USD flows: USD up on stronger CPI

USD gains across the board, though JPY initially sees the most weakness

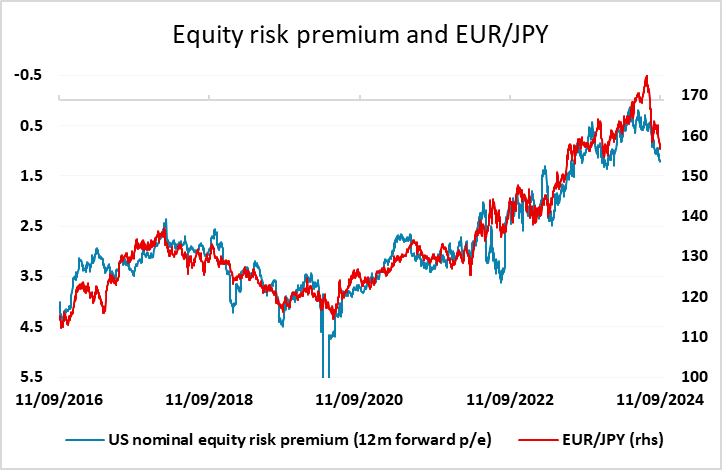

Stronger than expected US core CPI data for August has given the USD a boost across the board, although the JPY is losing slightly more ground than most. Headline CPI was in line with expectations at 0.2%, but this was rounded up from 0.188%, while core was rounded up from 0.28%, so was a little less out of line than it looks. The strength was largely in shelter and air fares. The data certainly makes a 50bp Fed cut next week less likely, but this will in turn put more downward pressure on equities, so while the JPY may suffer a little more than others initially, the negative impact on risk may mean that the JPY holds it own on the crosses.

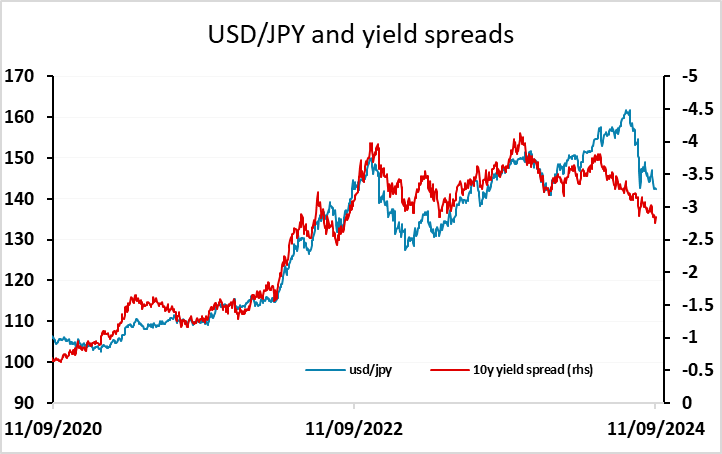

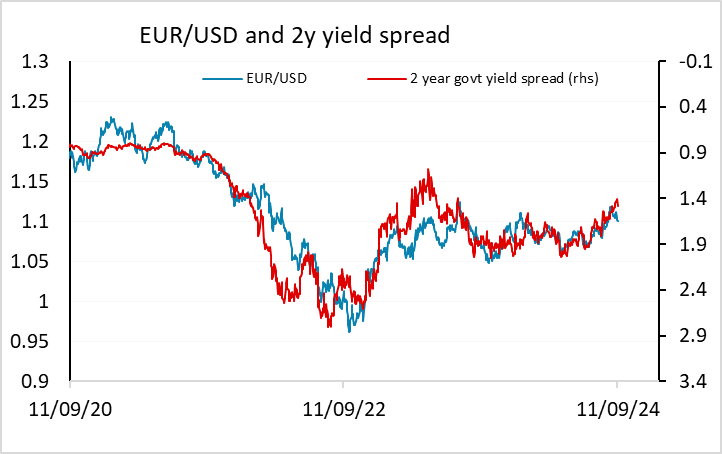

From a yield spread perspective, USD/JPY still looks unlikely to advance far, as current 10 year spreads still suggests scope for a move below 140, while real terms weakness in the JPY in recent years means there is more scope for JPY gains than seems likely based on the nominal charts. With the BoJ talking tighter policy again overnight, it may well be that there is as much scope for Japanese short term yields to rise as European yields in response to the data. So far, US front end yields have risen but European yields have not reacted, so EUR/USD may have scope to edge lower towards 1.10, but spreads started off favouring the EUR, so we doubt there is scope to break lower.