USD flows: USD slips on marginally softer CPI

US CPI only very marginally below consensus, but USD was looking overstretched so some further downside seen

US core CPI is marginally below expectations at 0.2% with the headline at 0.4% as expected. Surveys were split on the core, with the Bloomberg survey saying 0.3% but the Reuters survey at 0.2%. Given that the actual rise was 0.225%, and the Bloomberg survey median was close to being 0.2%, it’s hard to argue that the outcome was really significantly weak. But rate expectations have shifted a long way so that there is only one cut priced in for 2025, so anything slightly on the soft side tends to undermine the strong USD story that has dominated since the election.

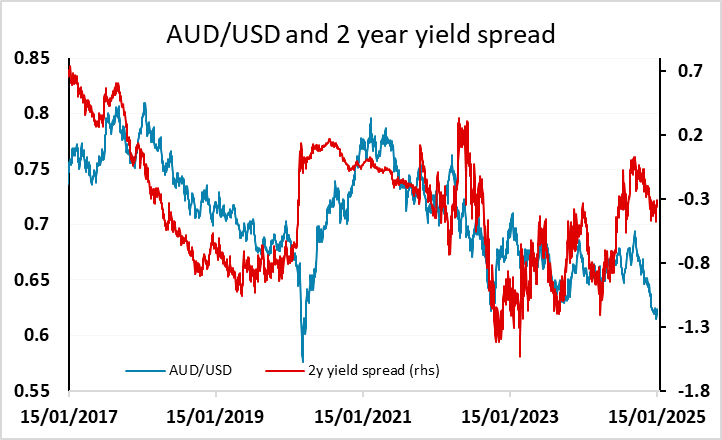

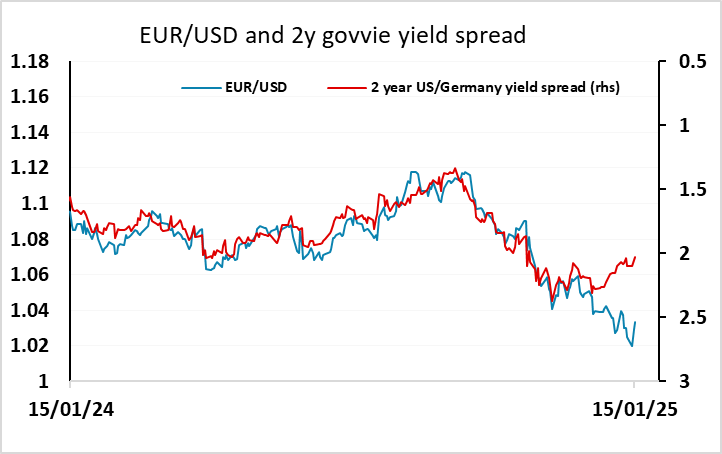

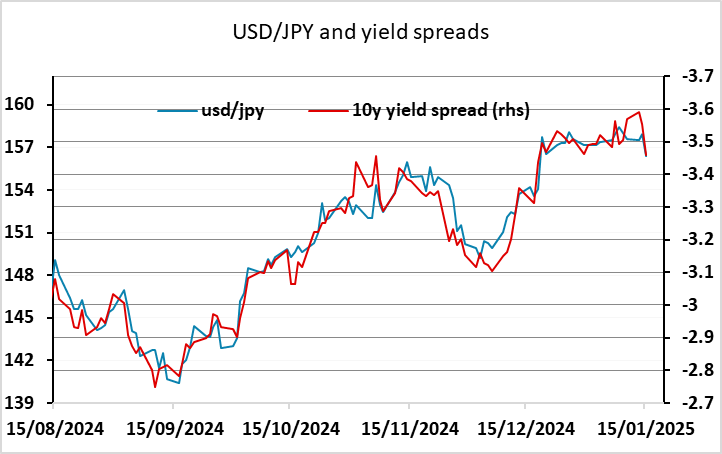

Yields are generally lower across the board in response to the data, and the USD has similarly fallen fairly evenly. We continue to see the AUD as the most attractive among the riskier currencies as US yields, while the JPY should benefit most among the lower yielders, but there is scope for general USD losses given the gain of more than 5% in the DXY since the election, with the USD generally outperforming yield spreads.