FX Weekly Strategy: November 10th-14th

USD may struggle as government shutdown extends

JPY still looks to have the most scope for gains

GBP can weaken as market prices in December rate cut

AUD should prove well supported provided domestic data remains solid

Strategy for the week ahead

The lack of official US data releases continues to starve the market of key information. As it stands, the market is pricing a 68% chance of a 25bp cut to the Fed funds rate at the December 10 meeting. However, if the government shutdown prevents any October data from being released, it is difficult for the Fed to act, and that cut may be in more doubt. At the same time, it’s hard to see the lack of data as a USD positive. Indeed, the longer the shutdown goes on, the more negative it is for Q4 GDP. Even though most assume any lost output will be recovered in coming months, the shutdown is likely to impact demand. We tend to se the extended shutdown as a negative for the economy and the equity market, and this argues for some gains for the safe haven currencies, with the JPY looking to have the most potential to recover.

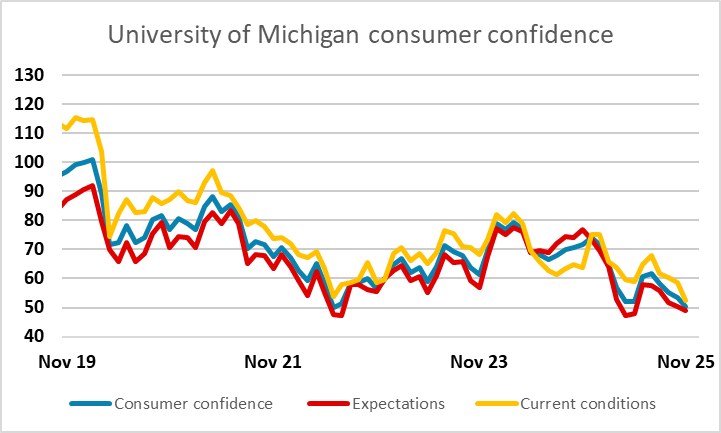

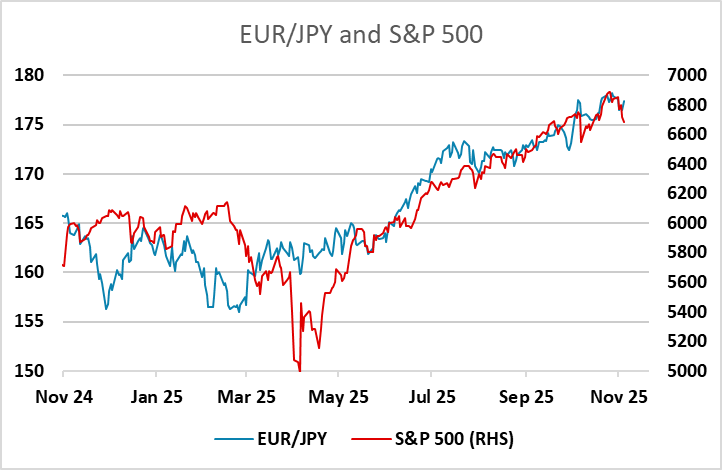

A weak University of Michigan consumer confidence number for November may to some extent have been affected by the shutdown, and gave the USD a push lower on Friday, with European currencies initially the main beneficiaries. The softer equity market suggests to us that the JPY ought to be benefiting more from the USD decline, but there look to have been some technical corrective pressures on JPY crosses into the end of the week. Even so, EUR/JPY looks to be closing in on the retracement target from the move down from the highs in the 1.7760-178 region, and we would look for the JPY to rally from there. We still see scope for the gap created at the election of new PM Takaichi to be closed, which would suggest scope for EUR/JPY to decline to 173.

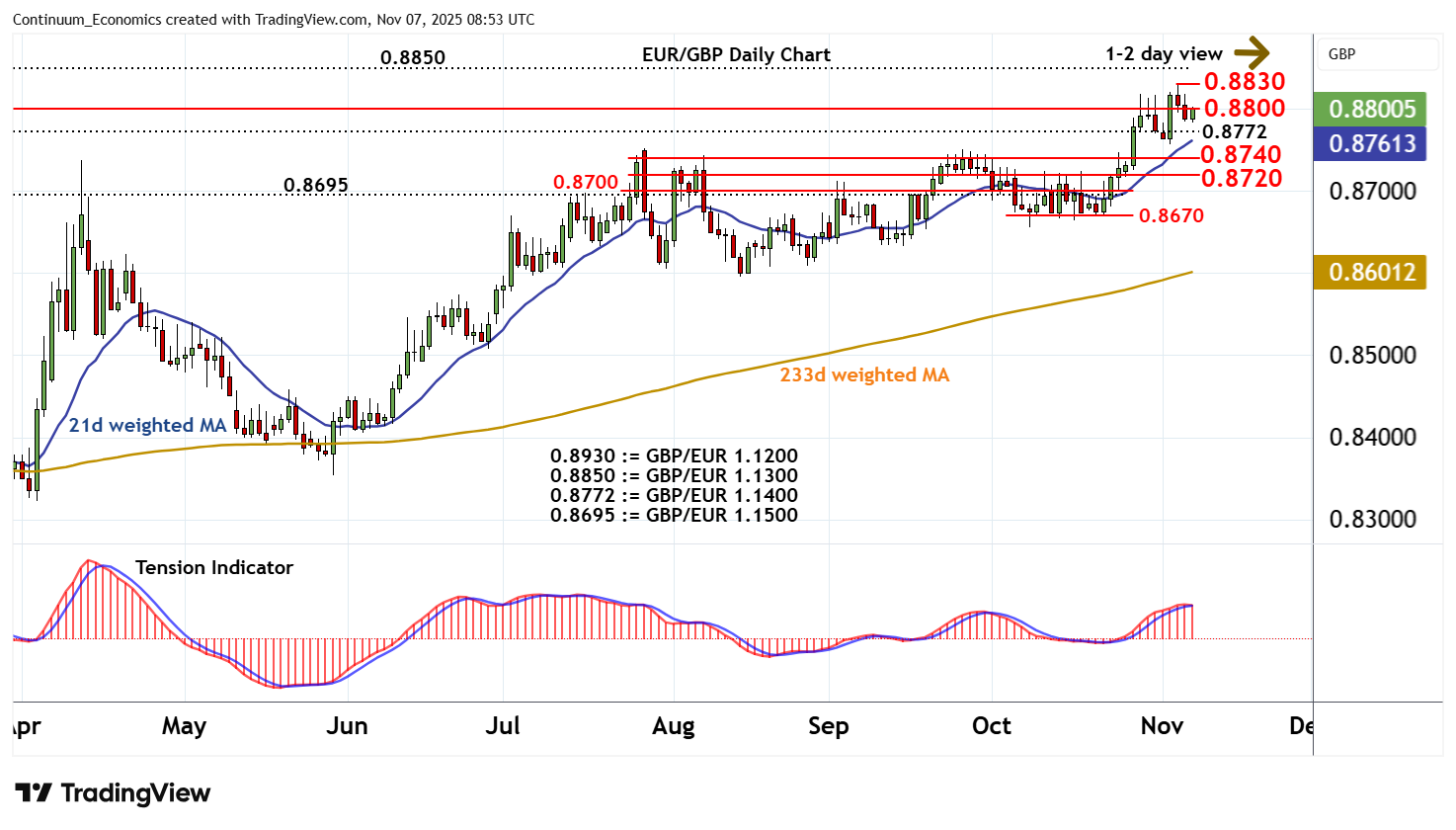

Elsewhere, we have labour market data from the UK and Australia this week. The UK data could be particularly significant, with the 5-4 vote at the MPC meeting last week suggesting that any weakness could result in a cut at the BoE December meeting. Indeed, we see a cut as being near certain, as the November 26 Budget is expected to deliver a substantial fiscal tightening which should justify a monetary easing, especially since the MPC is on a hair trigger in only needing one more vote to cut. It is surprising that the market is currently only pricing a 25bp cut in the UK as a 60% chance, as a tight Budget could even argue for a more substantial rate cut. The risks on the labour market data should therefore be on the downside, as weak data ought to push the market into anticipating a cut, while even stronger data won’t rue it out given the upcoming Budget. EUR/GBP should have scope to move above the recent 0.8830 high.

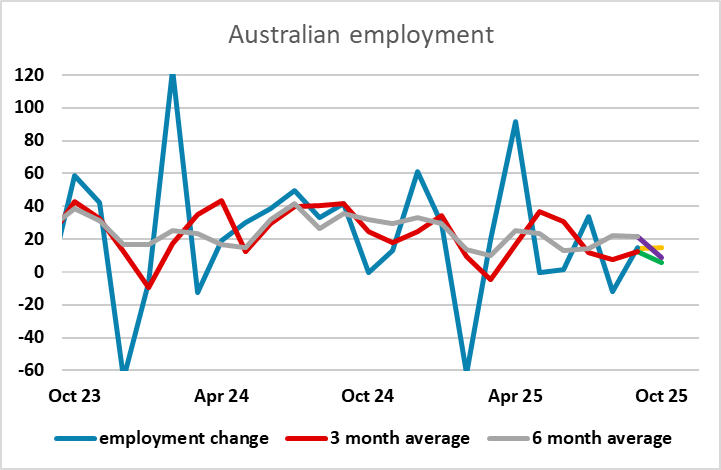

In Australia, employment data is expected to show another 15k rise, and the recent domestic news has continued to be quite solid, suggesting there should be upside for the AUD is risk appetite stabilizes. The AUD has underperformed yield spreads recently, suffering from a risk downturn in the last week, but it’s hard to make a case for weakness below 0.64 in AUD/USD if the domestic economy is solid and the equity market weakness is primarily driven by a correction from overvaluation rather than genuine negative news. So we tend to see AUD risks as being to the upside as long as any equity market weakness remains mild.

Data and events for the week ahead

USA

Pressure to end the US government shutdown is building but even if a solution is found delayed data releases may take some time to arrive. One of the first delayed releases likely to appear will be September’s non-farm payroll, which we expect to rise by 45k. October releases may never appear given a lack of data collection in that month, though October’s CPI was scheduled for Thursday. We expect that the release would have shown a 0.2% increase overall, with a 0.3% rise ex food and energy.

There are not many private sector releases due, though October’s NFIB survey on small business optimism on Tuesday will be worth watching. Fed speakers will be watched. Williams, Paulson and Bostic speak on Wednesday. Hammack speaks on Thursday and Schmid, Logan and Bostic again speak on Friday.

Canada

Canada releases September building permits on Wednesday. Friday sees September manufacturing shipments and wholesale sales. Preliminary estimates were for a 2.8% increase and unchanged respectively.

UK

The coming week once again sees several important economic updates. Tuesday sees ever-more important labor market numbers where apparent wage resilience has perturbed some MPC members but where even the hawks are starting to re-think. But this data release, now encompassing updates not just from the long-standing ONS but also real time figures from the HMRC (which we suggest are more authoritative data and are now officially accredited) is likely to see further and clear drops in the official earnings data, at least for private sector regular earnings which may fall toward 4%. Otherwise, the HMRC numbers are likely to show that employment is continuing to contract and maybe more broadly so as far as the private sector is concerned, such data possibly taking greater precedence than CPI numbers for some MPC members.

Thursday sees September GDP numbers. Notably, GDP has hardly moved since March but we think there will be distinct setback in the September numbers where the cyber-attack of JLR vehicle manufacturing may be sizeable – car reduction may have fallen some 25% m/m-plus in the month alone. As a result, we see September GDP dropping 0.2% m/m and with downside risks, albeit the latter partly alleviated by cooler weather boost utility production and already-published solid retail sales number. If so, this would mean Q3 GDP (to be released alongside) having slowed to 0.1% q/q, despite a perkier consumer performance.

Eurozone

Given the jump in the October German PMI Composite, while the Ifo outcome was more muted, there may be more interest in the German ZEW update (Tue), but where responses are also likely to be affected by what was a moderate recovery from poor German production numbers. Indeed, Thursday sees EZ industrial production figures, probably showing some clear bounce partly due to that German data. Otherwise, revised but still lacking detail Q3 EZ GDP data arrive on Friday.

Rest of Western Europe

There are some events in Sweden over and beyond what have been weaker labor market data (Fri), albeit very volatile of late and where final CPI data (Thu) will flesh out the drop seen in this week’s flash reading. But there are the minutes to this week’s Riksbank Board meeting (Tue) and a further Riksbank insight from its biannual Financial Stability Review (Thu). Norway too has a Financial Stability Review from the Norges Bank, but more interest will be in Monday’s October CPI numbers where we see the targeted inflation rate (CPI-ATE) fall a notch from 3.0%, thereby undershooting the Norges Bank projection by around 0.3 ppt.

Japan

All tier two data for Japan next week. Starting with economic and BoJ summary of opinions on Monday, followed by eco watcher survey & current account on Tueday and PPI On Thursday, which is arguably the most likely to be market moving.

Australia

Labor data on Thursday would be critical for Australia next week after the hawkish hold from the RBA. If we continue to see a solid employment change, it will very likely be the playbook of RBA. And vice versa. We also have consumer confidence and business confidence on Tuesday.

NZ

RBNZ inflation expectation on Tuesday triumphs business PMI on Friday. The RBNZ has taken a more dovish path than the RBA and unlikely to be more dovish in their inflation outlook. Thus, there maybe hawkish surprise if we we see any up move, though we feel it is unlikely.