Bank of Canada Sees Progress in Reducing Inflation, June Easing Possible

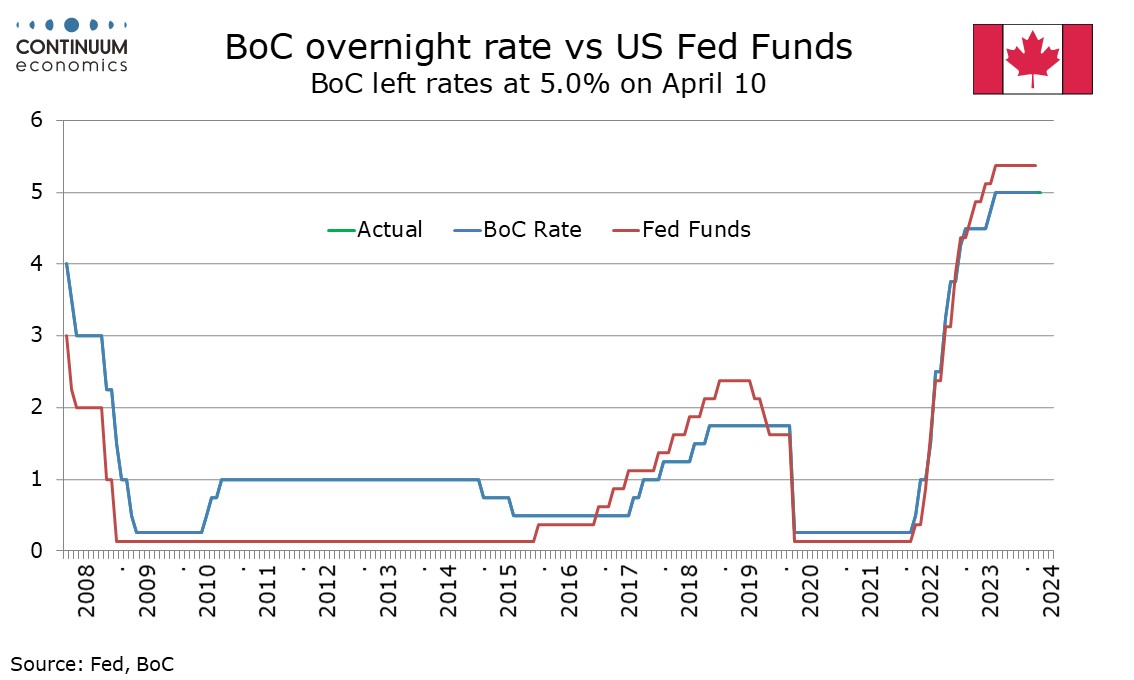

The Bank of Canada made no policy changes with rates left at 5.0% and Quantitative Tightening continuing as expected. However the tone of the statement is significantly more optimistic on inflation, focusing more on this than recent signs of stronger activity. The BoC still needs to see progress on inflation sustained before easing, but looks likely to move sooner than the FOMC.

BoC more optimistic on inflation despite improving activity

The BoC statement does say that inflation is still too high and risks remain, but noted that CPI and core inflation have eased further in recent months and they will be looking for evidence that this downward momentum is sustained. This is a significant shift in language from March, when the BoC said that it was still concerned about the risks to the outlook for inflation, particularly the persistence of underlying inflation, and wanted to see further and sustained easing in core inflation. The statement noted slower 3-month rates of core inflation while governor Tiff Macklem stated they moved below 3% in February.

The statement did not make an explicit mention of the fact Q1 GDP is looking significantly stronger than previously expected but did say that the economy is expected to pick up in 2024. The strengthening economy is expected to absorb excess supply through 2025 and into 2026, implying that the 2023 move into excess supply is expected to persist through 2024.

BoC debating when to ease, June seen possible

The timing of easing will be data-dependent, though Macklem sated a June rate cut was possible. Before then we will have seen March and April CPI data. We see risk that March CPI will look a little stronger than the January and February data, when seasonally adjusted ex food and energy CPI rose by only 0.1% in each month. Ex food and energy CPI is not one of the BoC’s core rates, but is useful as a guide to underlying pressures. Risk is later rather than sooner, though we will stick to our view that the BoC will cut in June for now, with a further 25bps in Q3 and 50bps in Q4. The latter however is likely to require some slowing in the US economy and easing starting from the Fed.

The recent stubbornness of US inflation data and progress in Canada does raise the risk that the BoC will ease sooner and by more than the FOMC, though we should remember that in late 2023 it was Canadian inflation data that was disappointing while the US was seeing significant progress. Data is volatile and the contrast between the two nations looks quite modest when looking at the last few quarters rather than early 2024 data alone.

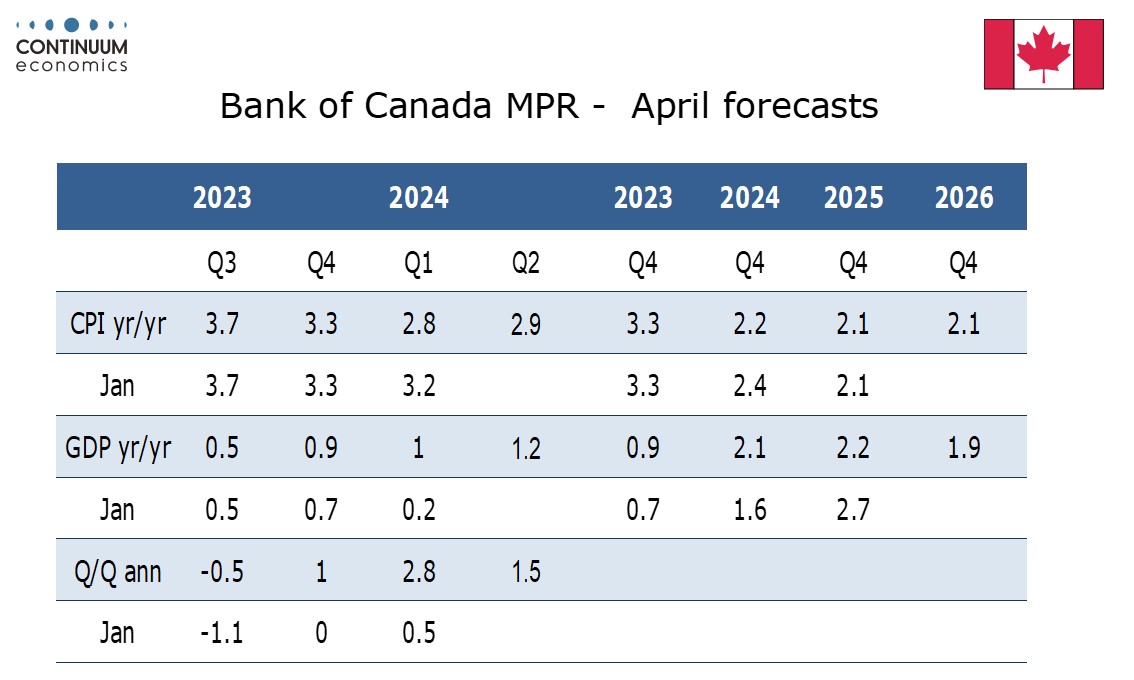

Forecasts not changed much beyond Q1

The quarterly Monetary Policy report did show recent data bringing significant revisions to Q1 economic forecasts, CPI to 2.8% yr/yr from 3.2% and GDP to 2.8% annualized from 0.5%. However 2024 Q4/Q4 forecasts of CPI at 2.2% from 2.5% and GDP at 2.1% from 1.6% suggests little change to the views on the remaining three quarters. 2025 CPI is unrevised at 2.1% Q4/Q4 and 2025 Q4/Q4 GDP has been revised down to 2.2% from 2.7%, offsetting the upward revision to 2024.

Neutral rate nudged up by 25bps

The BoC did raise its estimate of the neutral rate up by 25bps to 2.25% to 3.25%, on an upward revision to the US neutral rate and key Canadian domestic factors, notably faster population growth. However we remain well above the revised neutral rate and Macklem stated the revision does not change near term policy.