USD, GBP flows: USD edging lower on shutdown concerns, GBP firmer

USD softer as government shutdown looms. GBP edging up

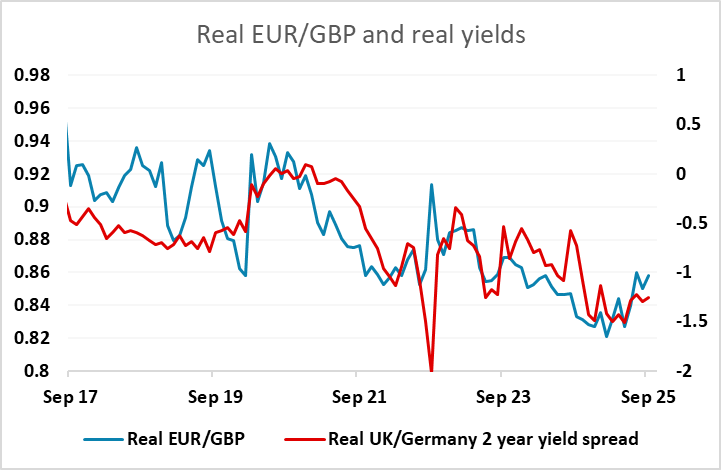

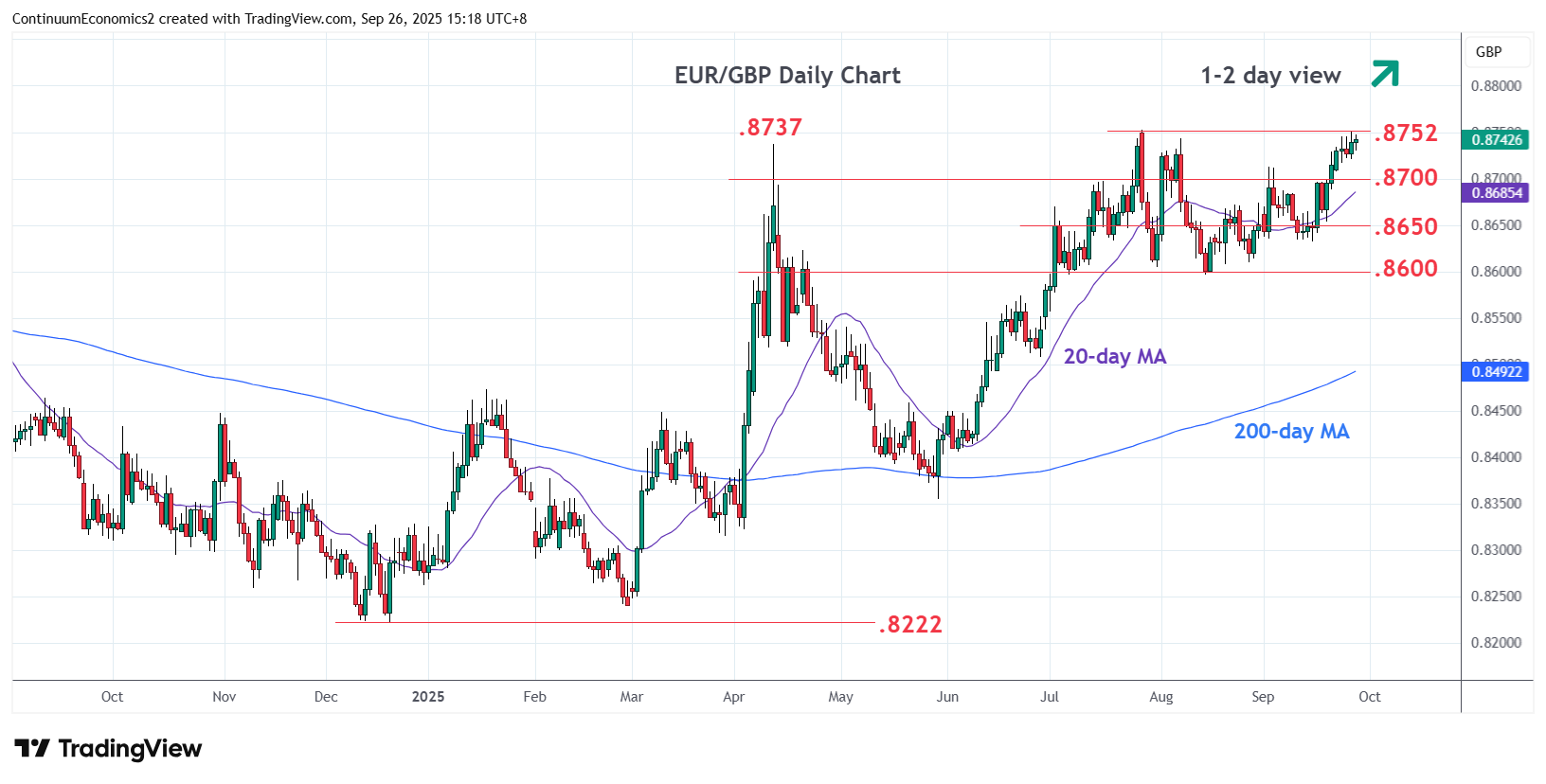

A typically fairly quiet Monday calendar, although there will be some interest in the EU Commission survey and the preliminary September Spanish CPI data. There are also a lot of central bank speakers, mostly from the ECB, but also Ramsden from the BoE and Waller from the Fed. Of these, Ramsden could be the most interesting, since Waller is an established dove and there is no real expectation of any near term change in ECB policy. Having stopped short of the year’s high at 0.8763 last Thursday. EUR/GBP has started the session a little softer and may now test down towards 0.87, but more dovish comments from Ramsden could reignite GBP weakness.

Overnight, the USD is a little softer, helped by the threat of a government shutdown this week if Congress don’t pass a funding bill by Tuesday. This would mean no employment report this week, which would leave the market somewhat rudderless. However, for the moment this isn’t being seen as a major market concern, with equities still firm, and we wouldn’t expect the USD to fall back far. A fairly rangy session looks likely.