USD flows: Election scenarios for the USD

USD to gain on Trump victory, fall on Harris win

So here’s a summary of what we expected for the G10 currencies under three election scenarios.

Trump win, split Congress

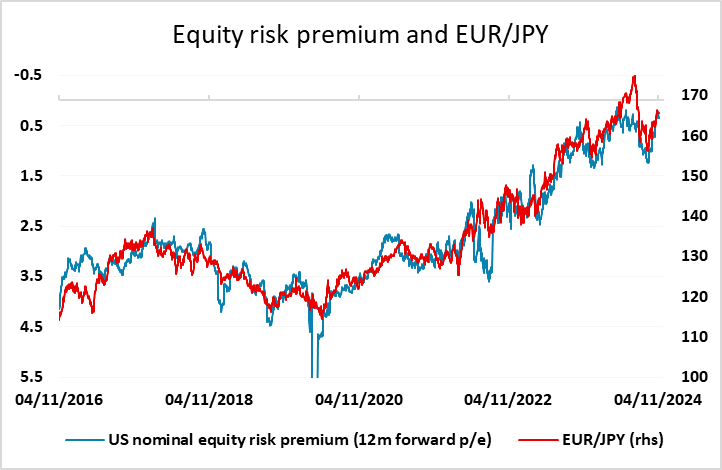

USD gains around 1% supported by rising US yields on the expectation of higher tariffs and potentially some more tax cuts. Equities may not do much, since higher yields will offset any gains from expected tax cuts, and there will be some concern about the impact of tariffs, but this still likely means a lower equity risk premium.

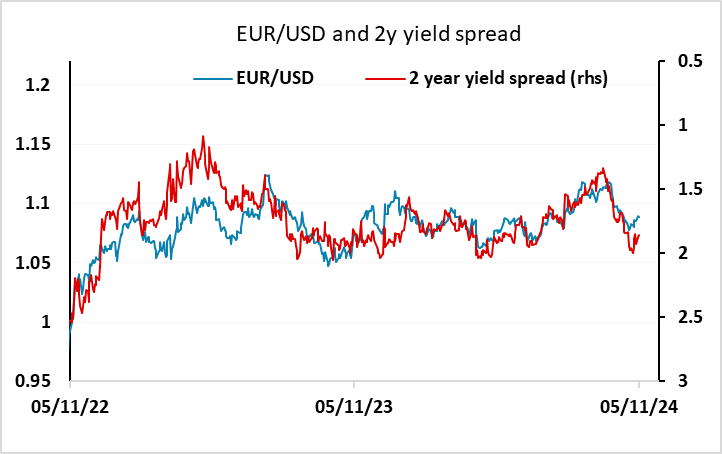

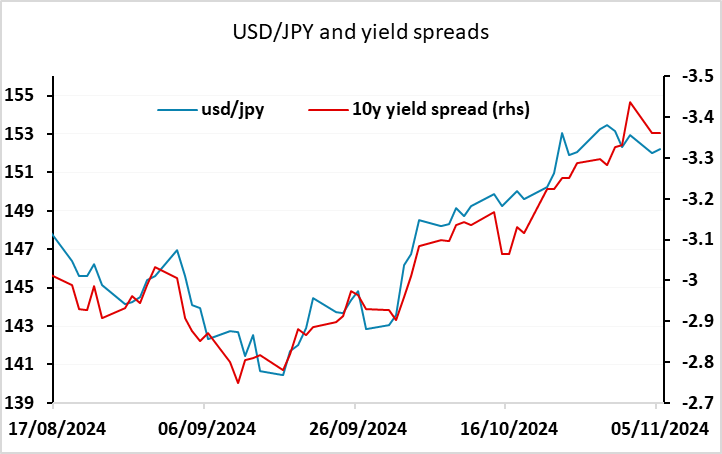

EUR/USD down 0.5%, USD/JPY up around 1%, AUD/USD down 1.5%.

Trump win, Republican clean sweep.

USD gains more aggressively as market anticipates larger tax cuts, particularly corporate tax cuts. Equities and yields up.

EUR/USD down 1.5%, USD/JPY up 2%, AUD/USD down 2%. JPY weakness may be limited by BoJ intervention.

Harris win, split Congress

Steady as she goes, not much policy change, recent rises in US yields partially reversed. USD falls across the board, JPY makes most substantial gains

EUR/USD up 1.5%, USD/JPY down 2.5%, AUD/USD up 2%