India GDP Review: India’s GDP Faces Headwinds in Q2 FY25

India’s GDP growth is projected to slow to 6.6% in Q2 FY25, marking the weakest pace in six quarters. This decline is primarily due to slower growth in manufacturing and services, though agriculture has shown resilience. Despite robust government spending and rural demand, weak private consumption and slow public capex remain challenges.

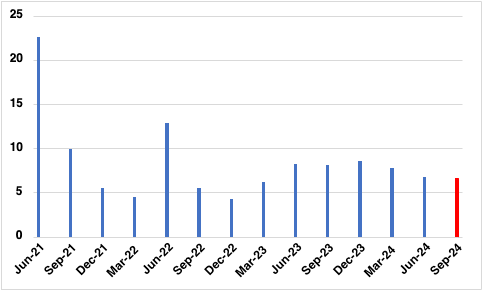

India’s economic growth is expected to slow to a six-quarter low of 6.6% yr/yr in Q2 FY25, marking a deceleration from the 6.7% yr/yr recorded in Q1 FY25 and 8.1% yr/yr in Q2 FY24. The anticipated deceleration reflects our expectation of a moderation in key growth drivers, including both the manufacturing and services sectors.

Figure 1: India GDP Growth Forecast (% change yr/yr)

Source: Continuum Economics

The July-September period will see more subdued growth, despite the Reserve Bank of India's expectations of strong pickup. The anticipated 6.6% growth for Q2 is notably lower than the Reserve Bank of India’s (RBI) projection of 7%, casting doubt on the possibility of reaching the central bank’s annual growth forecast of 7.2% for FY25. To achieve this, the economy would need to grow at 7.9% in H2, a target we believe is over-optimistic. The moderation is primarily attributed to weaker performance in the manufacturing sector, where factory output has significantly slowed. The Index of Industrial Production (IIP) averaged a modest 2.6% yr/yr growth in Q2, a sharp decline from 5.5% in Q1 and 7.8% in the same period last year. The services sector, a key contributor to India’s GDP, also experienced a slowdown.

However, agriculture has been a bright spot. We forecast the gross value added (GVA) in agriculture to rise robustly, driven by an uptick in rural consumption and a robust kharif harvest. Rural demand has remained resilient, with FMCG sales growing 6% in Q2, compared to just 2% in urban markets. This rural strength has also been reflected in increased sales of two-wheelers and tractors, signalling sustained demand.

On the consumption front, household spending in urban areas has shown signs of weakness, owing to elevated food inflation. Food inflation is reported to have eroded private spending during the quarter. Meanwhile, government spending has also provided some support, particularly in Q2, after a slower start to the fiscal year due to elections. However, concerns persist over the pace of public capital expenditure, which remains below last year’s levels. For the second half of FY25, a pickup in government capex will help stimulate growth, but substantial acceleration in spending is required to meet budgetary targets. Trade data paints a mixed picture, with both exports and imports slowing, particularly due to falling energy prices. The surge in gold imports, however, has widened the trade deficit, potentially exerting downward pressure on growth.