Brazil and Mexico: Supply and Demand Factors Affecting Inflation

We decomposed inflation in Brazil and Mexico using a Vector Autoregressive (VAR) Model, focusing on Imported Inflation, Demand, Supply, and Monetary Policy. Our analysis from 2003 to 2024 for Brazil and 2005 to 2024 for Mexico shows Brazil's inflation was primarily driven by supply and imported inflation shocks post-pandemic, while Mexico's inflation was more influenced by supply and demand factors. Notably, monetary policy in Mexico was slower to adjust, impacting inflation rates differently than in Brazil. Demand is still affecting Brazil inflation while in Mexico this effect is muted.

We ran a model to decompose inflation into four factors: Imported Inflation, Demand, Supply, and Monetary Policy. Our chosen model was a Vector Autoregressive (VAR) Model with four variables: Imported Commodity Prices, Monthly Economic Activity Index, CPI, and Policy Rate. All the variables are in annual variation except for the policy rate, which we kept at level. Imported Commodity Price data came from the IMF, which we then transformed into local currency by multiplying the exchange rate. The Monthly Activity Index used was the Central Bank Economic Activity Index from BCB for Brazil and the Monthly Global Economic Activity Index from INEGI for Mexico. We estimated the model using Bayesian techniques with four lags for each equation. To identify the shocks, we used a sign-restriction scheme as follows:

- An imported inflation shock raises the commodity imported inflation. We are agnostic about its impact on the monthly GDP, but we assume it raises inflation and the policy rate.

- A demand shock does not affect imported inflation but raises the GDP, inflation, and the policy rate.

- A supply shock does not affect imported inflation, raises the GDP, lowers inflation, and raises the policy rate.

- A monetary policy shock has no effect on commodity prices, lowers the GDP and inflation, and raises the policy rate.

We ran the model at a monthly frequency. By applying a historical decomposition, we can decompose the impact of each of these drivers on the CPI. Our model spans from January 2003 to April 2024 for Brazil and from August 2005 to April 2024 for Mexico.

Results for Brazil

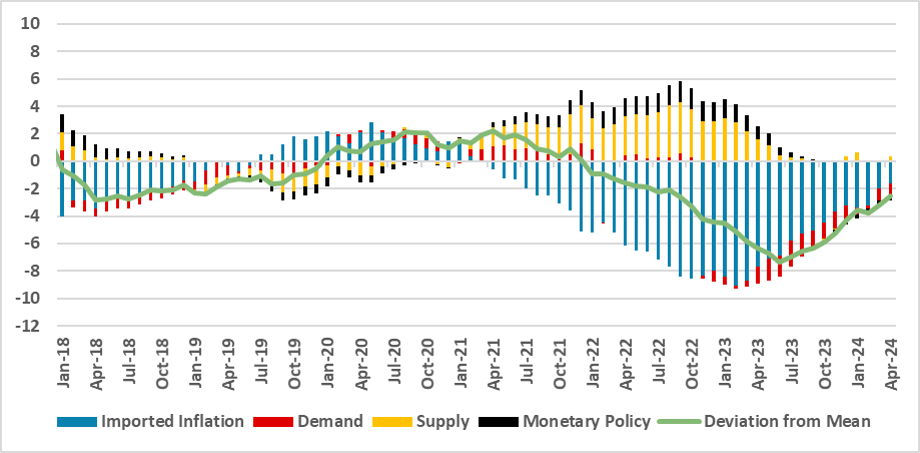

Figure 1: Contribution for Inflation (%, deviation from the mean)

Source: Continuum EconomicsNote: CPI sample mean: 5.3%

Our modeling suggests that the post-pandemic surge of inflation was dominated by supply and imported inflation shocks. This suggests that the restrictions still being applied to control the coronavirus were tightening the supply conditions, contributing to rising inflation. Imported inflation is related to the sudden rise in agricultural prices coupled with the strong devaluation of the BRL. The looser monetary policy during this period also contributed to accelerating inflation. The rapid disinflation during 2022 and 2023 seems to be strongly related to a reversion of imported inflation and an easing of supply conditions. Interestingly, our model suggests that demand had a minor role in the post-pandemic inflation trajectory. However, since mid-2023, we believe that demand is affecting inflation to the upside, which could be a concern for the BCB, which is being more cautious. Our model is not updated with May to July data, but we believe it will continue to show demand impacting inflation. With the increase in political transfers and strong wages and employment data, it could be more difficult for the BCB to put inflation back to the 3.0% target.

Results for Mexico

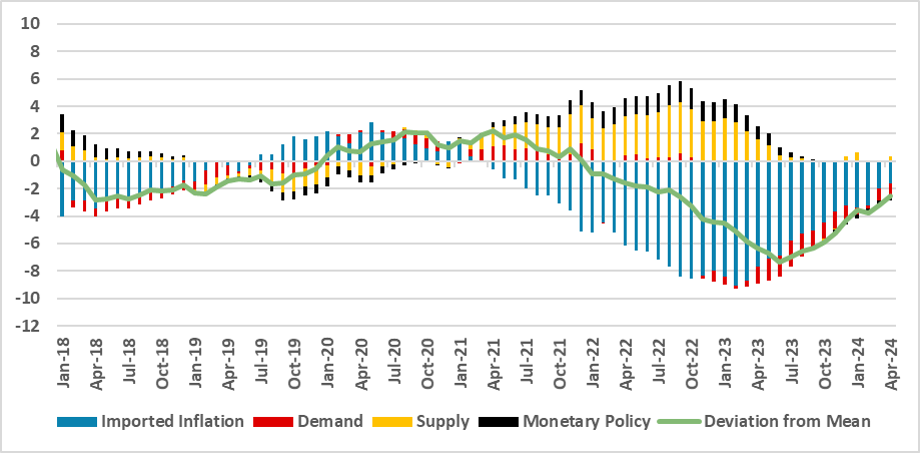

Figure 2: Contribution for Inflation (%, deviation from the mean)

Source: Continuum EconomicsNote: CPI sample mean: 4.4%

Unlike Brazil, Mexico's rise in inflation was more driven by supply and demand factors rather than by imported inflation. The rise in imported commodities and the depreciation of Mexico’s currency was significantly lower than in Brazil. However, we believe the appreciation of the MXN was a positive factor for Mexico in lowering its inflation rate in subsequent events, as demand and supply factors were still contributing to rising inflation. Additionally, Mexico took significantly more time to raise its policy rate, which made monetary policy contribute more to inflation. However, since the second half of 2023, demand factors diminished significantly, which likely gives more room for Banxico to cut rates. However, this cut needs to be cautious since some monetary policy continues to be contractionary and contributes to lowering inflation. On the other hand, supply factors continue to be tight, contributing to rising inflation. Mexico's labor market is significantly tighter than Brazil's, pressing firms' costs and thus generating pressure on prices through the supply optics. This will also be a cause of concern for Banxico. Our model is not taking into account the events after June elections, which contributed to rise inflationary risks in Mexico.