Published: 2024-01-04T09:52:54.000Z

EUR/USD, EUR/JPY, GBP/USD flows: EUR and GBP supported by PMIs, JPY still weak

Senior FX Strategist

-

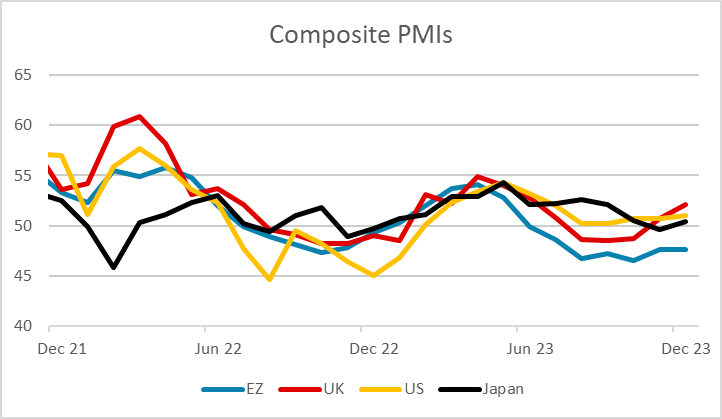

Upward revisions in services PMIs keep EUR and GBP well supported

Upward revisions in services PMIs have helped the EUR and particularly GBP to strengthen through the morning, with the UK composite PMI revised up to its highest since July. The EUR PMI has shown a more modest rise, and remains well below the 50 level, but the upward revision has been enough to push EUR yields and the EUR higher, with the French and German preliminary CPI data only marginally on the weak side of expectations.

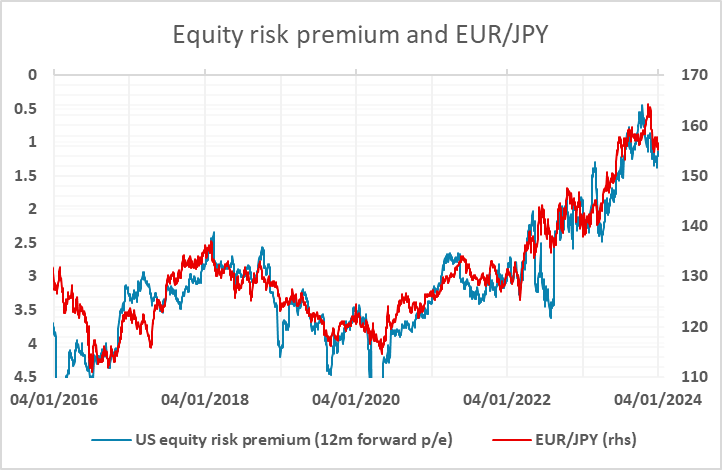

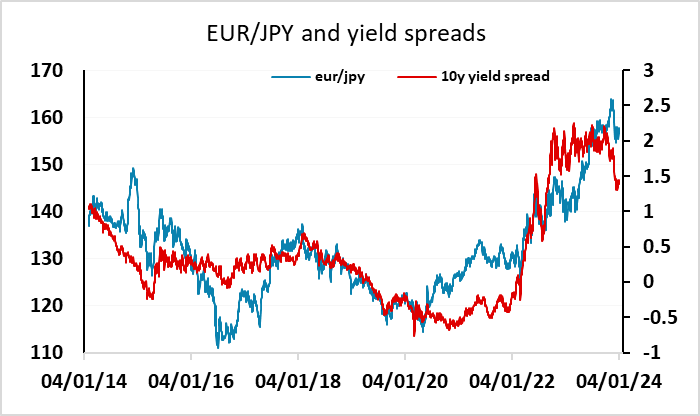

JPY weakness continues to be a theme, with USD/JPY as well as the JPY crosses looking high relative to yield spreads. The modest recovery in equities this morning also doesn’t really support JPY weakness, given the decline in equities earlier in the week, but the correlation with equity risk premia does still suggest that EUR/JPY is close to fair here. Nevertheless, we see the current JPY weakness as a JPY buying opportunity from a medium term perspective.