USD, EUR, JPY flows: USD stays firm, JPY under pressure

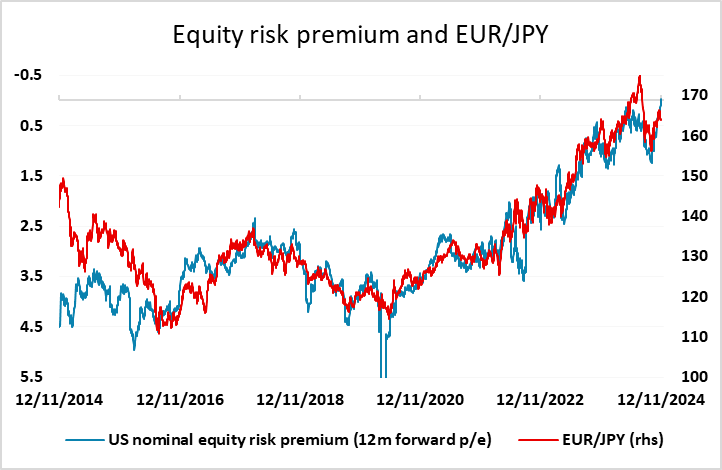

US yields and the USD continue to rise. JPY weakness the feature overnight helped by further decline in equity risk premia to the lowest since 2002.

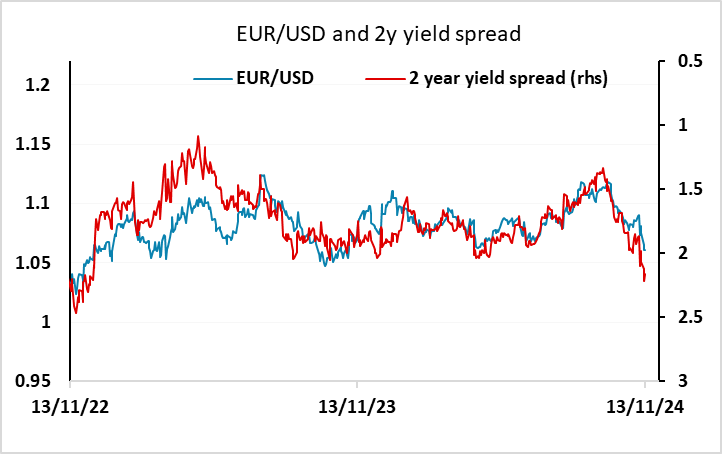

The USD has stayed strong with the JPY the main victim overnight, rising a further 50 pips to 155 since the European close yesterday. After dipping to new lows for the year below 1.06 at the end of yesterday’s European session, EUR/USD bounced modestly overnight to trade above 1.06, but is pressing lower in early trading. There isn’t much on the calendar ahead of the US CPI data later, but we would expect the USD to hold firm, with EUR/USD probably the most vulnerable as yield spreads still suggest plenty of downside scope.

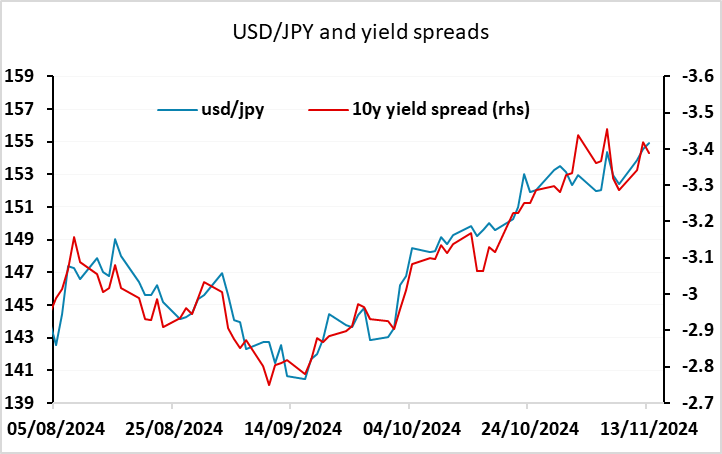

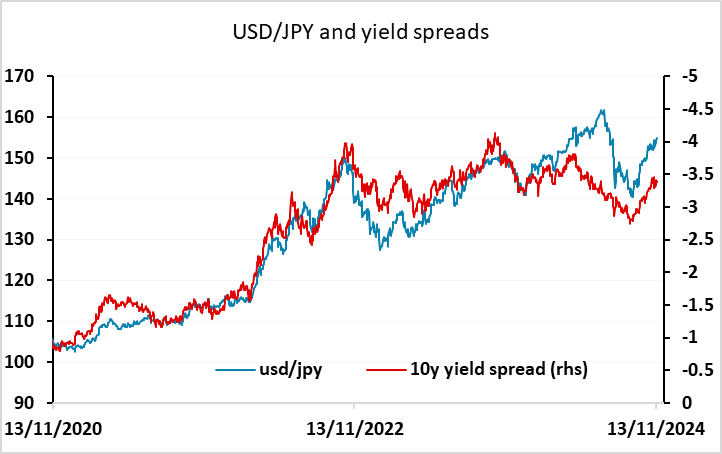

USD/JPY continues to trade in line with the yield spread moves seen over the last 3 months, although a longer term perspective still shows USD/JPY as being too high relative to the yield spread moves over the last few years, and even more overstretched if the JPY’s real terms decline is also taken into account. But as was the case before the late summer recovery, the JPY is suffering from the continued strength of the US equity market and the decline in the equity risk premium which traditionally correlates with a weak JPY.

The decline in the equity risk premium has been extreme since the election, driven by both higher yields and higher equities, and the measure we use of the nominal risk premium, based on 12m forward earnings for the whole US market and US 10 year government yields, has turned negative for the first time since 2002! As long as this continues it will be hard for the JPY to rally, but the reality of Trump’s policies may prove less equity positive than the current market projection. Most importantly, while we saw a similar move after the first Trump election victory, it started when the equity risk premium was at much higher levels. We would be very wary of assuming that the equity rally will continue against the background of higher US yields.