consumption remained steady, while fixed investment showed resilience with notable gains. Looking ahead, Q4 may bring further softening.

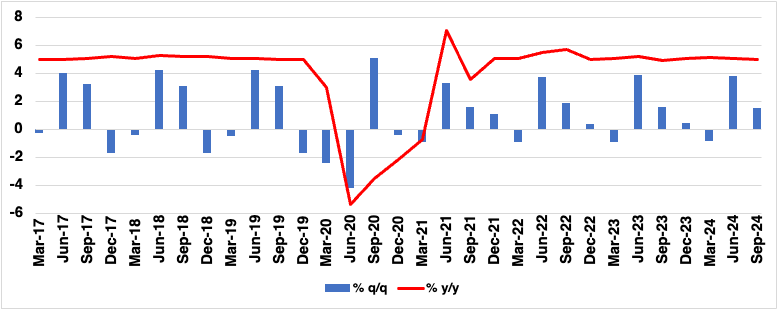

Figure 1: Indonesia Real GDP Growth (%)

Indonesia’s GDP growth edged lower in Q3 2024, slowing to 4.95% yr/yr from 5.05% in the previous quarter, according to the Statistics Indonesia (BPS). The result underscores a mild disappointment for the government, which has aimed to sustain growth at or above the 5% threshold, a target that now appears more elusive.

The slight deceleration highlights Indonesia’s economy reaching its long-term potential growth rate, but challenges remain. On a quarterly basis, GDP expanded by 1.5%, down from 3.79% in Q2, closely mirroring the 1.6% quarterly growth in Q3 of the previous year.

Household consumption, the largest contributor to GDP, maintained steady momentum, reinforcing its role as the economy's backbone. Government spending also added to growth, albeit at a reduced pace compared to Q1’s pre-election surge. Private consumption remained steady at 4.9% yr/yr, yet decelerated slightly in quarter-on-quarter terms. Government spending, meanwhile, bounced back to 4.6% yr/yr from a modest 1.4% in Q2, largely due to base effects. Investment picked up with accelerated expenditure on machinery and building assets, signalling continued business confidence. Fixed investment grew at 5.1% yr/yr from 4.4% in Q2. However, net imports weighed on overall GDP as imports jumped back into double-digit growth, resulting in a negative contribution of -0.1 percentage points.

On the supply side, manufacturing led the way, contributing around 1 percentage point to growth, followed by construction and retail trade. Notably, agriculture and financial services saw slower growth, which contributed to the overall slowdown.

Outlook and Potential Risks

Despite a subdued Q3, Indonesia’s economy remains on track to hit close to 5% annual growth in 2024, assuming Q4’s performance does not falter significantly. However, preliminary signals from the manufacturing sector suggest potential softness in Q4. For now, robust private consumption remains a vital stabiliser, helping cushion the economy against broader slowdowns. As Indonesia’s leaders eye strong 2024 growth, maintaining the 5% growth mark may depend on bolstered fiscal measures and sustained consumer confidence amid global uncertainties.