UK GDP Review: Less Fragile Recovery to Fuel BoE Hawks?

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.3% bounce in January data, a result that nevertheless is nothing more than a continuation of the monthly swings seen of late, which means that y/y growth is still negative. Admittedly, unseasonable weather may have played a part in hampering February activity, most notably in construction and it is noteworthy that the 3 mth rate tuned positive in February for the first time since last summer. Regardless, the modest added momentum so far in Q1 suggests that the quarter may see GDP growth of 0.3%, higher than BoE thinking and fully reversing the slide seen in Q4 last year.

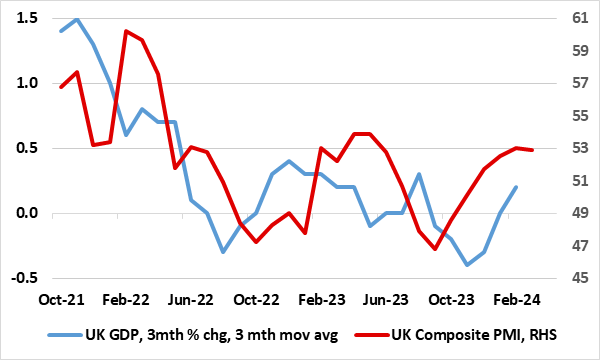

This, alongside some better business survey readings (Figure 1), may be something that the BoE hawks use as a rationale to argue for no near-term rate cut, even though this may add to effective debt servicing costs facing consumers. More notably, unless this early-year momentum builds, the economy is still likely to grow this year by no more than 0.3% q/q, a result that chimes with existing BoE thinking, which is being shaped more by price and costs developments not real activity.

Figure 1: Tentative Recovery – Output Recovering?

Source: ONS, CE

As for details, GDP is estimated to have grown by 0.2% in the three months to February 2024, compared with the three months to November 2023. Services output was the main contributor, with a growth of 0.2% in this period, while production output rose by 0.7% and construction fell by 1.0%. Perhaps the most striking feature was the large and broad based rise in manufacturing. Indeed, overall production output is estimated to have grown by 0.7% in the three months to February 2024 compared with the three months to November 2023. This was driven by a 1.1% m/m rise in manufacturing output. Electricity, gas steam and air conditioning supply also contributed positively, with a 1.2% growth in this period, while there were falls of 2.0% in water supply, sewerage, waste management, and 2.5% in mining and quarrying.