EUR, JPY flows: EUR starting the year soft, some potential for recovery

EUR looking soft against established metrics. USD/JPY still sticking to 10 year spread correlation.

The first full trading day of the new year looks likely to be relatively quiet, although the US initial claims data later may trigger some reaction. New years often see a change of paradigm in markets, so there is no guarantee that the metrics which worked last year will continue to work this year. Certainly, there was a significant change in FX market behaviour at the beginning of the first Trump presidency, so we will be on watch for any evidence of a break in market correlations this time around.

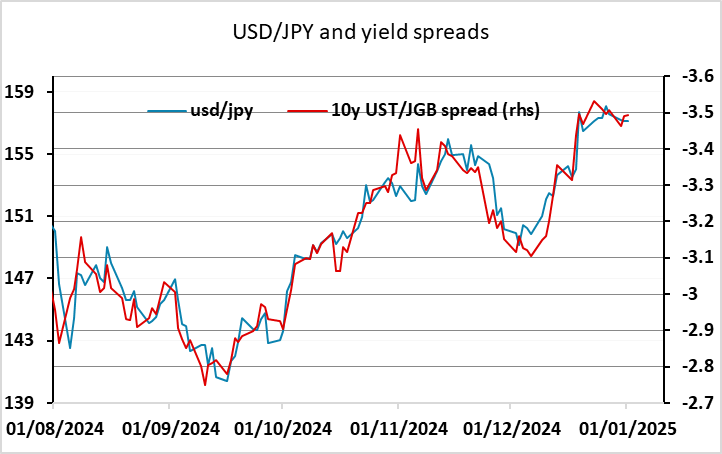

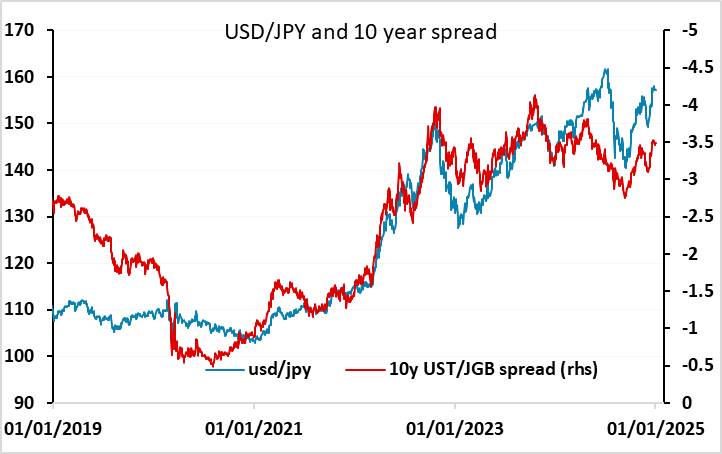

However, initially we must refer to the established relationships. USD/JPY has continued to closely track moves in 10 year spreads, and looks very fair on the basis of the moves of the last few months, although it still looks substantially overvalued on any longer term assessment, especially one that takes into account real rather than just nominal exchange rate and yield moves.

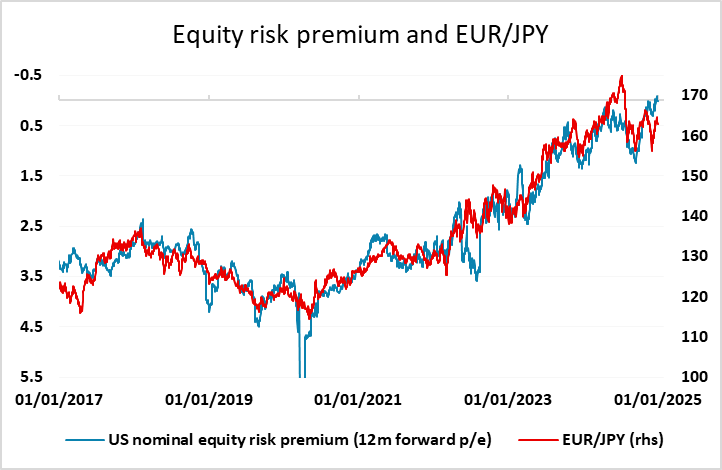

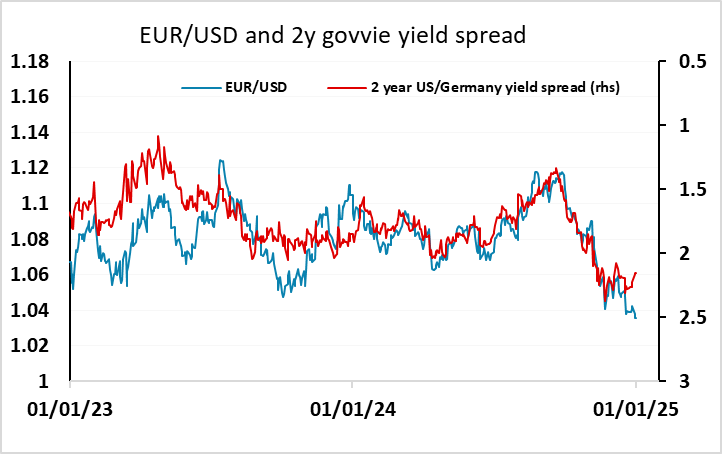

But EUR/USD is looking somewhat depressed relative to the 2 year spread correlation that has guided it in the last year or so, while EUR/JPY, in spite of strong gains through December, remains a little below the levels suggested by the enduring correlation with US equity risk premia. This suggests there is some upside risk for EUR/USD and EUR/JPY from current levels, based on these historically strong correlations. There is Eurozone money data later this morning that could potentially act as a trigger for EUR moves, but in practice we would expect a fairly subdued start to the year.