Preview: Due November 29 - Canada Q3/September GDP - A subdued quarter with a stronger finish

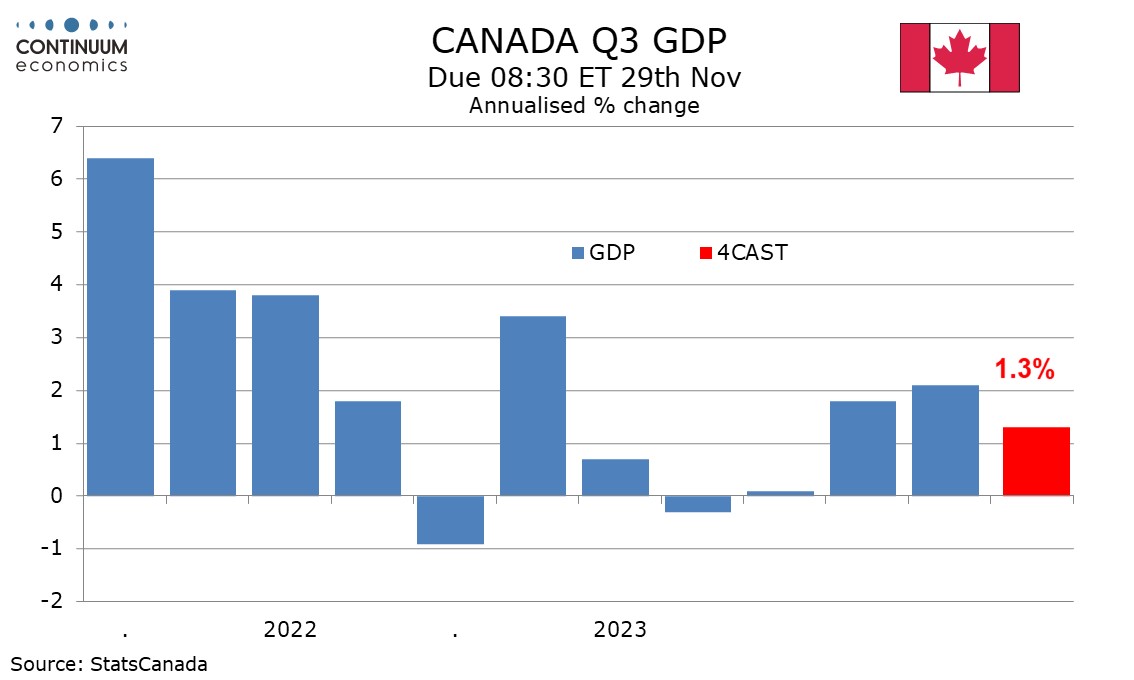

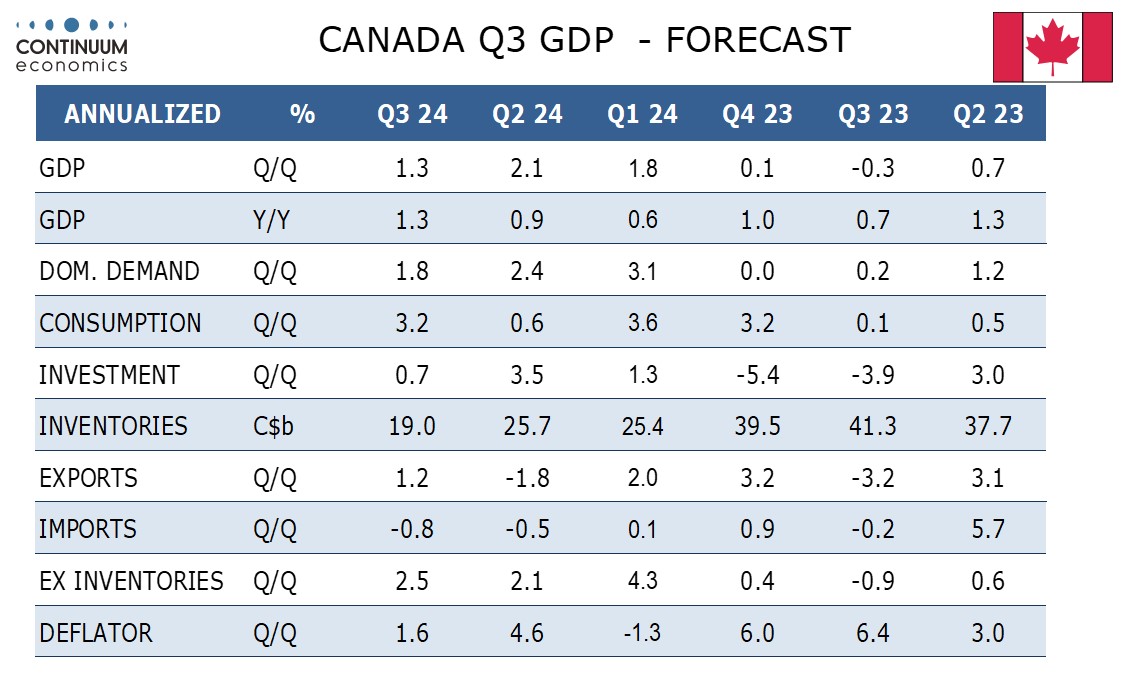

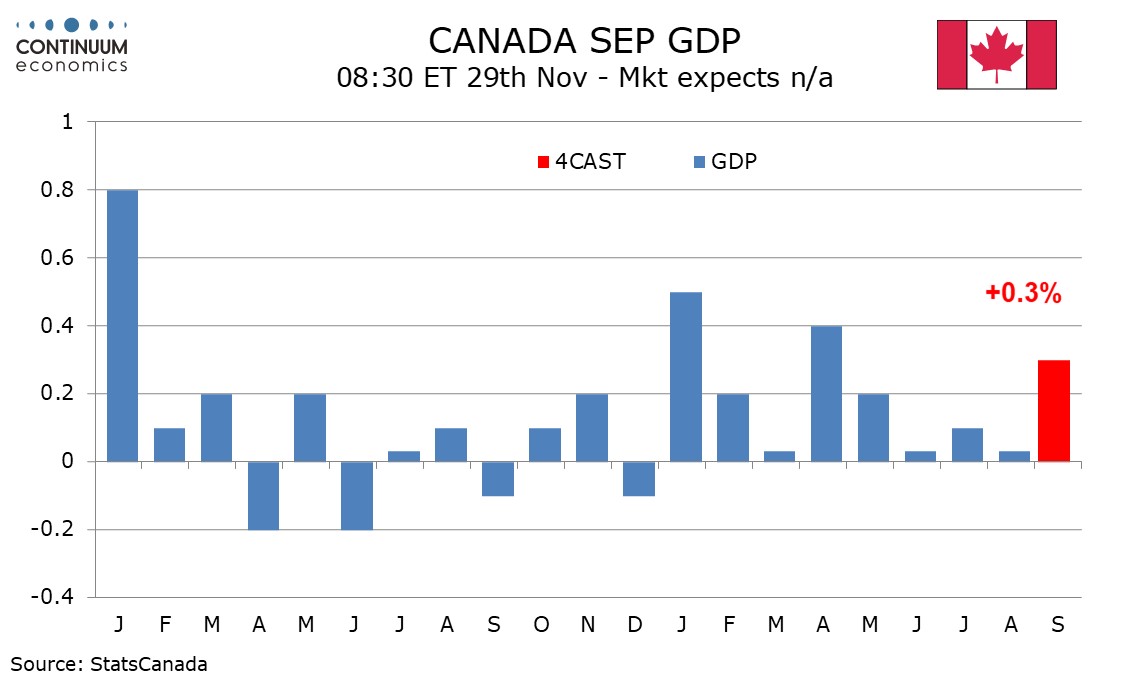

We expect Q3 Canadian GDP to rise by 1.3% annualized, a little below a 1.5% estimate made with the Bank of Canada’s October Monetary Policy Report and also slightly below the near 2% pace seen in the first half of the year. We do however expect the quarter to end with a stronger 0.3% rise in September GDP, in line with a preliminary estimate made with August data.

A 0.3% rise in September GDP would in fact be consistent with a 1.0% annualized increase in the quarter. Q3 is more likely to get further support from upward revisions to July’s flat outcome or August’s 0.1% increase than an even stronger rise than projected in September.

Retail sales suggest a positive quarter from the consumer while net exports are likely to be a positive, with exports seeing a modest increase in real terms, largely on energy, while imports saw a modest decline. Restraint is likely to come from a correction lower in government from a strong Q2 and inventories. We expect a modest slowing in business investment, but a third straight quarterly rise.

We expect a 1.8% annualized increase in domestic demand, stronger than GDP but also slightly slower than the preceding two quarters. We expect a modest 0.4% (1.6% annualized) increase in the GDP deflator.

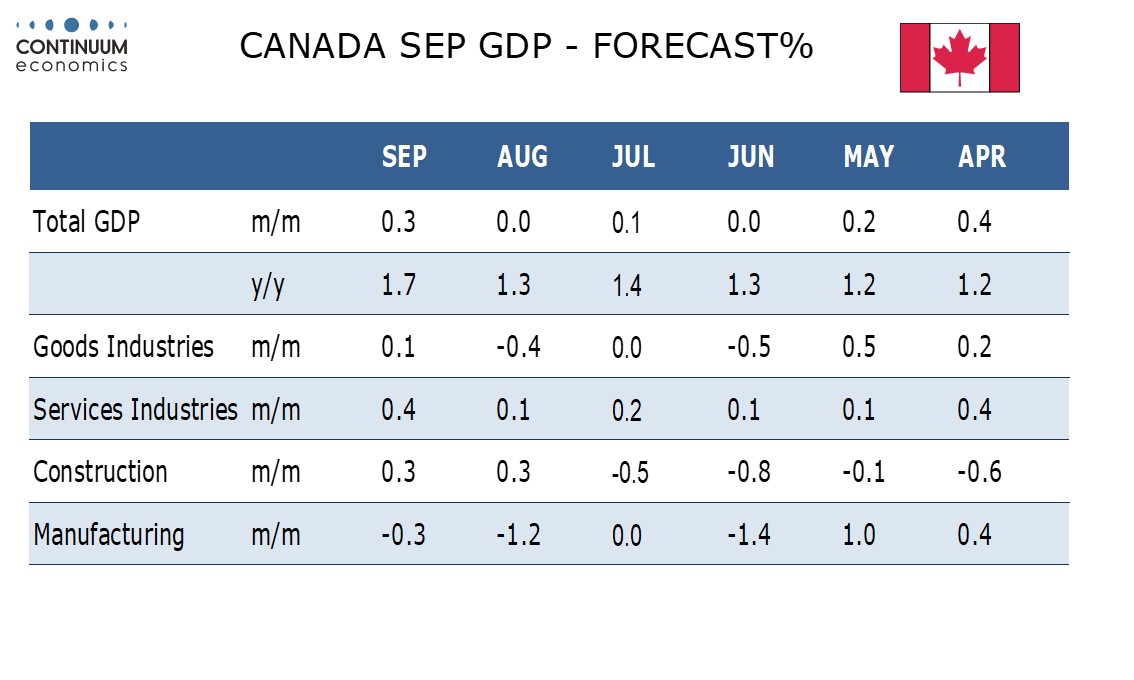

The monthly GDP gain is likely to be led by services, with September gains predicted in finance and insurance and retail with the August report. Goods are likely to be restrained by slippage in mining, though construction is expected to increase.