GBP flows: GBP stays soft after retail sales data

GBP stays on the back foot after retail sales data shows little change in underlying trends.

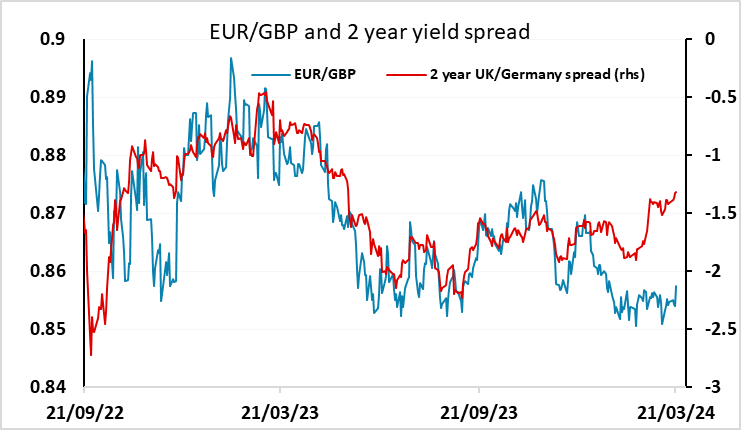

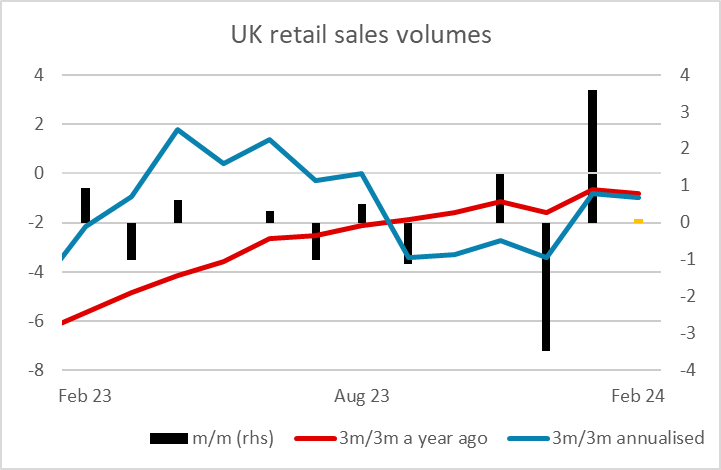

UK retail sales have come in slightly stronger than expected in February, but after the volatility of the last couple of months, the February numbers don’t add a great deal, with underlying trends little changed. GBP retains a soft tone after yesterday’s MPC meeting was seen as mildly dovish, with the chances of a 25bp May rate cut being priced up to around a 23% chance now from around 15% before the meeting. We still see this as unlikely unless we see a very significant decline in service sector inflation in the next month (there is only one more CPI number before the May meeting). There would also need to be further evidence of moderation in wage growth, but average earnings have essentially been flat for the last four months, so it would require renewed gains to undermine the impression of slowing growth. Nevertheless, GBP looks likely to remain on the back foot against the EUR, with front end yield spreads suggesting scope for gains beyond 0.86.