JPY, AUD flows: AUD softer o/n, JPY has upside scope

AUD softens as regional equities slip, JPY unaffected by Tokyo CPI but yield sreads suggest upside scope

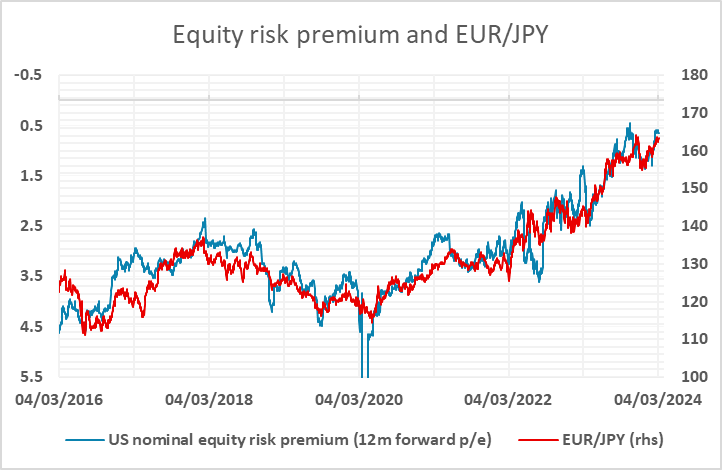

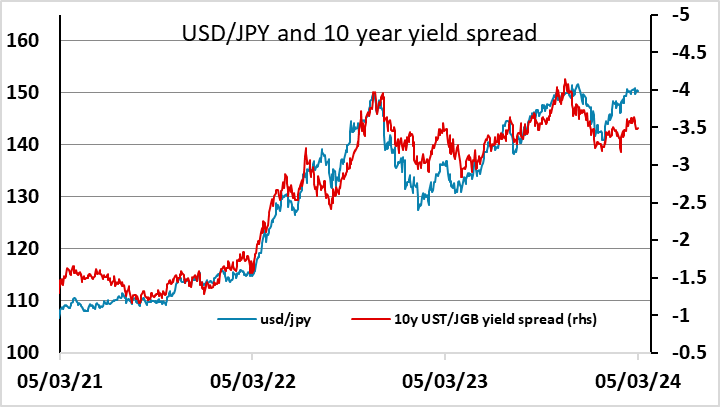

Weaker regional equity market performance weighed on the AUD and NZD overnight, but otherwise FX markets were fairly quiet, with EUR/USD and USD/JPY both close to last night’s European closing levels at the open this morning. USD/JPY was not much affected by the Tokyo February CPI data which came in in line with expectations. While the headline rate rose sharply to 2.5% y/y from 1.6%, and the ex-Fresh Food measure also higher at 2.5% from prior 1.8%, the ex Fresh Food & Energy fell to 3.1% from prior 3.3%, and this is probably a better guide to the underlying trend. Still, the market (and the BoJ) are more interested in the upcoming wage settlements in the spring, which they see as more important for the future progression of inflation. These are expected to show a strong pick-up and should lead to the recent paper talk of the government announcing an end to deflation being confirmed, and consequent BoJ tightening. As it stands, USD/JPY already looks ripe for a move lower based on the yield spread moves we have seen, but the market remains nervous of selling ahead of Powell’s semi-annual testimony tomorrow and the employment report on Friday, which could reverse the recent softer tone in US yields. Nevertheless, we see some risk of a test below 150 today.

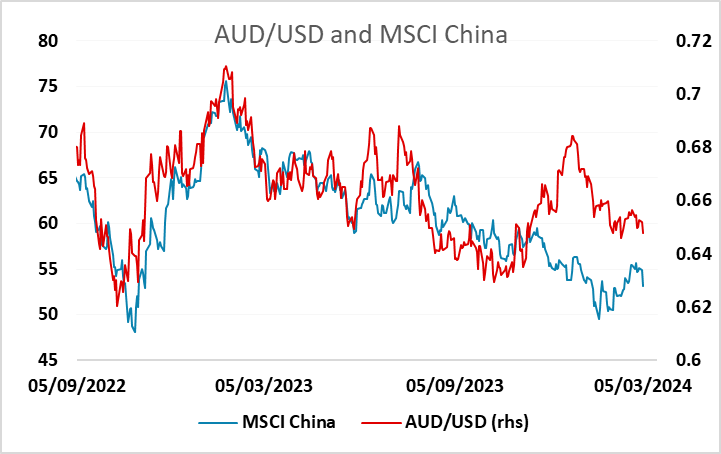

The softer AUD and NZD overnight reflected weakness in Chinese equities as the market showed itself unimpressed with the report that China will target around 5% 2024 GDP growth, which is a similar target to 2023. There has been some sympathetic softening in the CAD and the scandis, which also tend to suffer from negative risk sentiment. But we haven’t seen major moves and there isn’t a lot on today’s calendar to suggest breaks of recent ranges are likely. Nevertheless, the softer risk tone overnight also suggests there may be scope for some JPY gains on the crosses against European currencies.