USD, EUR, GBP, JPY flows: USD firm in early trade

USD firm as markets anticipate Trump administration. GBP resilient, USD/JPY stretched

The USD is starting firm in Europe, despite little change in US yields. The positive tone may be related to Friday’s announcement that Trump has asked protectionist Robert Lighthizer to run trade policy. Certainly, there is now anticipation of tariffs being widely applied. GBP has been relatively resilient, with the UK seen as less likely to be targeted, and EUR/GBP has dipped to its lowest since April 2022, helped also by the background of the more hawkish than expected BoE statement and Monetary Policy Report last week.

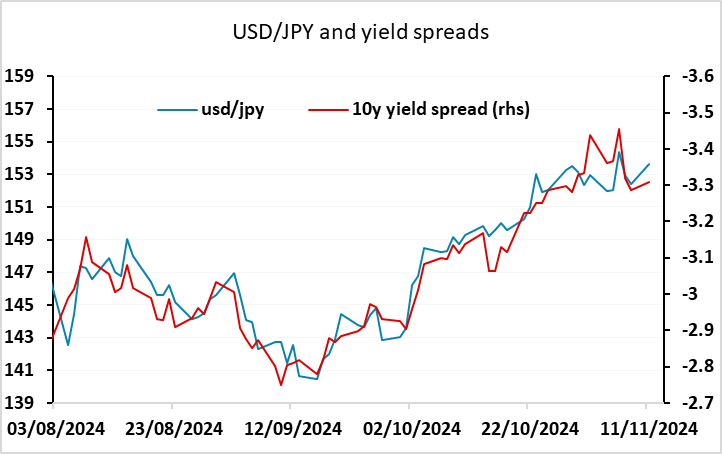

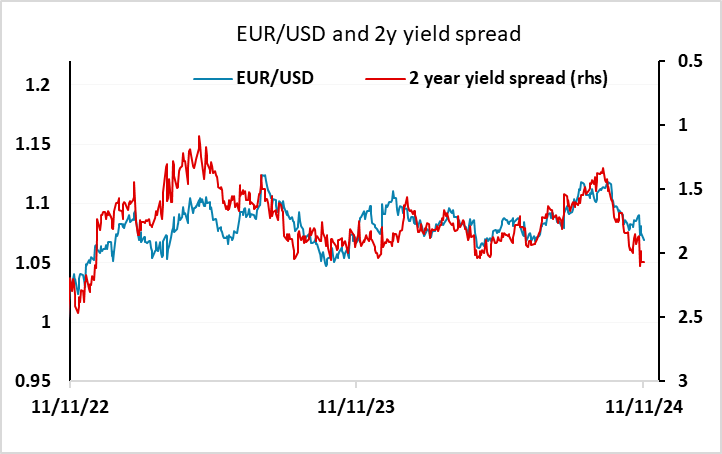

Even so, GBP/USD is still biased lower if EUR/USD remains soft, and yield spreads suggest EUR/USD still has downside risks. Conversely, USD/JPY is starting to look stretched at current levels, with JGB yields still firm and an increasing risk of intervention as we approach 155. The focus will remain on the political manoeuvrings of the impending Trump administration. There is no data of note today with Norwegian CPI having come in essentially in line with expectations.