USD, EUR, JPY flows: Steady picture, JPY still vulnerable

Steady picture. JPY recovers a little after Japanese CPI. EUR range bound

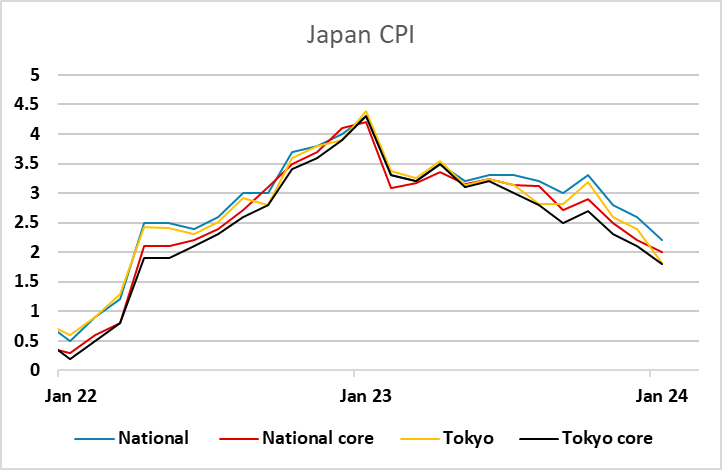

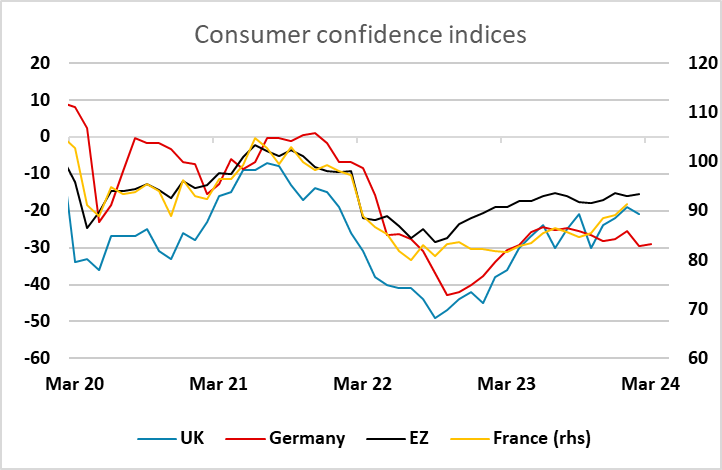

Japanese CPI fell slightly less than expected in January, not quite matching the declines seen in Tokyo CPI, and this helped the JPY recover modestly overnight. But the JPY was weak going into the data, with EUR/JPY just stopping short of a test of the November highs. EUR/USD started the European session on the front foot, appearing to gain some encouragement from the German consumer confidence data. Even though this was essentially unchanged on the month, the market may find some encouragement tin the fact that the recent shallow downtrend hasn’t extended. But French confidence data has disappointed, and the EUR has edged lower.

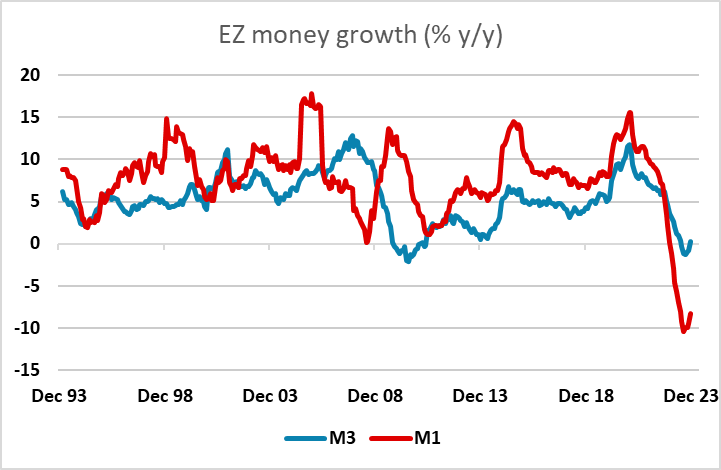

The 1.08-1.09 range looks likely to hold for today, with the next focus on Eurozone money data later this morning. This may have some impact on market expectations of the ECB. The money data has shown a mild improvement in the last couple of months, in spite of the very weak starting point, but seems unlikely to provide anything very conclusive.