Brazil CPI Review: December CPI Prompts some Caution

December's CPI data in Brazil exceeded expectations with a 0.6% month-on-month increase, contributing to a 4.6% year-on-year CPI for 2023, slightly above the central bank's target. Food and Beverage prices surged (+1.1%), driven by year-end festivities, while service inflation remains a concern. Despite caution over inflation, we maintain our forecast at 3.9% (Y/Y Average) and 10.25% for the policy rate.

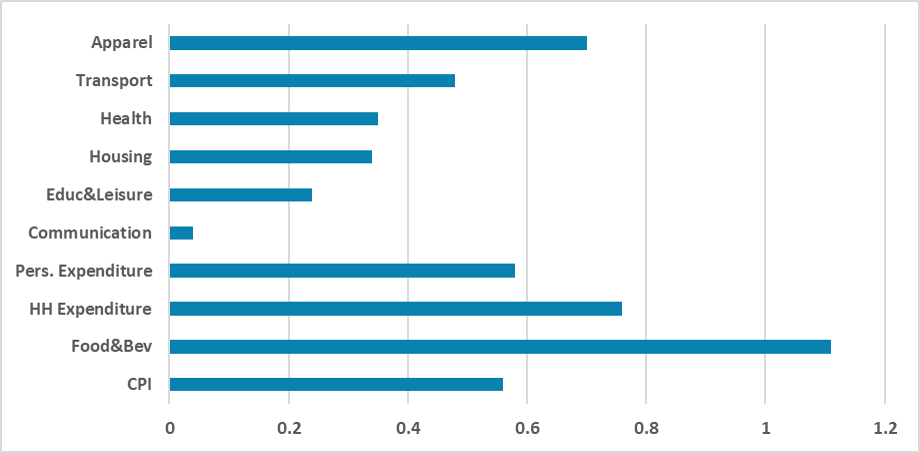

Figure 1: Brazil’s CPI by Groups (%, m/m)

Source: IBGE

The Brazilian National Statistics Institute (IBGE) has released the CPI data for December. The data reveals a 0.6% month-on-month (m/m) increase, slightly exceeding market expectations, which anticipated a 0.5% rise according to the Bloomberg Survey. Consequently, the year-on-year (Y/Y) CPI for 2023 concluded at 4.6%, within the Brazilian Central Bank's (BCB) target range for 2023 (1.75% to 4.75%) but above the center of the target (3.25%). It's worth noting that the BCB missed the target band in both 2021 and 2022.

Examining specific groups, the most significant increase occurred in Food and Beverages (+1.1%), driven by the seasonal effects of year-end festivities. Potato prices surged by 19%, while bean prices rose by 13.8% in the month. On a Y/Y basis, food inflation remains low at 1.0%. Airfare tickets increased by 8.9%, responding to higher demand during this time of the year, influencing the transport CPI. Electricity also experienced a rebound, growing by 0.6% in the month, impacting the Housing CPI.

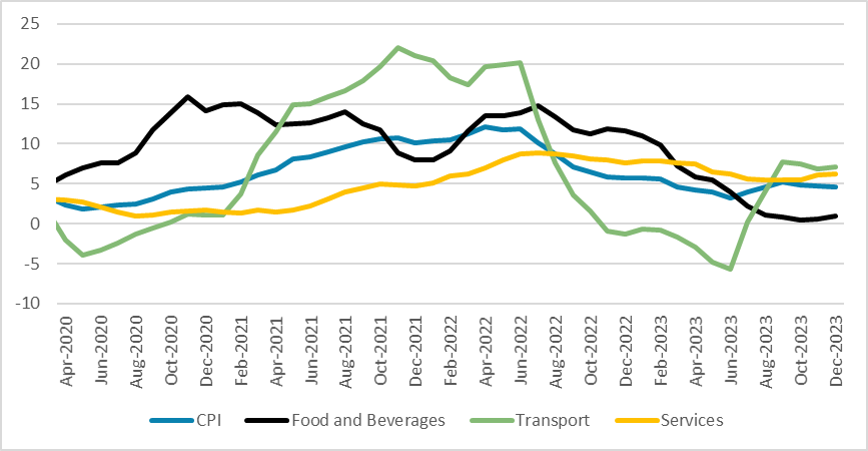

Figure 2: Brazil’s CPI (%, Y/Y)

Source: IBGE

A notable concern is Service inflation. Service CPI grew by 0.6% in December, with Y/Y inflation at 6.2%, a slight increase from November's 6.0%. We anticipate that service inflation will gradually decline in the coming months, although the pace is expected to be slow throughout 2024. However, food inflation is likely to accelerate somewhat in the first half of the year due to the El Niño phenomenon.

Overall, the December figures raise caution regarding inflation. Inflation convergence has not been achieved yet, and the December numbers could be interpreted as an acceleration compared to the previous trend. However, it is possible that much of this movement was seasonal, and it is highly likely that inflation numbers will revert to their previous trend. In terms of monetary policy, we anticipate that the BCB will remain cautious, and there will be no acceleration in the pace of rate cuts. We continue to expect the BCB to pause in the middle of the year. Our forecast for both the CPI and the policy rate remains at 3.9% (Y/Y Average) and 10.25%, respectively.