FX Daily Strategy: Europe, August 2nd

Focus on US employment report, USD downside risks

CHF strength may be approaching limits

AUD weakness looking overdone

Focus on US employment report, USD downside risks

CHF strength may be approaching limits

AUD weakness looking overdone

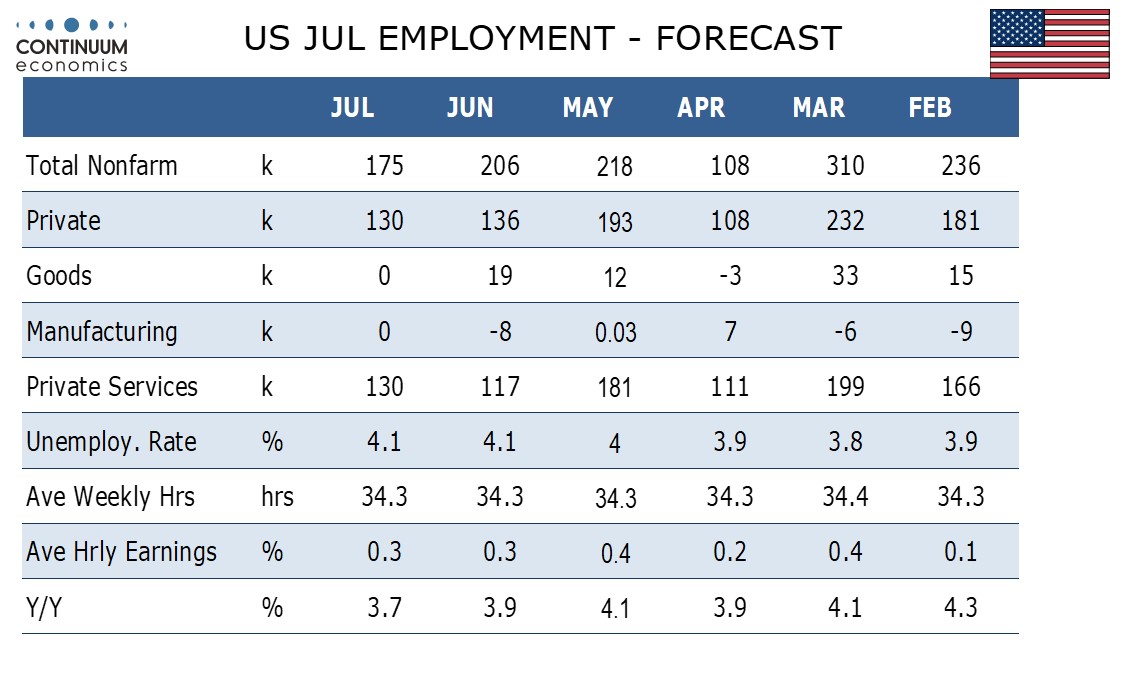

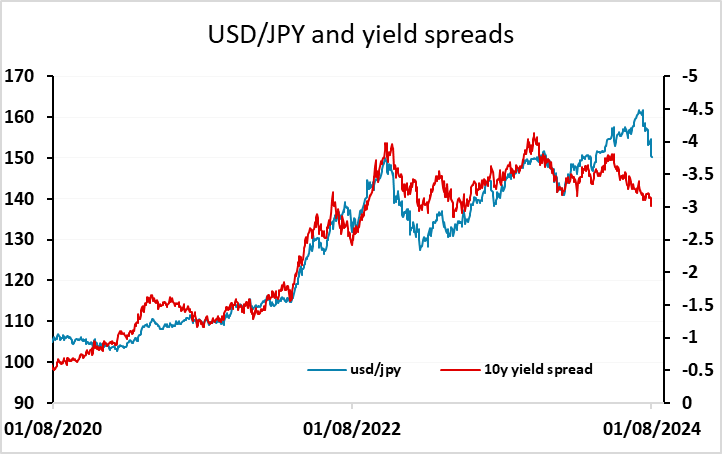

The US employment report is the prime focus on Friday. The US data on Thursday was on the soft side, with another rise in initial claims and continuing claims the highest since November 2021, while unt labour costs were also much weaker than expected in Q2 and the ISM manufacturing index came in very weak, particularly on the employment index. While the USD has traded slightly firmer since the FOMC meeting, US yields are lower and yield spreads suggest USD downside risks, particularly against the JPY, with spreads against Europe still not suggesting any substantial upside for EUR/USD.

We expect July’s non-farm payroll to rise by 175k, 130k in the private sector, both slightly slower than in May and June but stronger than in April, suggesting only a moderate loss of momentum in the labor market. We expect an unchanged unemployment rate of 4.1% and a second straight 0.3% increase in average hourly earnings. Our forecast is essentially bang in line with consensus, so the knee jerk reaction may not be large, but we still see downside potential for USD/JPY if US yields hold at current levels.

Before the employment data there is Swiss CPI data, which is of more interest given the strength of the CHF in recent days. While this to some extent reflects some decline in risk appetite with a general unwinding of risk positions, the decline is starting to look a little overdone with EUR/CHF now at its lowest since February. While the CHF is still not significantly strong in real terms, as low Swiss inflation means the nominal decline in EUR/CHF in recent years was required to maintain real terms stability, the SNB will not welcome this renewed CHF strength now inflation is back nearer 1% than 2%. SNB action in the FX market tends to be quiet and unadvertised, but the SNB have indicated that they are prepared to be active if the CHF gets too strong (or too weak) and we are likely approaching that level. EUR/CHF levels near 0.94 may be seen on strong CPI, but there should be strong support there, while weak data could trigger a reversal of the recent EUR/CHF downtrend.

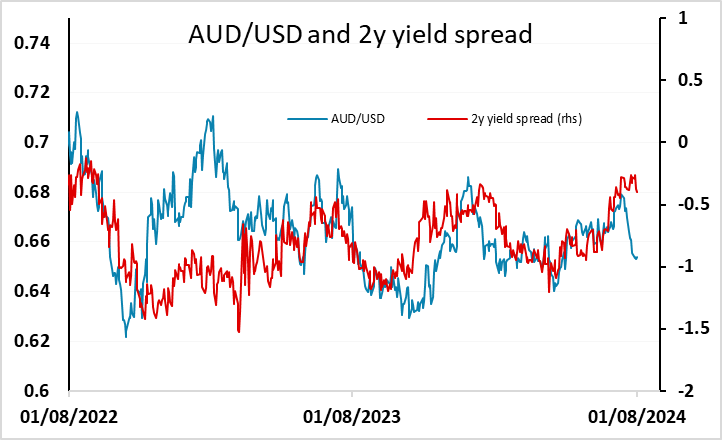

While the AUD was one of the better performers on Thursday, reaching a high above 0.6560, it took a knock when equities fell back after the US ISM data. We still see a strong case for an AUD recovery as the recent declines on the back of softer Chinese equities haven’t been supported by moves in yield spreads, and unless there is a sharper deterioration in global risk sentiment, the relatively strong performance of the Australian economy should allow a reversion towards the levels above 0.66 suggested by the historical yield spread correlation. A moderate US slowdown which is accompanied by easier Fed policy ought to prove supportive for riskier currencies against the USD.