FX Daily Strategy: Europe, August 6th

Markets remain focused on risk sentiment

Equity market stabilisation could allow some retracement of recent safe haven gains

JPY remains extremely weak, so downside very limited

Scope for NOK recovery

RBA Kept Rates on Hold

Markets remain focused on risk sentiment

Equity market stabilisation could allow some retracement of recent safe haven gains

JPY remains extremely weak, so downside very limited

Scope for NOK recovery

RBA Kept Rates on Hold

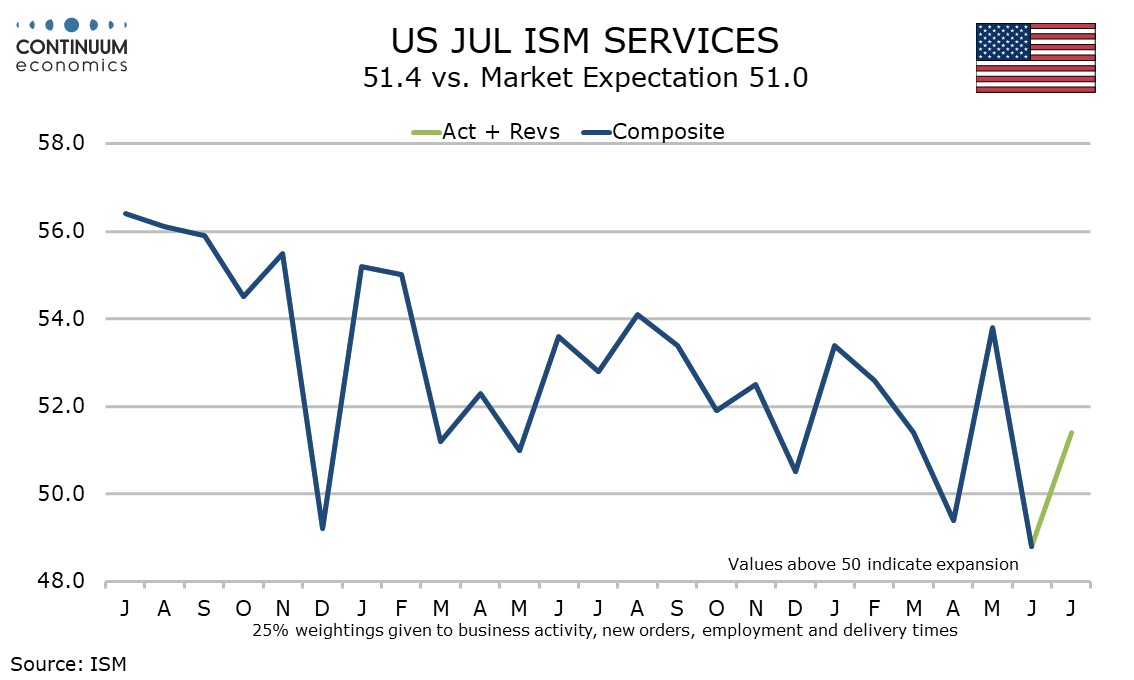

The much stronger than expected non-manufacturing ISM data on Monday has triggered a general if modest risk recovery, with the JPY and CHF both falling back from their highs, while the riskier currencies generally managed some recovery, with the EUR and CAD the best performers. Certainly, the strength in the ISM data is a reminder that most of the US data hasn’t been notably weak, and the weaker than expected employment report last week was not weak enough to suggest we are on the brink of recession. The risk sell off we have had may therefore have been excessive, so that some recovery is justified.

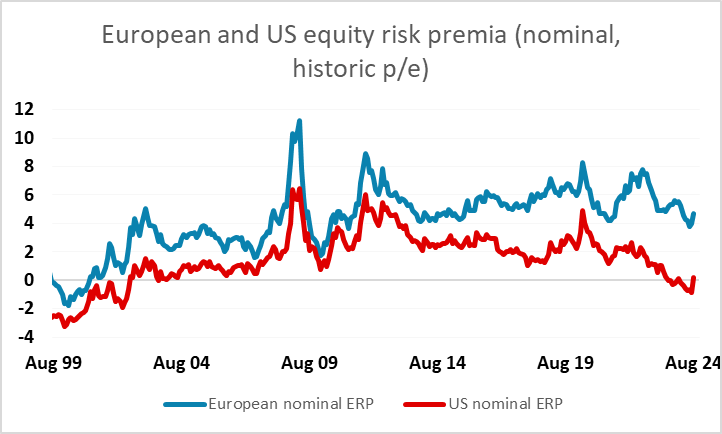

However, the reaction looks to have been due to extreme valuation more than extreme data. Mildly weaker data has consequently triggered a sharp move, and while we may see some correction if we see stronger data, current equity market levels look more sensible than the levels we saw at the highs a few weeks ago. The US market remains extremely highly valued, both in terms of current p/e levels and relative to current yields, and it is hard to justify a substantial recovery given the current degree of uncertainty on the economy and politics, both domestically and globally.

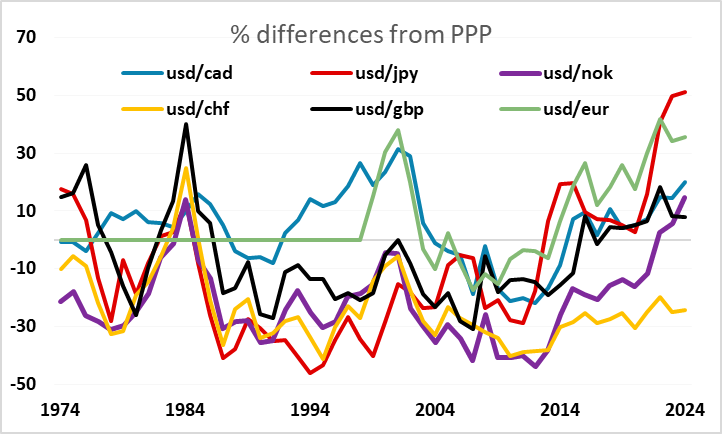

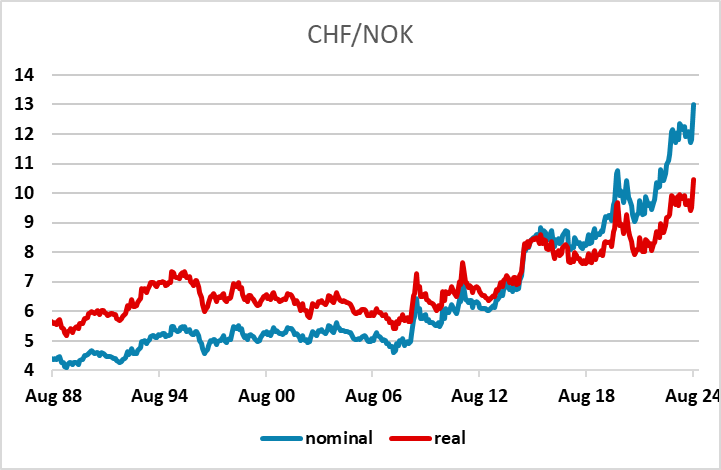

In the FX market, the valuations are even more extreme, with the JPY still extraordinarily weak, even after the 20 figure decline in USD/JPY from the highs in the last month. There are also a lot of other extreme valuations. The CHF remains exceptionally strong, while the NOK has fallen to new all time lows against the EUR, GBP and CHF (excluding the pandemic spike), a decline that looks hard to justify on fundamentals. This may lead to more significant FX volatility in the coming weeks and months, even if equity markets stabilise.

For Tuesday there isn’t a huge amount on the calendar, with the RBA meeting the only event of note. It’s doubtful that the RBA will feel the need to react to the recent weakness in risk sentiment, with the decline of the AUD in any case providing some monetary easing. The market is pricing in around 5bps of easing (or a 20% chance of a 25bp cut) so there may be a modest uplift for the AUD if rates are left unchanged, especially if the statement is calm and optimistic about economic prospects.

The RBA kept the cash rate on hold at 4.35% as the current inflation picture does not support any change of monetary policy. The forward guidance statement has changed to "Data have reinforced the need to remain vigilant to upside risks to inflation and the Board is not ruling anything in or out. Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range." from "The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out.". However, we do not see the change in wordings equal to opening the doors to more tightening with them highlighting both "Inflation in underlying terms remains too high" and "Momentum in economic activity has been weak.... Wage growth seems to have peaked". Yet, the RBA acknowledged there is upside risk to their current inflation forecast.

Despite the latest Q2 CPI has shown a rebound to 3.8% y/y and has eliminated the possibility of any early easing from the RBA, the RBA trimmed mean CPI is lower than forecast and monthly CPI in June has rotated lower to 3.8% from 4% in May. To the contrary, PPI is steadily edging higher to 4.8% y/y in June which may translates into a certain level of inflationary pressure but is likely balanced by the softer domestic consumption and slower wage growth. The RBA did not change their inflation forecast and seems to be content with the trajectory of inflation by seeing 2-3 percent in 2025. We maintained our forecast of terminal rate to be 4.35% and now only see one 25bps easing by year end 2024.