Preview: Due October 17 - U.S. September Retail Sales - A moderate end to a stronger quarter

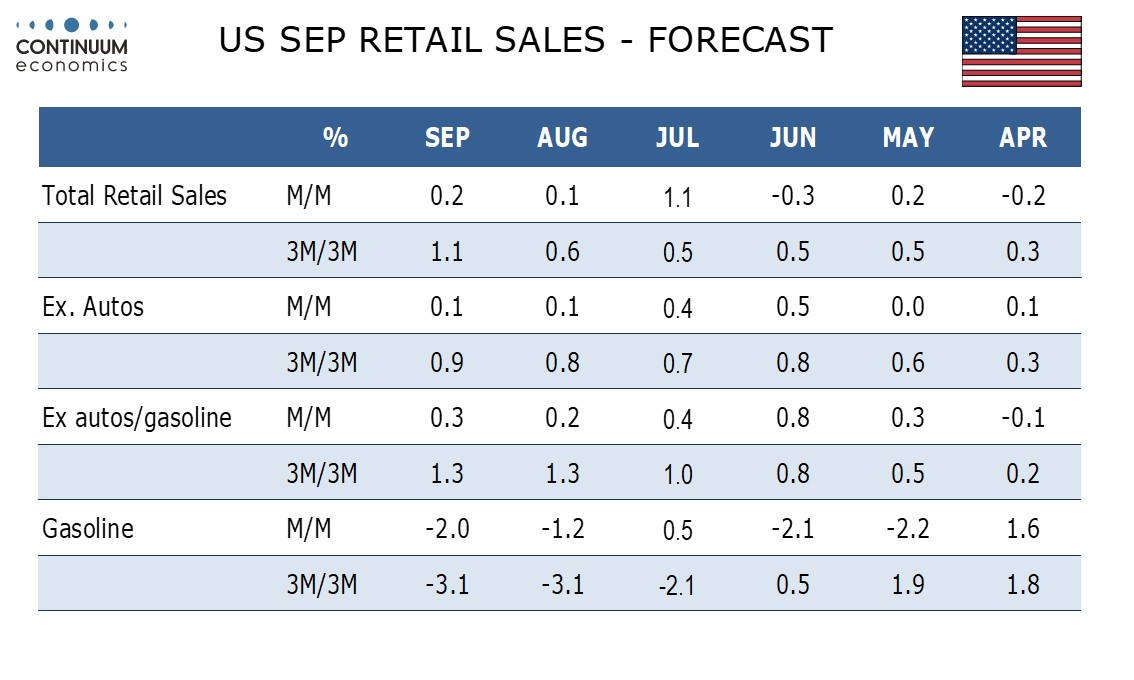

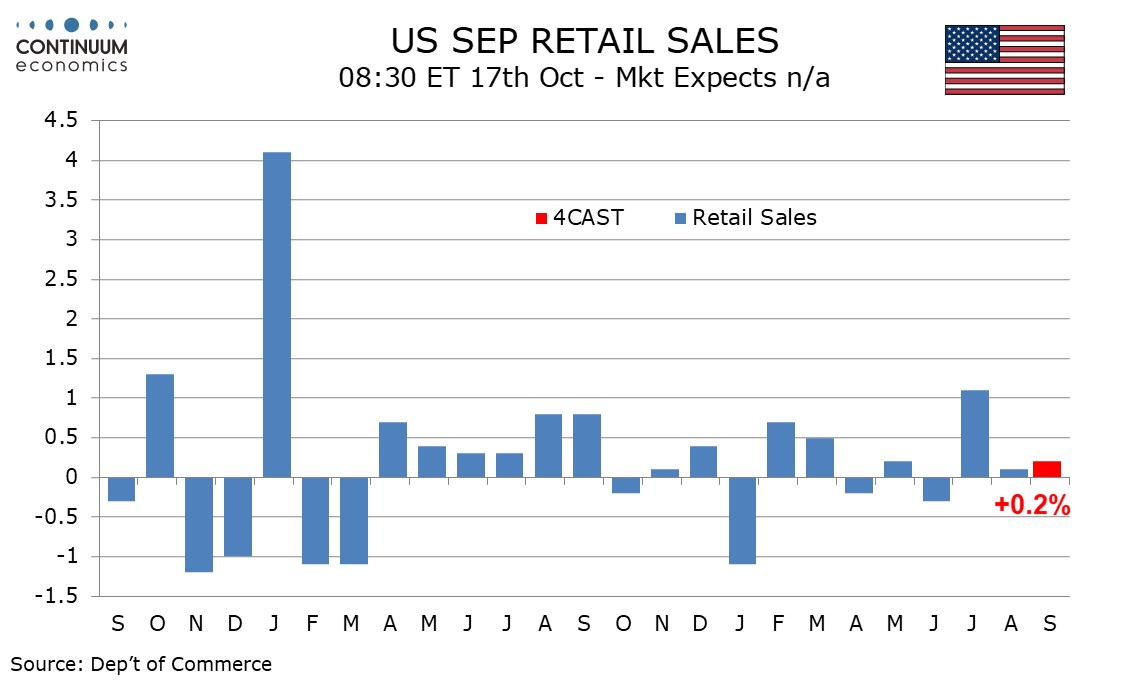

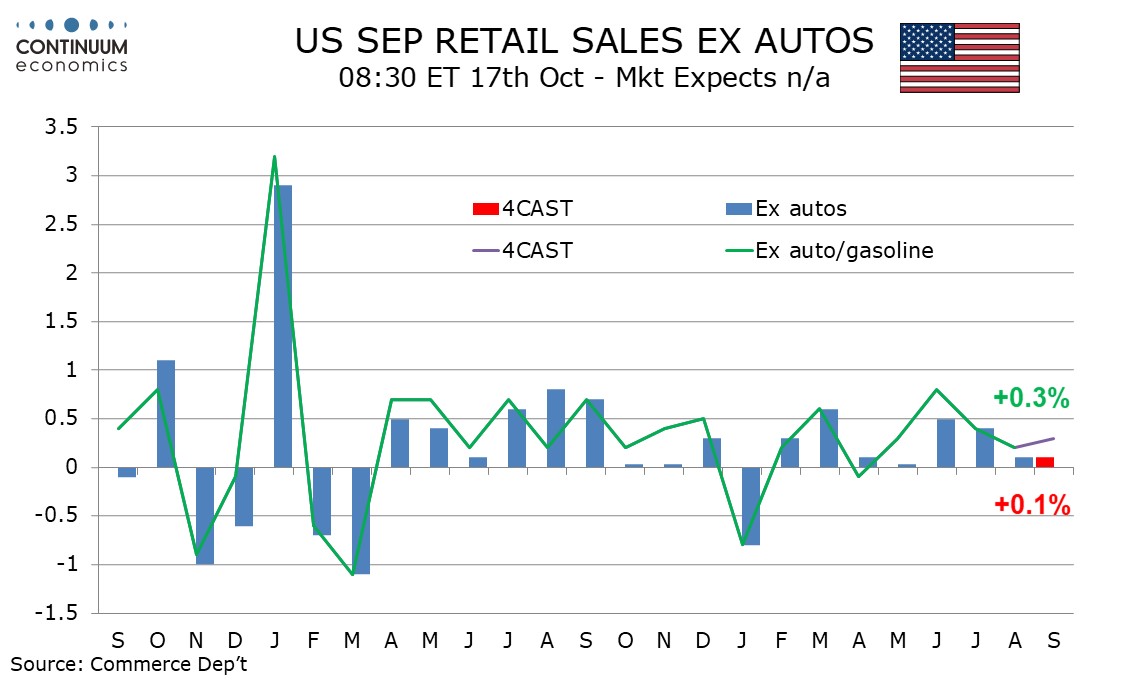

We expect a 0.2% increase in September retail sales with a 0.1% increase ex autos, similar to the 0.1% increases seen in both series in August. Ex autos and gasoline we expect a 0.3% increase, slightly stronger than August’s 0.2% but not quite matching a 0.4% gain seen in July.

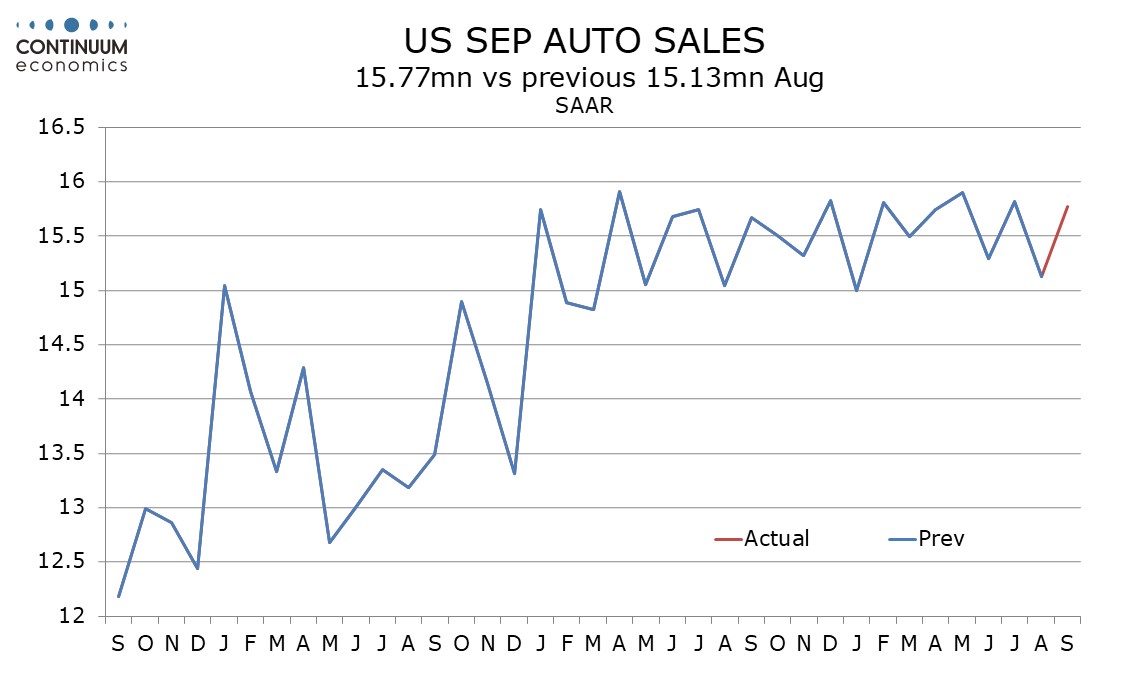

Industry data shows a bounce in September auto sales after a dip in August but trend has little direction. With retail sales having shown little change in August auto sales any bounce in September’s auto retail data is likely to be modest.

Lower gasoline prices are set to act as a restraint on September retail sales values.

While we expect only a modest rise in September sales ex auto and gasoline, 3 month/3 month data will show the strongest quarter in the series since Q3 2023. This will also be the case for overall retail sales. Ex autos, we expect the 3 month/3 month data to show the strongest quarter since Q4 2023.

That the quarter is already set to be a strong one limits the upside scope for September. However upward revisions to income in the recent GDP revisions have reduced the downside risks to consumer spending going forward.