Bank of Canada Eases by 25bps on Improved Inflation Picture

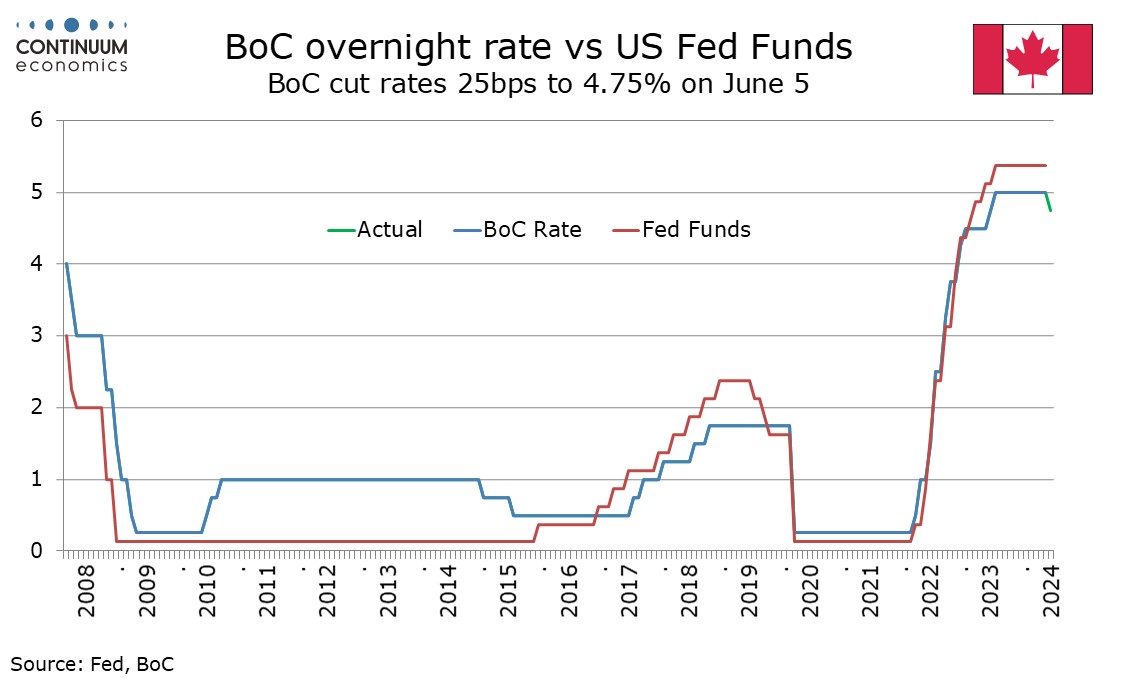

The Bank of Canada delivered a 25bps easing to 4.75% as expected and the tone of the statement and particularly the press conference was somewhat dovish, giving some detail on why it is pleased with progress on inflation. However easing at each of the remaining four meetings this year looks unlikely. We continue to expect 25bps moves in September, October and December, after a pause in July.

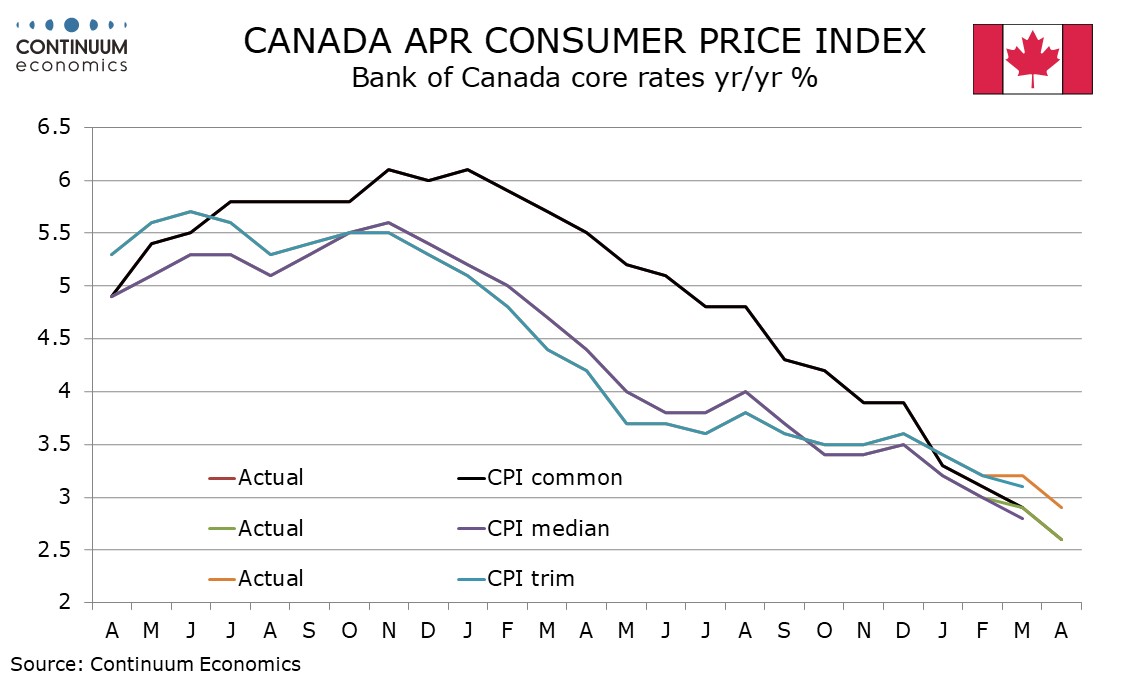

In his opening statement to the press conference Governor Tiff Macklem outlined first the declines in headline CPI (to 2.7% in April from 3.4% in December) and the core measures (to around 2.75% from around 3.5%). Less obviously he stated three month rates had fallen below 2% from about 3.5% in December and the proportion of components increasing above 3% is close to the historical average. However, the statement noted that shelter inflation remains high and that risks to the inflation outlook remain.

Macklem stated that if inflation continues to ease and confidence that it is headed to the 2% target continues to increase it is reasonable to expect further cuts in rates. However he warned that lowering rates too quickly could jeopardize the progress made. The BoC will be aware of the recent history in the US, where two straight target-consistent quarters from core PCE prices were followed by disappointment in early 2024. That 3-month Canadian core measures have fallen below 2% on an annualized basis could be similarly overstating how much progress has been made. Macklem said rate decisions would be taken meeting by meeting and the pace of rate cuts was likely to be gradual.

Macklem expects further progress on inflation to be uneven and if so the path of easing is unlikely to be smooth. Which of the future meetings will see easings and which will see pauses is likely to be dependent on incoming data and forecasts for individual meetings should be treated cautiously. There are two more CPI releases (for May and June) due before the July 24 meeting and if both are subdued we could see a further easing, but disappointment on one of the releases could bring a pause, and that is our current leaning. Only one further CPI (for July) is due before the September 4 meeting, so if July sees an ease we would expect September to see a pause, though if July sees a pause easing would likely to resume in September, provided the majority of the inflation releases were moving in the right direction. We expect that by Q4, progress on inflation will be sufficiently clear to allow easing in both October and December.

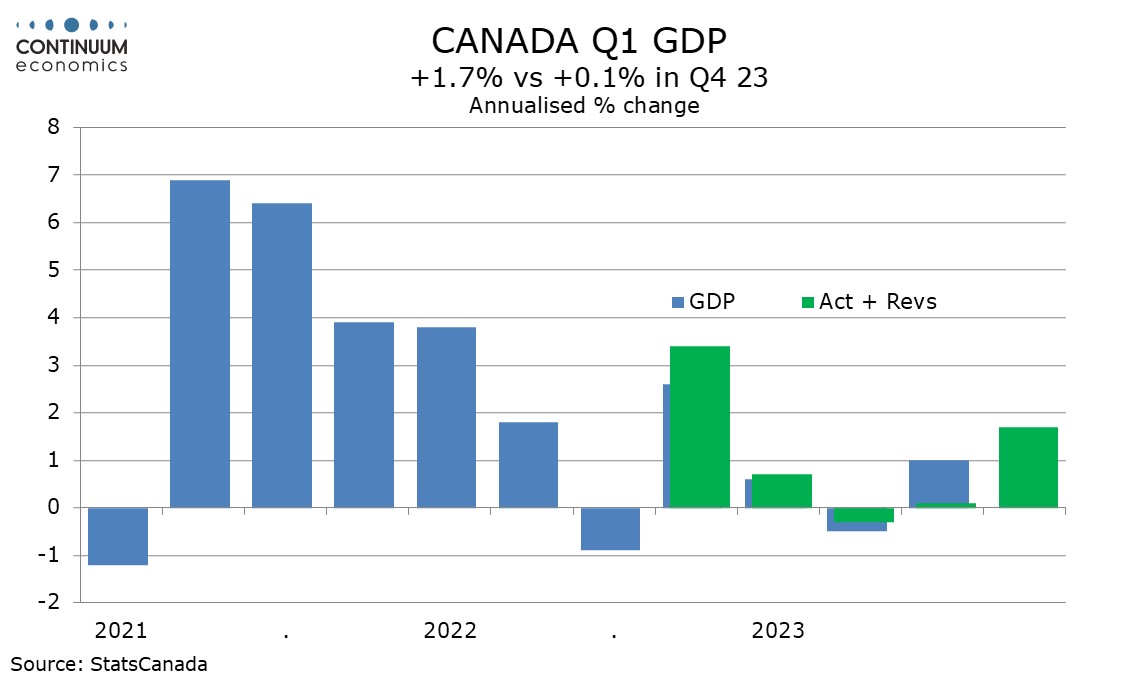

One dovish element of the message coming from the BoC was that signs of improving activity were downplayed, with excess supply giving scope for growth even as inflation continues to recede. The BoC did not draw a dovish conclusion on Q1’s 1.7% annualized GDP increase falling below its expectation, with the data restrained by inventories while consumer spending, business investment and housing activity all improved. GDP appears to have some momentum entering Q2 though we expect momentum to fade, led by slowing US growth, in the second half before regaining momentum in 2025. Inflation will be the key for easing decisions, but slowing growth in H2 2024 could help accelerate the pace of easing, while improving growth in 2025 could slow the pace. In 2025 we expect one 25bs move in each quarter, leaving rates at 3.0% at the end of 2025.

Despite starting easing and looking for more, the BoC is continuing with Quantitative Tightening. In April Deputy Governor Toni Gravelle stated that he expected QT to continue into 2025.