AUD, CHF, JPY flows: AUD dips, CHF firm

Zhongzhi bankruptcy undermines AUD. Swiss data supports CHF for now

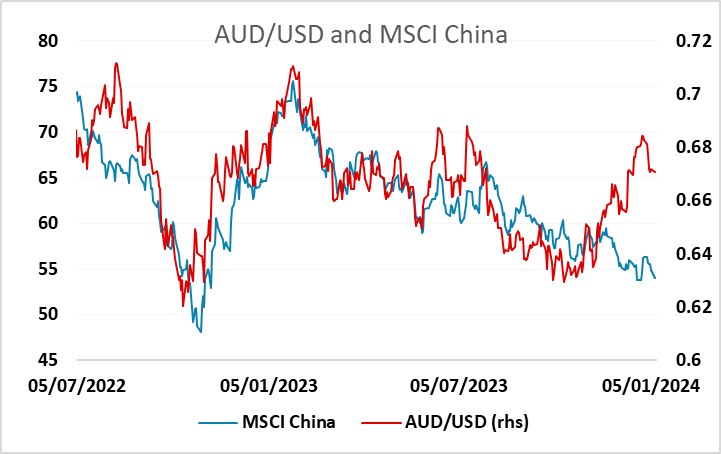

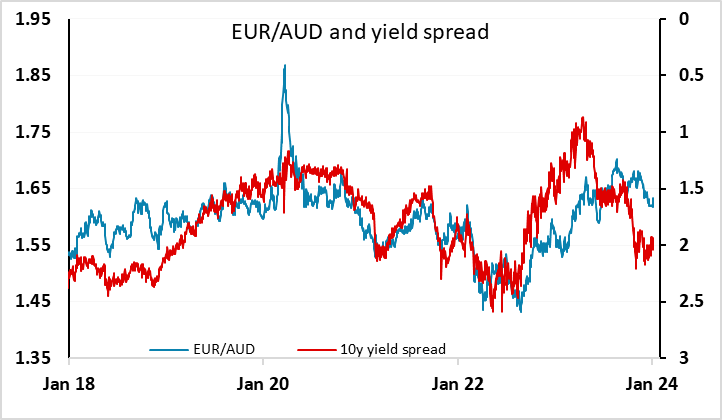

The weakness in Chinese equities due to the bankruptcy of the Chinese wealth manager Zhongzhi announced over the weekend is likely to keep the riskier currencies on the back foot in early trade, particularly the AUD. Zhongzhi was exposed to the Chinese property sector, and while its demise is not of major relevance in itself, it highlights that Chinese property woes remain. This has generally negative implications for global growth prospects. While the direct AUD correlation with Chinese equities appeared to break down at the end of 2023, the AUD remains sensitive to global growth prospects. Having said this, the AUD continues to looks attractive against the EUR based on yield spreads, so here may be more general downside for the riskier currencies.

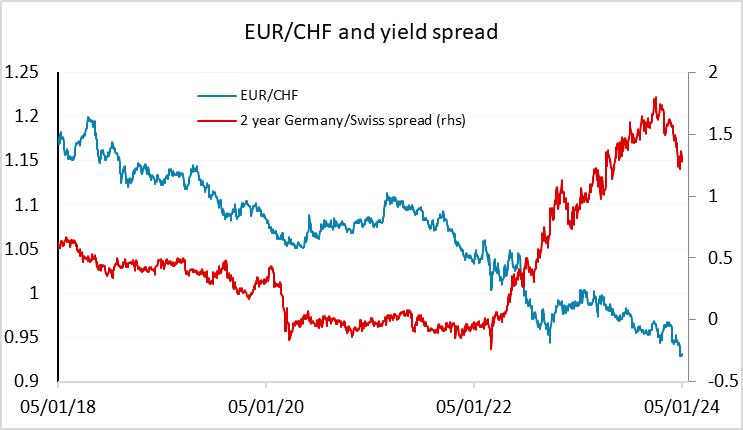

Early trade this morning has seen the CHF rise on the back of stronger than expected Swiss CPI and retail sales. While these may encourage expectations of a slightly less dovish SNB approach in the coming months, it is hard to make a case for CHF strength based on yields and policy, with the CHF having sharply outperformed any moves in yield spreads in the last few years. Nevertheless, the trend of CHF strength this year is hard to oppose, and concerns about financial stability related to the Zhongzhi bankruptcy are only likely to strengthen this trend. (The CHF benefitting from financial concerns is a little ironic after the recent demise of Credit Suisse, but that is the way of the world). We continue to see the JPY as the better value safe haven, with CHF/JPY coming off all time highs at 170.80 on Friday. However, Japanese yields remain subdued and may need to pop higher to encourage JPY bulls. Tomorrow’s Tokyo CPI data will consequently be a focus this week.