JPY flows: JPY weakens on Ueda comments

USD/JPY has risen a figure in response to the Ueda press conference. While Ueda retained his longer temr hawkish stance, his comments suggested there was no hurry to raise rates

USD/JPY has rallied on Ueda’s remarks at the BoJ press conference. The trigger seems to have been Ueda’s indication that market remain unstable, in reference to a question about deputy governor Uchida’s remark that the BoJ would not raise rates while markets remain unstable. Markets are also reacting to the comment that there is some time to make decisions on monetary policy because upside price risks have decreased given recent FX moves. But other than that, Ueda’s comments remained broadly hawkish. He said the BoJ would pay particular attention to how wage hikes are reflected in service prices in October. This data won’t be available in time for the October BoJ meeting, so suggests the first opportunity for a rate hike will be in December. The market prices a 10bp move as an 80% chance, but still only sees a peak in rates at 50bps by the end of 2025, so there is still scope for rate expectations to rise from here if the market moves into line with the BoJ’s more hawkish view.

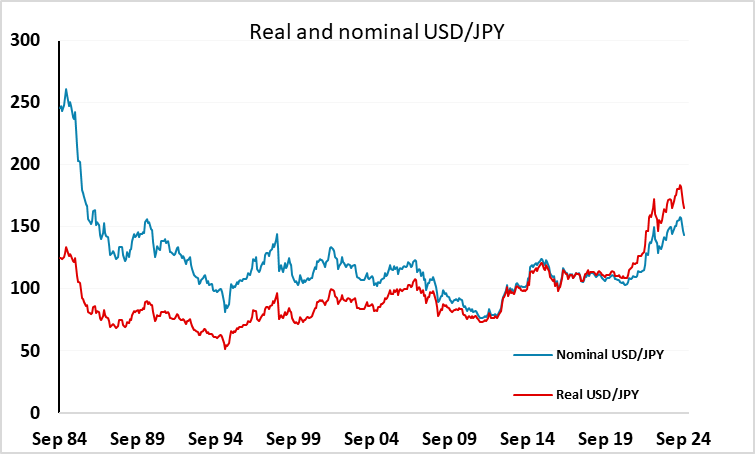

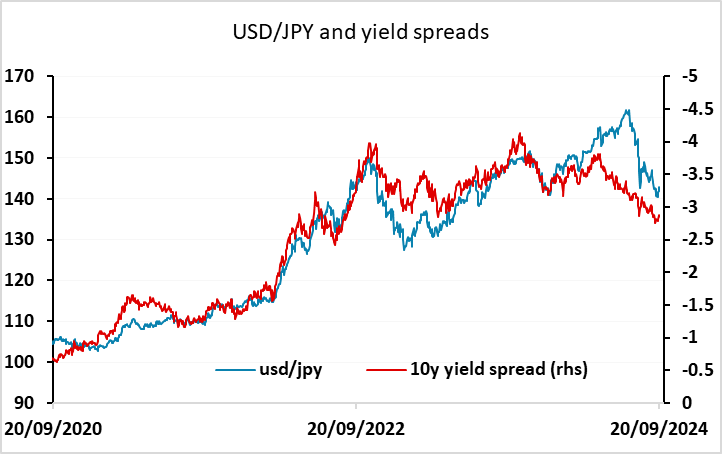

Up to now, most of the movement in yield spreads has been due to changes in US and European yields rather than Japanese yields, but from here we may be entering a phase where Japanese policy matters more, as longer term yields abroad look likely to stabilise close to current levels. The JPY remains extremely weak in real terms by historic standards, so we still expect JPY gains in the coming year(s). But this may need to wait for more BoJ tightening. For now, expect USD/JPY to hold in a 140-145 range.