UK GDP Review: Continued Weakness Evident – BoE Voicing Concern?

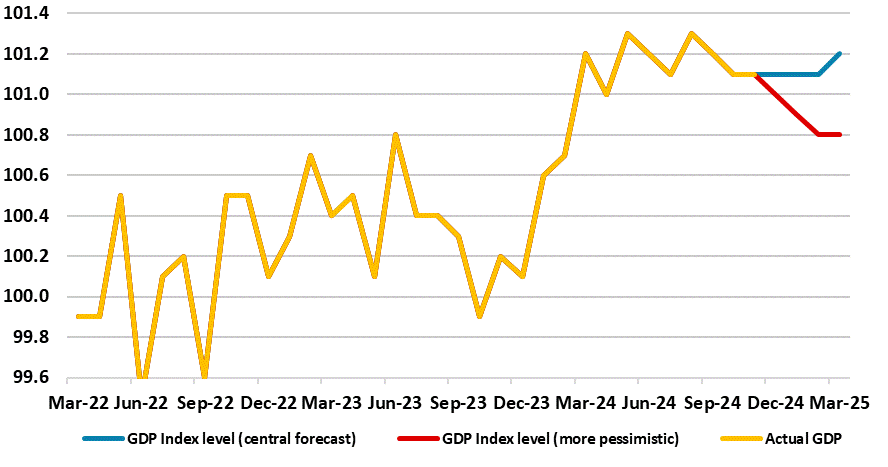

The latest set of GDP data add to already-growing questions about the UK’s economy’s apparent solidity, if not strength, as seen in sizeable q/q gains in the first two quarters of the year. As we envisaged, November saw a bare almost-0.1% m/m rise, this came after October saw a second successive m/m drop of 0.1%, all below expectations, this adding to what have now been only three positive outcomes in the last eight months of data a period in which the economy has ‘shrunk’ a cumulative 0.1%. This backdrop included evidence that the economy actually fell again in terms of private sector activity in November. Thus the 0.1% m/m rise for November must be seen in that weak and pared –back context and the likelihood remains that Q4 2024 may have seen a small q/q contraction, ie even weaker than the BoE’s recent downgrade to zero. With momentum into early 2025 also ebbing, it is clear that many on the MPC are concerned about activity weakness!

Figure 1: Momentum Ebbing – Amid Continued Downside Risks?

Source: ONS

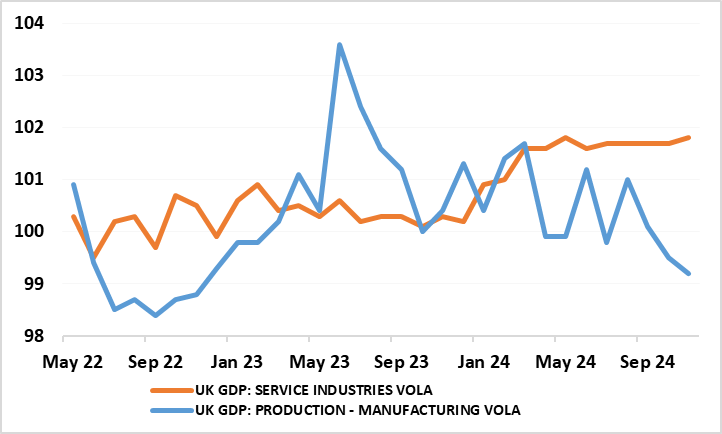

This all the more notable as it suggests a weaker trend that dates back prior to the election of the new government let alone its October Budget and its mixed policy measures. Although most evident in a further drop in manufacturing, the data do also suggest weaker services of late. While monthly real gross domestic product is estimated to have grown by 0.1% in November 2024 largely because of modest rebound in services in which the latter output grew by 0.1% in November 2024, after falling by 0.1% in October 2024 (revised down from no growth in our last release), but it showed no growth in the three months to November 2024. Otherwise, production output fell by 0.4% in November 2024, following an unrevised fall of 0.6% in October 2024; production fell by 0.7% in the three months to November 2024, driven by a decline in manufacturing. Construction output grew by 0.4% in November 2024, following a fall of 0.3% in October 2024 (revised up from a fall of 0.4% in our last release); construction also grew by 0.2% in the three months to November 2024. But the whole economy was boosted by the public sector – again!

This raises the important policy question as to whether any such weakness suggests that the support from private sector services to the economy seen of late, thereby offsetting manufacturing weakness, is faltering (Figure 2) and where even hitherto upbeat construction activity may be starting to soften, if not falter. This raises clear questions about underlying momentum

Figure 2: Services Faltering?

Source: ONS

Certainly business surveys suggest that ebbing momentum may be the case, this putting more emphasis on the PMI update due on 24 Jan. But the data suggest that even with an assumed recovery in the remaining month of the last quarter, Q4 GDP may not have growth and with a risk that it may have fallen afresh. This is an important consideration for the likes of the BoE which had projected a more upbeat 0.3% GDP rise for the last quarter, albeit that pared back to a zero projection in an update last month.

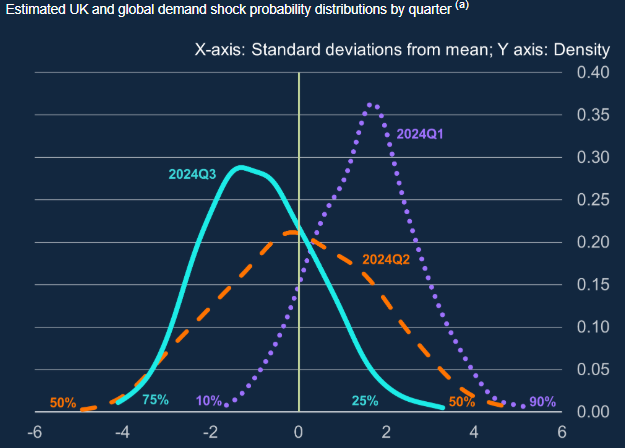

To the BoE, the weaker GDP backdrop has been something of a surprise, but critically any policy response depends on the extent to which softer activity reflects demand and/or supply factors. It does seem as if the BoE blames demand as the main culprit at least more recently, both as price pressures still seem to be receding and as its own models implies that demand shocks may have turned negative in Q3 of this year, having been more positive at the start of the year (Figure 3). In addition, as trends in supply are particularly uncertain at the moment, it is difficult to identify where exactly a supply shock could be coming from, this view recently expressed by MPC member Breeden. We think this implies that the BoE will need to cut rates several time this year, probably some five 25 bp cuts. This is view that chimes with recent MPC recruit Alan Taylor, who said yesterday that the BoE’s “gradual” approach to rate reductions implied four quarter-point cuts by the end of 2025. He suggested that right now is quite different to recent history, as he sees signs of weakening demand and labour market softness amid signs if adverse demand shocks also citing the results seen in Figure 3.

But he warned of an increasing risk that the weakening economy would need a “more accelerated pace of rate cuts” that would lead the BoE’s benchmark rate to fall by 1.25 or 1.5 ppt in the next 12 months, ie up to six such 25 bp cuts. He noted weak figures on GDP and business sentiment as he concludes it is time to get interest rates back toward normal to sustain a soft landing given that the latest three-month CPI adjusted reading has now fallen within a normal range, and where the trend towards 2% across various time horizons is also clear. The question is whether such concerns are a deliberate attempt by him and maybe on behalf of the MPC majority to persuade markets that the recent reining in of rate cut expectations has been both premature and overdone. Regardless, it does seem as if the monthly real economy data may be becoming an increasingly important factor in shaping BoE policy ahead, especially if more weakness of the kind we envisage duly occurs.

Figure 3: Adverse Demand Shocks Seen By BoE?

Source: BoE; Chart shows the estimated distribution of the demand shocks that have hit the UK economy in 2024 Q3 (aqua line), 2024 Q2 (orange line) and 2024 Q1 (purple line). These shocks are derived from a SVAR model for the UK economy