Bank of Canada Keeps Markets Waiting

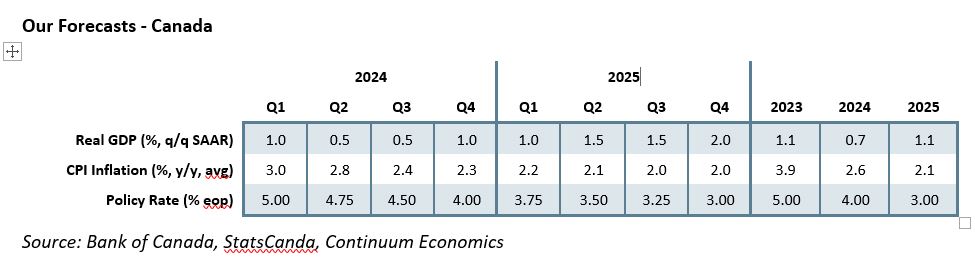

The Bank of Canada left both rates (at 5.0%) and its forward guidance unchanged in its latest statement. A rate cut at the next meeting in April now looks unlikely, and while we continue to project a move in June it is now a close call between June and July for when the BoC starts to cut rates.

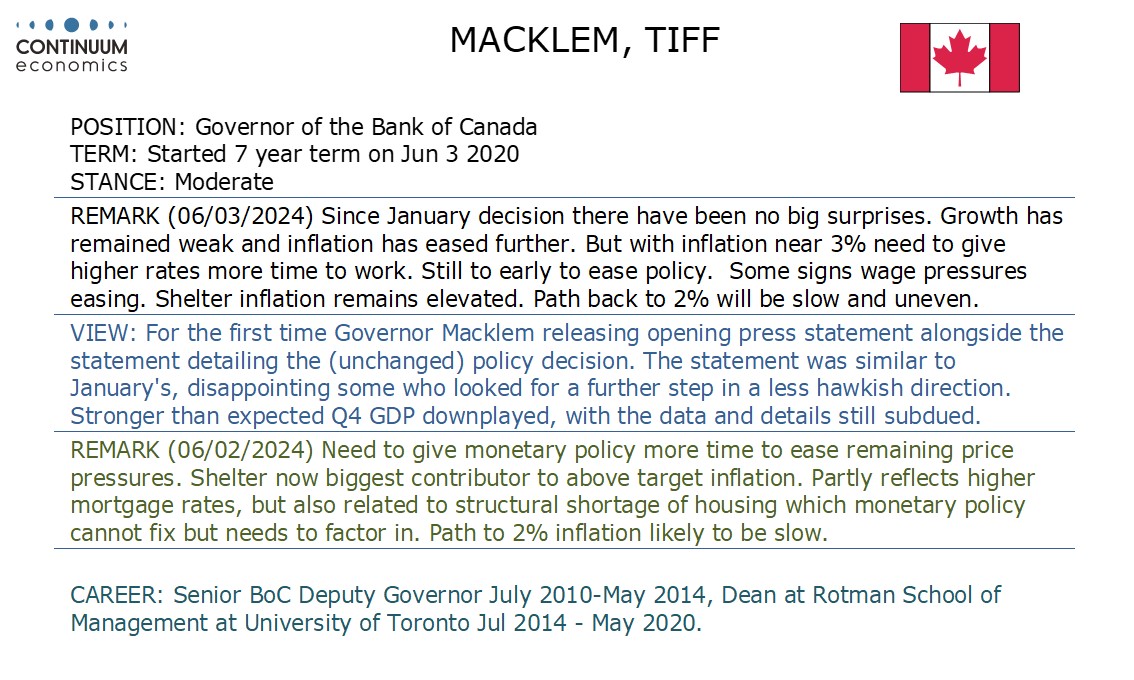

This meeting saw the BoC release its press conference opening statement alongside the policy statement, and there was more detail in the former than the latter. Governor Tiff Macklem stated that there were no big surprises since the last statement in January. Q4 GDP at 1.0% annualized did exceed a flat projection made in January but Macklem described it as weak and below potential, while the statement noted that the gain was dependent on a large rise in exports. January CPI at 2.9% yr/yr was below the BoC’s Q1 forecast of 3.2% on lower goods inflation but the statement sees yr/yr and 3 month measures of core inflation as running in a 3.0-3.5% range and expects the pace to remain near 3% during the first half of 2024 before gradually easing. The statement reiterated January’s concern about persistence in underlying inflation and wants to see further and sustained easing in core inflation. Macklem stated that shelter inflation remains elevated and mote broadly underlying price pressures persist. Macklem stated it is still too early to consider lowering the policy rate.

There is only one more CPI release (for February) due before the next meeting on April 10, though Macklem also noted they would be watching fresh information on corporate pricing and inflation expectations due before the meeting. Still, it looks unlikely the BoC will have enough information to ease. That the April 16 budget will leave the fiscal policy outlook clearer will be another reason to wait. April’s meeting will still be watched for updated economic projections in the quarterly Monetary Policy Report. March and April CPI data will be due before the subsequent meeting on June 5 and with Canadian GDP growth likely to remain below potential, if signs of progress on inflation are by then convincing easing could be seen, though that may require none of these CPI releases surprise on the upside. We continue to expect 100bps of easing in 2024, with a pause in July assuming June sees a move, but moves in each of the subsequent meetings in September, October and December.

While we are not revising our 2024 forecasts for rates, risk is for less rather than more. We are revising our views for 2025 however, seeing 100bps of easing (25bps in each quarter) leaving the end 2025 rate at 3.0% rather than 2.5% as we had previously projected. While Canada’s economy is looking significantly weaker than that of the United States it does appear to be avoiding a move into recession and recession fears should fade into 2025, particularly if Fed easing keeps the US economy growing. There is also talk that the BoC may revise up its estimate of the neutral rate in April from its current 2.0-3.0% range.